The ETF Portfolio Strategist: 03 NOV 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

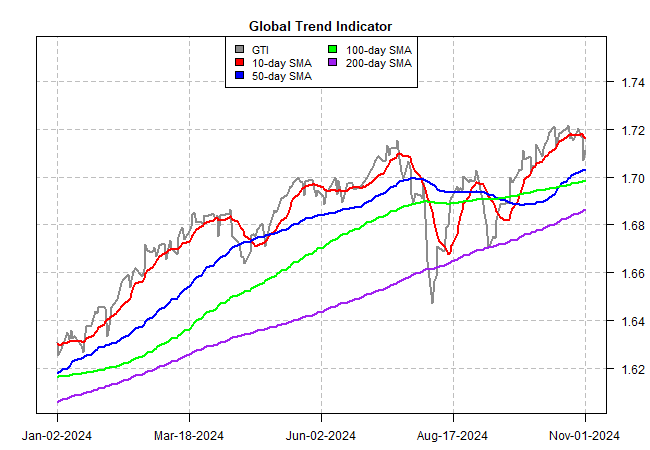

Markets retreated for a second week through Friday’s close. The downturn was modest and the setback didn’t change the overall trend profile for the four global asset allocation ETFs that are standard fare as proxies in these updates. The Signal scores in all four cases held steady at a modestly bullish score of +2. See this summary for details on the metrics in the tables.

Yet it’s hard not to sense that markets, and everyone else, are waiting on pins and needles to see the results of Tuesday’s US election. Given the tight polling and confrontational plans to litigate results, the official outcome might not be known for days, or possibly weeks. But this much is clear: there are stark differences in policy plans.

No one knows how the election will turn out, or what exactly it will lead to for the economy and markets, but that doesn’t stop anyone from guesstimating. Some analysts, for example, worry that Trump may try to influence the Federal Reserve to keep interest rates lower than the central bank prefers (or that inflation implies), which suggests the possibility for higher inflation.

There’s also a view that a Republican sweep of the White House and both chambers of Congress would give Trump a green light to fulfill a campaign promise to sharply raise tariffs, which in turn might stoke inflation and thereby drive up interest rates. Arguably that’s a factor that’s behind the recent rise in the US 10-year yield — a rise that, some argue, is based on expectations that Trump is poised to win.

On the flip side, if Harris wins the election the concern is that tax rates on corporations and wealthy individuals will take a bite out of economic growth. By some accounts, that may lead to a stronger run of disinflation.

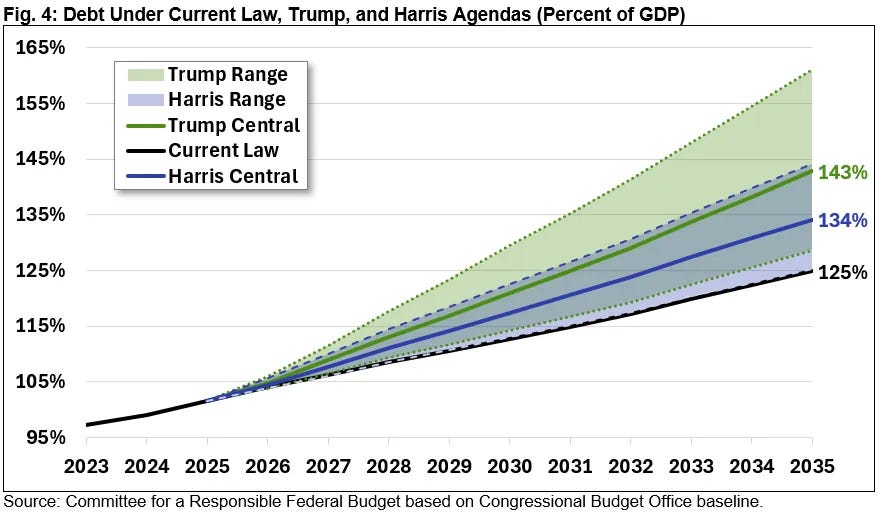

One common feature that both candidates share is a distint lack of discussion for fiscal austerity and so the federal deficit is likely to deepen. The distinction is that the expected rise in government debt is projected to be steeper compared with Harris’s plans, according to several forecasts. Estimates by the Committee for a Responsible Federal Budget, for example, project the Trump agenda will raise debt by 143% vs. 134% via Harris, based on the central estimates. For context, if current laws are kept in place the debt will rise 125%, this forecast advises.

Your editor recommends taking such estimates with a grain of sale. Ditto for deciding how markets and the economy will react to a Trump or Harris victory. But while there’s a boatload of uncertainty, there are sharp differences in stated policy agendas and so markets may be in a holding pattern for the next few days, if not longer, until something approximating clarity emerges on the other side of Tuesday.

Meanwhile, last week’s slide in markets didn’t change the big-picture profile for the Global Trend Indicator (GTI), an index that summarizes trend behavior for the four asset allocation ETFs listed above. Your editor will be keenly watching this benchmark and its performance in the days ahead. Key questions that are top of mind: Will GTI’s bullish trend persist and set new highs? Alternatively, will the election outcome trigger a loss of confidence and cut GTI sharply to the point of signaling a longer run of downside risk? Stay tuned.

There may be many twists and turns ahead, and plenty of surprises. The only thing I know for sure: the policy differences are stark and the stakes are high, not just on the economic and financial fronts, but for foreign policy and related matters.

Like everyone else, I’m holding my breath, hoping for the best, but assuming that we may be none the wiser come Wednesday morning. ■

Well written. Always a good read.

Thanks