The ETF Portfolio Strategist: 08 DEC 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

No news is good news when the overall market trend is solidly positive. Therein lies the core takeaway for assessing results over the past week.

By “news” we’re referring the trend data in general, and by that definition the bull stampede is still robust.

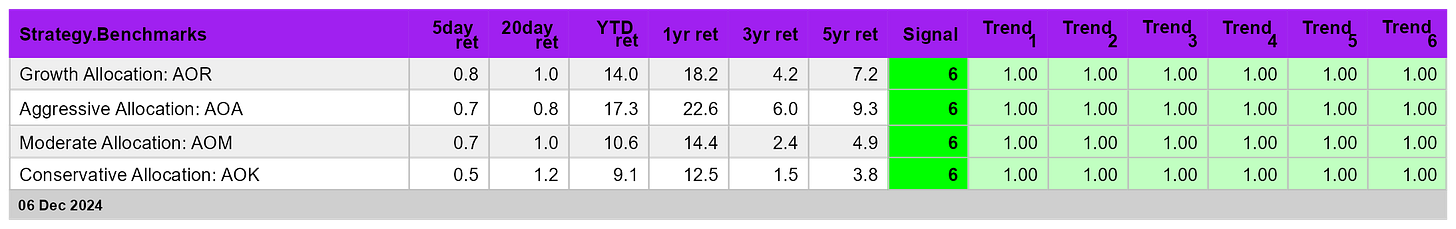

All of our proxy ETFs for global asset allocation rose again last week, maintaining a strong bullish Signal score of 6 — the highest level possible. There’s a temptation to second guess the crowd at these moments, but when markets are posting healthy gains, there’s a compelling case to sit back and enjoy the ride until the trend profile gives us a reason to do otherwise. See this summary for details on the metrics in the tables.

The strength of rally is clear when we review the Global Trend Indictor (GTI), which summarizes the bias for all the ETFs listed above. Extending the signaling from recent weeks, today’s update points to a continuation of a bullish pattern that’s dominated since October.

The GTI Drawdown Risk Index is also all-in on the bullish profile. This benchmark quantifies the current strength of bullish trend activity for the four asset allocation ETFs in one indicator. A zero reading is flat-out bullish. When/if the market starts to stumble, early signs of a possible trend shift will show up here. For the moment, however, the all-clear signal remains conspicuous.

It’s telling that most of the major market categories for global portfolios are reflecting robust trend strength. The main downside outlier remains stocks in Latin America (ILF), which continues to lose ground in what’s been a persistent slide for much of 2024. Otherwise, the majority of markets are enjoying bullish profiles, many in the extreme (indicated by the green boxes in the Signal column).

A similar story applies to the US equity sectors. The main exceptions: healthcare (XLV) and materials (XLB).

For investors with low risk tolerance, short time horizons or other reasons for favoring a cautious stance, the current market profile may be disarming. For such folks, there’s a case for gradually de-risking as prices climb. Keep in mind, however, that contrarian-oriented policy shifts can inflict a significant price tag over medium-/long-term horizons. To the extent your horizon is relatively short, you can downplay that risk and, for instance, hold more cash than you otherwise might relative to, say, 6 or 12 months earlier.

Otherwise, the game of trying to outguess Mr. Market looks precarious these days. Sure, we can point to any number of reasons for why the rally deserves to pause if not reverse. Take your pick: valuation, geopolitical risk, policy-regime shift in Washington, and on down the line.

The question is what does any one investor know that overrides the collective wisdom of markets? That’s a high bar. And while it’s not impossible that some market sages can make profitable contrarian bets, that’s a rare beast for most of us.

This much, at least, is clear: When the bullish trend starts to deteriorate, it’ll be obvious early on in the metrics above. Pay particular attention to the profiles of the asset allocation ETFs, collectively and individually. On that front, the bull run remains intact in a non-trivial degree.

It could all end in a heartbeat, of course. Or not. The future’s uncertain. What else is new?

Meantime, the expected payoff tends to be slight, at best, from trying to be early re: predicting the next downturn/bear market by going defensive early. By contrast, waiting for some quantitative basis to start de-risking strikes your editor as more favorably skewed for investors with medium-/long-term horizons. Yes, that’s the bias on these pages, and it’s not perfect. But history suggests its preferable to its sibling, at least for those of use without Oracle-like skills.

In short, stay focused, watch the numbers, and don’t get distracted by the firehose of noise and news. Steady as she goes. This recommendation will eventually give way to a different outlook, but not yet. ■