The ETF Portfolio Strategist: 04 MAY 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Financial markets continue to find a degree of comfort with the recent surge in global trade tensions. Stocks around the world rebounded last week, providing lift for a set of global asset allocation ETFs, led by the aggressive strategy (AOA), which rallied 2.3%.

Although all four funds are still trading below their recent peaks, the sharp drawdowns are fading. A key level to watch is whether the ETFs are able to regain all the lost ground and set new highs, which would be a strong bullish signal. That recovery event could arrive within days for the conservative (AOK) strategy, which is closest to retaking its February peak.

Note that throughout the recent correction the risk-off signal didn’t trigger for the long-term trend (per the table above). The implication: the selling, although fierce, didn’t derail the bull market for global asset allocation strategies. Rather, markets reacted to the increase in tariff tensions by demanding a higher expected risk premium (i.e., by reducing prices), but the initial response is increasingly seen as too harsh.

These are still early days for the trade war, of course, and so it’s premature to embrace the optimism narrative completely, but for now it’s a view that’s gaining more traction among investors, and will continue to do so as long as the risk-on signal for the long-term indicators holds.

The overall recovery of the asset allocation funds is still a work in progress and retaking the previous high isn’t imminent for the Global Trend Indicator (GTI), which aggregates the technical profiles of the four ETFs above. A lot has to go right on the trade front before GTI moves back to record-high terrain and signals the all-clear in broad terms.

But progress of late is conspicuous — GTI’s drawdown has returned to garden-variety terrain, for instance.

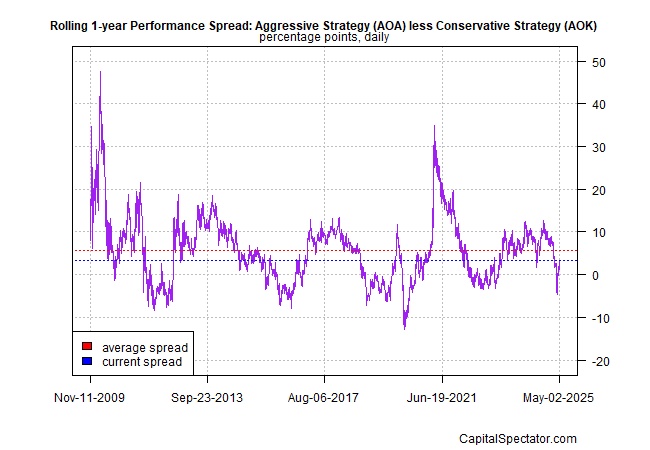

Ditto for the 1-year spread for the aggressive strategy (AOA) less its conservative counterpart (AOK).

The setup that will favor ongoing repair and recovery, in sum, appears to be in place for asset allocation strategies.

Note that only small-cap US stocks are signaling bear market conditions (via the risk-off posture for the long-term trend in the table below). The rest of the field is still green for the long trend, which is encouraging in that markets overall continue to downplay the odds for bear-market risk.

The threat to the sunny narrative is that genuine progress on taming tariff risk still falls short and the global economy is left with a non-trivial headwind that will likely strengthen. A key indicator for assessing this risk: trade talks between the US and China. So far, the silence has been deafening.

Last week China expressed openness to trade talks, but so far there have been no substantive developments beyond a few crumbs of upbeat comments. Meanwhile, the clock is ticking.

The high tariffs the US placed on Chinese products kicked in a month ago, but companies prepared by frontrunning imports and stockpiling goods. The main blowback for the economy, in other words, still lies ahead.

An early sign: US ports are starting to report falling import volumes due to tariffs. Meanwhile, some firms are beginning to raise prices as the loss of Chinese products work its way through the economy.

Exactly how big of tariff-related shock is coming is uncertain, but the longer the US-China trade talks are on ice, the greater the probability of a significant headwind.

The good news is that the US economy is still growing, despite the modestly negative print in Q1 GDP, which was weighed down by a surge in imports. As the Dallas Fed’s Weekly Economic Index suggests, output was still solidly positive through Apr. 26.

But the real test is brewing in the weeks and months ahead, and so it’s far too early to conclude that the worst of trade-related fallout has passed.

Markets seem to be willing to price in higher odds for a relatively upbeat outcome, and for all we know that will prove to be correct. But laying out a path of how we get from here to there still requires a bit of magical thinking.

Further progress in recovering lost ground in markets looks highly dependent on hard news that leads to a pullback in tariffs. So far, that news flow is nowhere on the immediate horizon. Perhaps the White House will have good news this week. If not, market sentiment is going to find it tough to keep the optimism train rolling. ■

Excellent analysis James. As always. Gold price has not fallen as quickly as market has rebounded so I believe we are in a cautiously-optimistic upward trend.