The ETF Portfolio Strategist: 02 FEB 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The winners kept on winning last week, but there’s an elephant in the room (carrying a GOP sign).

President Trump on Saturday ordered sweeping tariffs on goods from Canada, Mexico and China — the three largest trading partners with the US. With affected countries quickly announcing retaliatory tariffs, it seems that a new phase of a global trade war has started. What this means for markets and economic growth is open for debate at this point, but for now it’s reasonable to assume that risk is rising.

We’ll dig into some of the details in a moment, but first let’s review last week’s market activity. Before we get started, here’s a bonus for readers: A free sample of the new issue of The US Business Cycle Risk Report (a sister publication) in the link below. For details on how to subscribe, see the details here.

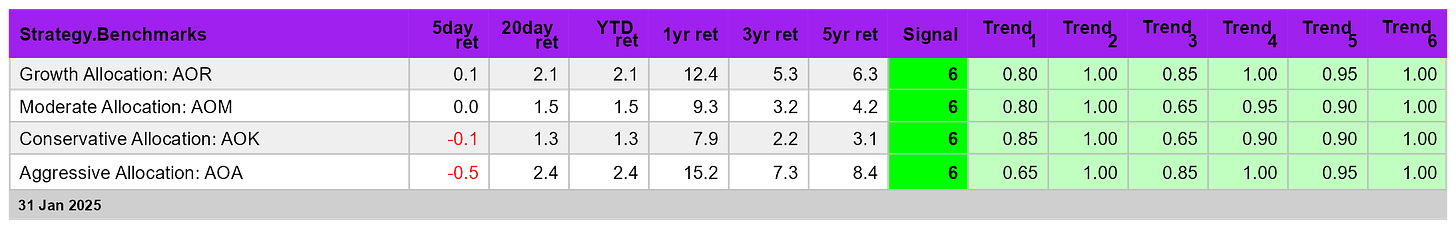

As for the latest market action, our usual set of global asset allocation ETFs posted mixed results last week. The aggressive portfolio (AOA) fell 0.5% while the conservative strategy (AOK) was nicked 0.1%. Growth (AOR) ticked higher while the moderate (AOM) allocation was flat. Note, however, that Signal scores for all four funds jumped to an all-out bullish state. See this summary for details on the metrics in the tables below.

Absent the start of what appears set to be a global trade war, the strong Signal scores would be a slam dunk in terms of maintaining a strong positive outlook on markets. Indeed, that’s also the message via the Global Trend Indicator (GTI), which summarizes the technical profile for the four ETFs listed above.

The GTI Drawdown Risk Index is also signaling the all-clear by falling to a roughly nil-risk state on Friday.

There’s also plenty of green on the screen when reviewing the primary slices of global markets.

Ditto for US equity sectors.

But the upbeat profiles above rely on hard data published to date. Normally, that’s a powerful resource for evaluating risk and return on an ex ante basis. But these are no longer “normal” times and so the data in hand may not provide its usual trend-based insights.

Let’s start with a basic fact: Mexico, Canada and China collectively represent roughly 40% of imports and exports vis-a-vis the US. Implementing tariffs on this trio, in short, is not an insignificant affair for the US economy.

Not surprisingly, Canada and Mexico — US allies — said they will respond with their own tariffs on US exports. China has yet to outline details, but in a statement today would take “corresponding countermeasures to firmly safeguard its own rights and interests.”

There are several risks here, including the potential for raising inflation and reducing import/export-related business activity and economic growth in the US and elsewhere.

How this evolves and where it leads is, to state the obvious, unclear. What is obvious is that the relatively moderate risk profile that prevailed at Friday’s close is no longer relevant.

Granted, it may all come to nothing. But it could all go horribly wrong too. The history of trade wars certainly isn’t reassuring. As the Corporate Finance Institute observes: “In the short term, trade barriers can protect industries. However, over the long term, they usually turn out to be negative for the economy overall.”

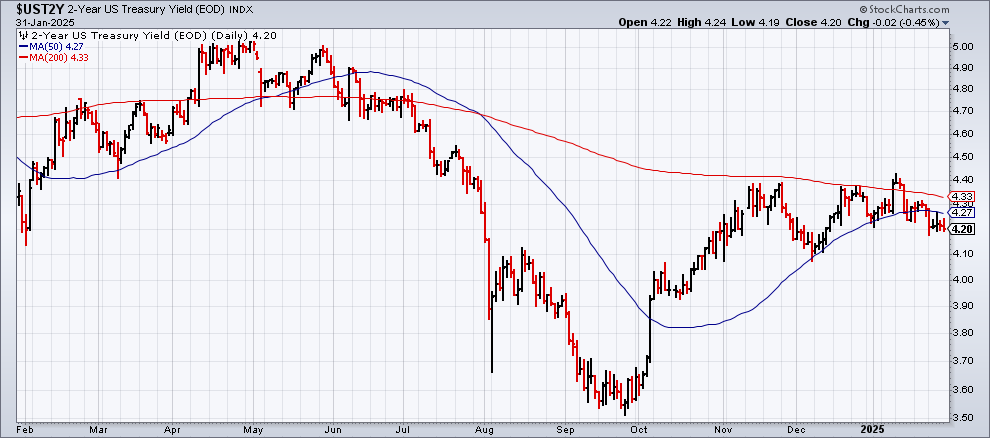

Markets going forward will be focused like a laser for clues on how the current experiment with protectionism fares. On the short list of indicators to watch: Treasury yields. The 2-year rate is good place to start. This policy-sensitive maturity is widely followed as a proxy for rate expectations. Echoing the Federal Reserve’s decision last week to leave its target unchanged and remain in a wait-and-see posture, the 2-year yield has been trading in a tight range recently. A runup in this yield would be quite worrisome at this juncture.

Fed funds futures at the moment are pricing in a high probability (83%) that the central bank will leave its target rate unchanged again at the next FOMC meeting on Mar. 19. That could quickly change, of course, if the Fed sees incoming data that suggests that higher tariffs are starting to lift inflation.

But tariffs can be a two-edged sword. Higher inflation via higher import prices is one risk. The question is whether tariffs take a toll on economic activity, which in turn could persuade the Fed that holding rates steady or even cutting is a better decision.

Responding to a reporter’s question last week about how the Fed is thinking about tariffs-related risk, he punted (of course) but did say “the range of possibilities is very, very wide” for what could happen. “We just don't know and I don't want to start speculating, as tempting as it is, because we really don't know.”

Readers won’t be surprised to learn that your editor doesn’t know either. But what is clear is that the potential for significant blowback in some form is non-trivial.

The week ahead deserves close attention as markets deliver an initial reaction to the tariffs. Meanwhile, the tea leaves for expectations aren’t encouraging.

Paul Ashworth, Capital Economics’ chief North America economist, advises that the tariffs are “just the first strike in what could become a very destructive global trade war.” He predicts: “The resulting surge in U.S. inflation from these tariffs and other futures measures is going to come even faster and be larger than we initially expected.”

“WILL THERE BE SOME PAIN?”, President Trump asks today in his signature all-caps commentary on social media today. “YES, MAYBE (AND MAYBE NOT!). BUT WE WILL MAKE AMERICA GREAT AGAIN, AND IT WILL ALL BE WORTH THE PRICE THAT MUST BE PAID.”

Let’s see if the markets are inclined to agree in the days ahead. ■