The ETF Portfolio Strategist: 09 MAR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

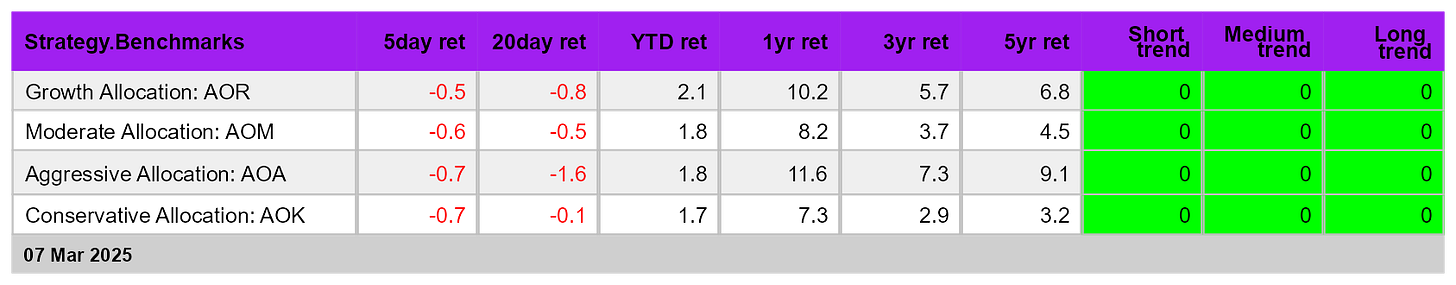

The selling spread last week across all flavors of risk targets for global asset allocation strategies, based on a set of ETF proxies.

Since the current downturn started in mid-February, strategies with a relatively defensive bias have been somewhat immune from the selling while the more aggressively-positioned portfolios took it on the chin. But last week delivered an across-the-board setback (see first table below). The question is whether this is noise or capitulation that signals an extended run lower? Crucial clues could emerge in the trading week ahead.

Before we dig into the numbers, a quick digression. Starting today, I’m using a revised methodology to summarize trend profiles for ETFs, as shown in the tables below. The new suite of analytics offers, in your editor’s view, a clearer, moderately more reliable overview of how fund prices are trending for the trailing short-, medium- and long-term windows. In an upcoming issue I’ll provide some background context on how the new trend data is calculated and how it can be used.

The new indicators are binary: 0 is a positive trend; 1 is a negative trend. On that basis, all four global asset allocation ETFs continue to reflect positive biases across the board. Encouraging, but we’re keeping on a close eye on the short-term indicator, which may be approach a tipping point that flips it to negative.

Meanwhile, the Global Trend Indicator is showing ongoing weakness. GTI summarizes and aggregates the technical states for the four ETFs listed above. Despite the latest downturn, GTI is still signaling a garden-variety correction, but the margin of safety is fading and so this indicator will soon trigger a formal warning if the selling persists. For now, we’re in a wait-and-see mode via GTI for deciding if a full-throated risk-off storm is brewing.

Reviewing the GTI Drawdown Risk Index suggests that the current downturn is approaching the deepest levels since last-August’s correction. The latest slide is relatively orderly by comparison, whereas the August decline was sharper and faster.

One reason for reserving judgment about whether a defensive posture is warranted: global markets continue to exhibit a range of results. The implication: global diversification is still blunting the worst of the selling. Last week, stocks in Europe continued to provide ballast to offset weakness elsewhere. The Vanguard Europe ETF (VGK) surged 4.5% for the trading week, closing at a record high on Friday.

US stocks, by contrast, extended their retreat for a third straight week, based on Vanguard Total US Stock Market (VTI), which shed 3.3%.

Year to date, Europe (VGK) is outperforming US equities (VTI) by a wide margin: 15.6% vs. a 2.2% loss for American shares. US small caps (IJR) are faring even worse, sinking 6.4% so far in 2025.

Despite the recent surge in European stocks, it’s important to be clear-eyed about the risks that are lurking — risks that can be summed up in one word: uncertainty.

To be fair, there’s always trouble afoot and no one knows what awaits beyond the next bend in the road. But in the current climate, maximizing uncertainty seems to be the goal, based on recent actions by the Trump administration. On the topic of tariffs, for instance, the president’s agenda, whether you agree or not with the underlying assumptions, has been erratic, to put it mildly. The on-again/off-again decision-making process is making it hard to for businesses to weigh the pros and cons of investing, expanding, hiring, etc.

The US economy, however, still looks resilient, based on numbers published to date. If there’s fallout from the Trump rollercoaster, it’s not showing up in the hard data. But these are early days, and the US stock market’s decline appears to be the crowd’s collective decision to demand a higher ex ante risk premium to adjust for the jump in uncertainty.

Perhaps it’s all a temporary setback that will soon give way to a resumption in US-led leadership for equities. Right now, however, the vibe suggests otherwise.

“The administration wants higher growth because animal spirits are unleashed,” said Rebecca Patterson, a senior fellow at the Council on Foreign Relations and former chief investment strategist at the hedge fund Bridgewater Associates. “But how do you get more animal spirits — more mergers and IPOs — if there’s uncertainty around market and economic conditions? That seems contradictory.”

The optimistic view is that the administration is still figuring out how to effectively communicate and implement the president’s policies in a way that’s productive. On that basis, the learning curve in recent weeks has been steep.

There’s still time to right the ship and persuade markets that US policy is pro-growth and mindful of where macro landmines are buried. But time is running short and the US stock market is already signaling elevated anxiety about the administration’s priorities and its definition of best practices for achieving worthwhile objectives.

At the risk of pushing the metaphors too far, one might say that the honeymoon is over but there’s still time to avert a divorce. ■

Thoughtful, great selection of words, and well written. I enjoy your posts. Thank you.

Great stuff James. Thank you for doing what you do!