The ETF Portfolio Strategist: 02 MAR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Risk assets remained on the defensive last week, but the value of global asset allocation was shining.

Diversifying across asset classes was relatively resilient, particularly for conservative- and moderate-risk strategies. Using a set of four global asset allocation ETFs highlights a modest rise for the conservative portfolio (AOK) and a flat performance for the moderate strategy (AOM). Growth (AOR) and aggressive (AOA) fell, but overall it was a solid week that kept all four funds in the positive column with year-to-date gains in the mid-2% range while stocks around the world took a hit.

Despite the upbeat performances for the year so far, markets are experiencing a new bout of turbulence — the most since last summer, based on the Global Trend Indicator (GTI), which summarizes and aggregates the technical states for the four ETFs listed above.

The GTI Drawdown Risk Index rose after a period of calm, signaling a bit more downside risk for the asset allocation strategies in the-term future.

Although the upside bias that prevailed in previous weeks has faded, it’s still too soon to make strategic decisions about the odds for a new risk-off environment. Until the latest run of deterioration persists for a bit longer, and spreads, the limited selling in some corners should be viewed as noise.

The potential for a risk-off signaling is rising, however, and so the coming days and weeks deserve close monitoring. Are we approaching a tipping point in favor of downside risk? Maybe, but making that call today strikes me as highly speculative at this point. Keep in mind that I say that in the context of a medium-to-long-term horizon. For investors with a shorter horizon and/or a relatively low risk tolerance, the calculus and implications of current conditions may offer a different view.

Nonetheless, even for strategic-minded investors there are some key issues to watch, starting with the rebound in the bond market.

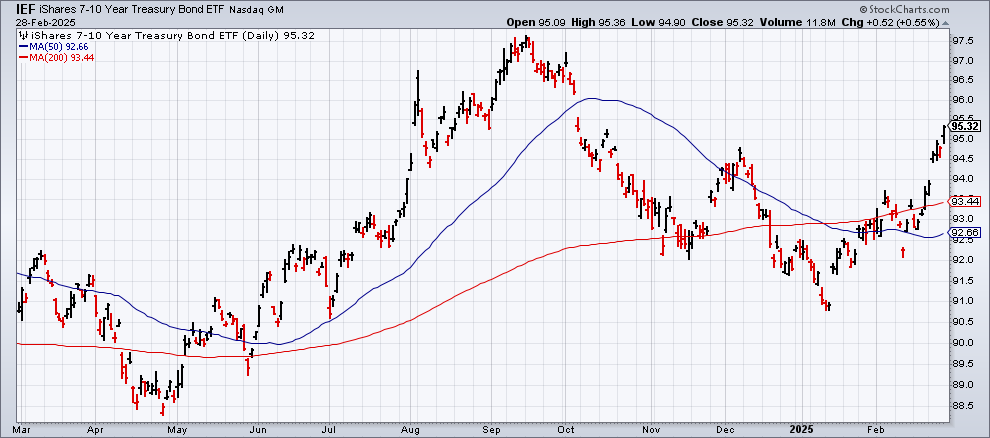

US Treasuries (IEF) posted a red-hot gain last week, jumping 1.7%. The rise marks the seventh straight weekly advance for the ETF. Note, too, that recent rally in bonds is a key reason why diversified strategies are looking comparatively strong this year. IEF’s 3.4% year-to-date rise is suddenly looking strong next to the 1.1% advance for US stocks (VTI). Small-cap equities (IJR) have fared even worse in 2025 and are now in the red with a 3.0% loss this year.

For investors diversified across stocks and bonds, the ballast by way of fixed income is welcome, of course. But the caveat is that the macro factors that appear to be driving purchases of bonds may be a warning.

Recall that sticky inflation risk has been lurking as a potential spoiler recently for the bond market. But Friday’s PCE inflation data for January took some of the sting out of the worrisome consumer price profile released earlier in the month. It will take several more inflation updates at a minimum to develop confidence about what’s going on, but for the moment the sight of softer comparisons for the Fed’s preferred inflation metric — PCE — offers some breathing room for bonds.

Meanwhile, Fed funds futures continue to price in high odds that the central bank will leave its target interest rate unchanged at the upcoming Mar. 19 policy meeting.

The rally in Treasuries, however, may be less about expecting inflation risk to ease and more of a sign that investors are beginning to lean into a risk-averse posture. One reason for thinking so is the return of the 10-year-less-3-month Treasury yield curve to sub-zero readings lately. After briefly rebounding to a positive spread for the first time in over two years, the yield curve has inverted again. By some accounts, the return to red indicates a growing wariness on the economic outlook.

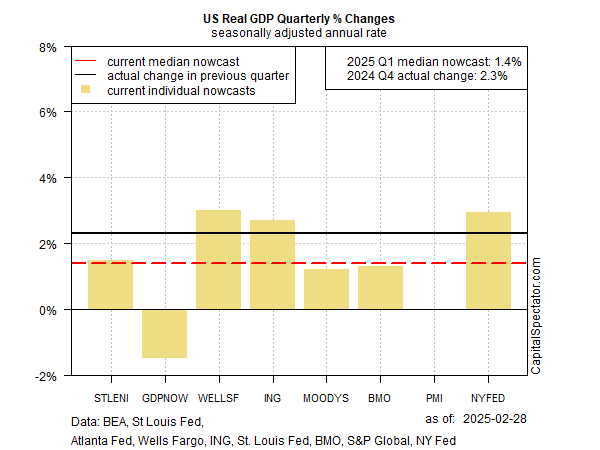

It didn’t help that the Atlanta Fed’s nowcast for the first quarter crashed in Friday’s update. The GDPNow model’s Q1 estimate for GDP was sharply downgraded to -1.5% due to weak data in the latest numbers for net exports.

A worrisome development, but one that should be kept in perspective, at least for now. As I wrote in this week’s edition of The US Business Cycle Risk Report,

The sensitivity of the GDPNow model to net exports looks excessive. But every model comes with a unique set of pros and cons, which is why we prefer to rely on the median from several models to minimize noise in nowcasting the next GDP report. On that note, our new median Q1 estimate for GDP has fallen to +1.4% today from +2.3% in the previous week’s update (see chart below). That’s a significant downgrade, but it’s arguably a more reasonable estimate [vs the GDPNow data], at least for now.

The main dilemma for markets at this stage is the path ahead for how and when the spike in macro uncertainty is resolved. From fading CEO optimism to sliding consumer sentiment at a time of threats of mass layoffs of federal workers and higher tariffs, the disruption flowing from Washington appears to be taking a toll on expectations.

Another joker in the deck: sliding odds that Ukraine can end the war on reasonably favorable terms after a fiery Trump-Zelensky meeting in the Oval Office on Friday. The macro outlook for Europe may hang in the balance.

To the extent that the recent increase in anxiety about where all this is headed is driven by President Trump’s mercurial pronouncements and policy preferences, the markets will have a tough time separating signal from noise.

From the vantage of your editor’s chair, it’s reasonable to assume that a wait-and-see approach will prevail for the near term. But patience in markets may wear thin, perhaps sooner than later.

Meantime, an ongoing rally in Treasuries (and a commensurate fall in Treasury yields) will increasingly be viewed as a warning sign that strengthens a case for adopting a defensive stance at some point. ■