The ETF Portfolio Strategist: 06 APR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Well, that escalated quickly.

Investors were braced for trouble at the start of last week, but the blowback surprised almost everyone after President Trump outlined tariffs that were significantly broader and higher than expected. The stock market was not amused.

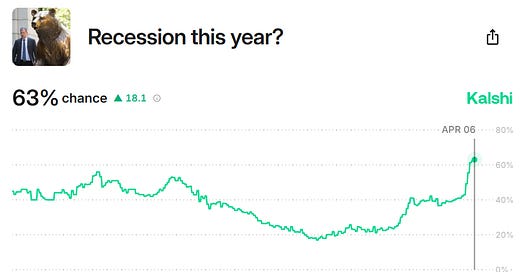

The S&P 500 Index cratered last week, posting a steep 9.1% drop and leaving equities at the lowest level in nearly a year. The market is pricing expectations that inflation will rise and economic growth will slow, perhaps leading to a recession, which is more likely, say a growing chorus of economists from JP Morgan, Moody’s Analytics and elsewhere, including the Kalshi betting market, which is now pricing in a 64% chance of a recession sometime this year.

The worrisome outlook is all guesswork at this point and the data published so far still skews in favor of growth. But published numbers for the economy arrive with a lag, and they’re rapidly becoming out of date in the current environment.

Financial markets, on the other hand, are shooting first and asking questions later and so the zeitgeist has clearly taken a bearish turn in the extreme and the remaining optimists are hard-pressed to talk up a bright future for the near term.

US Treasury Sec. Scott Bessent and National Economic Council director Kevin Hassett gave it the old college try earlier today by downplaying the gathering storm clouds. “I see no reason that we have to price in a recession,” Bessent said. Hassett chimed in: “I don't think you're going to see a big effect on the consumer.”

If there’s still a case for optimism, it’s not showing up in our usual set of ETF proxies for global asset allocation, which posted hefty declines across the board. The conservative strategy (AOK) kept the damage to a minimum vs. its more-aggressive counterparts. After sliding 2.0% for the week, a bearish signal for AOK was contained to the short-term horizon. For the rest of the field, the medium-term trend flipped to bearish after last week’s signals (based on a proprietary methodology calculated by your editor).

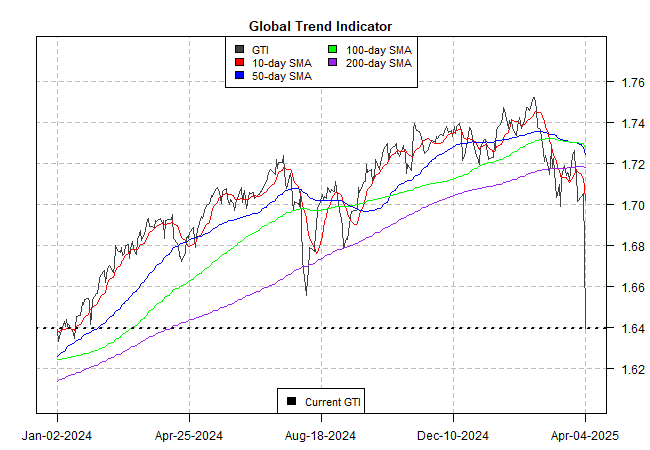

Turning to the Global Trend Index (GTI), which aggregates the technical profiles of the four ETFs listed above, it’s clear that the floor gave way. The trend destruction for GTI was so fast and deep that it left the longer-term moving averages still running on bullish fumes that pre-dated the President’s “Liberation Day” announcement on Wednesday.

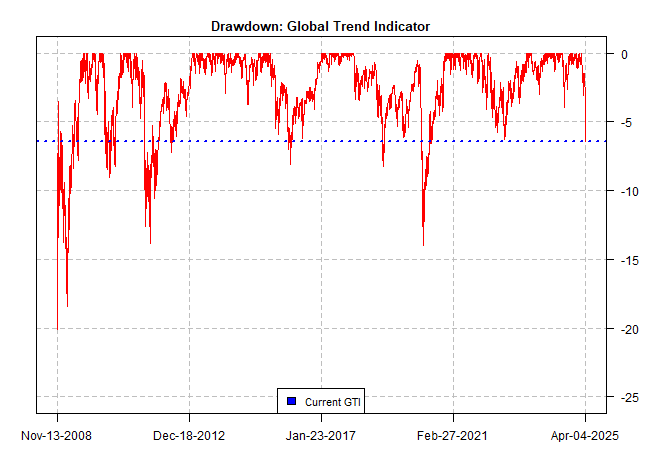

GTI’s drawdown quickly collapsed to -6.5%, the deepest since the pandemic was raging in 2020.

For another perspective on the dramatic, sudden change in sentiment, the performance spread for the 1-year return for the aggressive allocation strategy (AOA) less its conservative counterpart (AOK) turned negative in short order, signaling a sharp bearish pivot.

On an upbeat note, there were a handful of winners last week in some markets, courtesy of the safe-haven trade for bonds. The week’s biggest winner via our ETF scorecard: government bonds in developed markets ex-US (BWX) with a strong 2.3% rally. US Treasuries (IEF) were a close second-place winner (+1.9%). US investment-grade corporates were the third-best performer via a 0.7% advance. Otherwise, the rest of the main categories of global markets took it on the chin.

There are still several market categories posting bullish trend scores for short-, medium- and long-term horizons:

US Treasuries (IEF)

US investment-grade corporates (LQD)

Emerging markets government bonds (EMLC)

International junk bonds (IHY)

Latin American stocks (ILF)

African stocks (AFK)

But note that the green signaling for Latin American stocks (ILF) and African equities (AFK) are hanging by a thread and so red could easily slip into the picture quickly.

The main risk factor for all markets is the spike in uncertainty that now hangs over the global economy. Putting aside the deeply misguided logic of returning to a 21st century version of mercantilism, everyone’s wondering what’s the gameplan?

Is raising US tariffs to the highest level since 1910 a strategy to generate new revenue for the US? Or is it a negotiating tactic to eventually lower tariffs? Each is in conflict with the other. Consider a thought experiment: All the US-aligned factories in foreign countries move to America and in some alternative universe US imports fall to zero. That also means tariffs fall to zero. On the other hand, if the spike in tariffs is a strategy to persuade foreign governments to lower their tariffs and buy more from America, the incentive for building factories in the US fades.

If the goal is to raise revenue, one can reasonably ask: At what cost. The price tag is already steep, measured in trillions of dollars of losses for the stock market in the past several days.

Granted, the blowback for the real economy has yet to be tallied. Many economists, however, expect slower growth and higher inflation. But, yes, that’s a forecast and there are no numbers yet to confirm or reject the outlook. In fact, using the latest numbers published to date still show the US economy is growing at a solid pace, based on the Dallas Fed’s Weekly Economic Index through Apr. 3.

The strong rebound in US payrolls in March tell a similar story.

Why, then, is the stock market sliding so sharply? The short answer: the market is forward-looking and the economic data is rear-view mirror.

The market could be wrong, of course. It wouldn’t be the first time.

Let’s end on a positive note with White House National Economic Council Director Kevin Hassett’s report from earlier today that “more than 50 countries have reached out to the president to begin a negotiation.”

Vietnam offered to reduce tariffs on US imports to zero, asking America to do the same for Vietnam. If it happens, it might be one small step forward.

Is this a framework for a solution? Unclear, but for now it’s the only game in town. ■

Hi James, as always, this is an excellent data an analysis. I never miss reading your updates. I'd like to propose two things - [1] since we are not in a 1929 depression, and since this is a one-time impulse to the markets, we should expect a rebound in a few(?) weeks, and [2] it seems that since the election, the S&P has been flat to down and very volatile, and this is (very big) down-spike is part of the down trend. So therefore I think its not the beginning of another 2008. Just my 2c.