Beta portfolios had a good week at the close of trading on Aug. 21, based on our four passive benchmark strategies. By contrast, the two proprietary strategies posted mixed results and for one of the portfolios another sell signal was issued, joining the two that were triggered the previous week.

As a quick recap, let’s start with the benchmark strategies. All four edged higher this week, ranging from a 0.2% rise for Global Beta 15 (G.B15) to a solid 0.6% increase for the US 60/40 stock/bond mix (US.60.40). Brief definitions of the benchmark and proprietary strategies can be found below.

Momentum for all four benchmarks continues to print at a high level, with US.60.40 running hottest at a 100 reading. Our momentum ranking (MOM) is calculated as the average of 10 return and moving-average signals and is useful for monitoring how momentum stacks up on a relative basis for a set of strategies and/or assets. The scores range from zero (maximum negative momentum) to 100 (the highest degree of positive momentum).

Turning to our two proprietary strategies, Global Minimum Volatility (G.B15.MINV) gained 0.5% last week. For the year, the strategy is ahead by a modest 2.5%. That’s well behind Global Managed Risk (G.B15.MR), which is ahead 13.0% year to date. Compared with the four benchmark portfolios, G.B15.MINV’s gain this year is middling.

G.B15.MINV, which is rebalanced at the end of each week, is currently weighted as follows:

Note: the G.B15.MINV asset allocation table has been revised—an earlier version posted incorrect numbers. Apologies for the confusion.

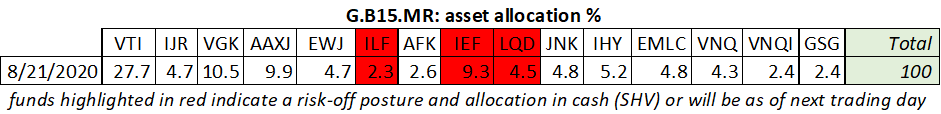

A third risk-off signal was triggered at the end of last week for G.B15.MR when the regional equity fund iShares Latin America (ILF) was slated to be sold at Monday’s opening, with the proceeds moved to cash via iShares Short Treasury Bond (SHV). There are now three risk-off signals in play for G.B15.MR:

Here’s how G.B15.MR’s asset allocation ended the week:

Finally, here are brief definitions of the benchmark and proprietary strategy portfolios:

US.60.40: US stock (VTI)/bond (BND) portfolio, rebalanced every Dec. 31 to a 60%/40% allocation.

GMI: an unmanaged global portfolio that holds the major asset classes in market-value weights. GMI represents a broadly defined opportunity set for conventional investing strategies and is presented as a passive benchmark that’s theoretically the optimal strategy for the average investor with an infinite time horizon.

G.B4: a twist on GMI that reduces holdings to four broadly defined ETFs that target global exposure to stocks (VT), bonds (BNDX), real estate (REET) and commodities (GSG). Target weights: 60% stocks, 30% bonds, 5% real estate and 5% commodities. The portfolio is rebalanced every Dec. 31.

G.B15: an expanded version of G.B4 via 15 ETFs that slice and dice the world’s major asset classes into a more granular opportunity set. The overall allocation matches G.B4 weights: 60% stocks, 30% bonds, 5% real estate shares and 5% commodities. For tickers and weights, see table below.

G.B15.MINV: a proprietary strategy that uses an optimization algorithm to identify the lowest-variance portfolio (without cash) based on the G.B.15 funds in the table below. The portfolio is rebalanced weekly. No constraints are imposed on the optimization output, except that only long positions are allowed.

G.B15.MR: a proprietary strategy that uses drawdown as a risk-management tool. If current drawdown falls below the 50th percentile (based on a rolling 50-day window), a risk-off signal is issued. A second filter applies before any tactical trading takes place: If the risk-off signal persists for each of the last two trading days in a given week, the asset is sold at the open on the first trading day of the next week and the proceeds are moved to the “safe” asset: iShares Short Treasury Bond (SHV), a cash proxy.

Hi James,

I’ve seen you over at another investing site on occasion. Good to see you branching out and publishing here on Substack.

Good luck with your newsletter! I’ve enjoyed your articles and comments wherever I’ve come across them!

Best regards,

Mike