Negative momentum strengthens across global markets

Portfolio strategy benchmarks are buckling

It’s getting ugly out there. Persistent inflation is the likely cause, or at least the leading contender, for the latest reacceleration in selling. Today’s update on US consumer inflation for May — prices rose 8.6% year-over-year, the highest since 1981 — offered little reason to think that this headwind is set to ease substantially in the near term. There’s still a case for thinking that inflation is close to peaking, but if that’s true it’s only a technical distinction since post-peak pricing pressure will probably stay high by historical standards for months.

However you slice it, markets aren’t happy. Save for a slight gain in broadly defined commodities, the rest of our 16-fund opportunity set suffered sharp losses this week. For details on the metrics in the table below, see this summary.

The outlier: WisdomTree Commodity Index (GCC), which rose for a fifth straight week with a slight 0.3% increase. GCC is approaching its upper range for 2022, which certainly looks encouraging in a world where market trends otherwise are weak in no small degree. Then again, there’s reason to wonder if it’s time to take profits in commodities. US and global growth is slowing and the warning signs for recession are bubbling. Demand destruction, in short, may be approaching, which could offset the supply shortage currently propping up many commodities prices.

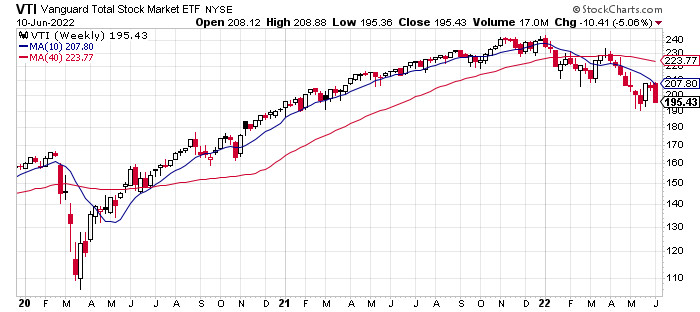

Elsewhere, the outlook is clearer in terms of expectations. US stocks look set to test recent lows in the wake of this week’s sharp 5.1% loss in Vanguard Total US Stock Market ETF (VTI). Although a recession for the US is still unlikely in the near term, the second half of the year is increasingly vulnerable. The renewed slide in VTI is effectively forecasting just that.

By some accounts, the contraction is already here. “We’re in technical recession, but just don’t realize it,” opines Michael Hartnett, chief investment strategist at Bank of America. Economic Cycle Research Institute’s Lakshman Achuthan says a recession at some point is plausible but it could be mild due to a tight labor market. He adds “that there is a setup for a more severe recession. A more international recession. The last time we had that would have been like the early 1980s.”

A worrisome sign is the ongoing deterioration in US consumer sentiment. The University of Michigan’s sentiment benchmark tumbled to the lowest on record, surprising to the downside vis-a-vis all the estimates in the Bloomberg survey of economists.

“Throughout the survey, consumers signaled strong concerns that inflation will continue to erode their incomes, and the factors they cited are unlikely to abate soon,” advises Joanne Hsu, director of the survey. “While consumer spending has remained robust so far, the broad deterioration of sentiment may lead them to cut back on spending and thereby slow down economic growth.”

Meanwhile, interest rates continue to rise, thereby erasing any support from bonds to offset weak stock prices. The benchmark 10-year Treasury yield broke out to a new 3-1/2-year high of 3.15%. Bond prices, in turn, tumbled. The iShares 7-10 Treasury Bond ETF (IEF) slumped 1.8% this week, closing at the lowest level in over three years.

The bearish storm that’s overtaking markets has been a long time in the making and it appears that the die is cast for even lower prices in the weeks and months ahead. Until central banks find some traction on reversing inflationary pressures, markets will be on the defensive. Unfortunately, the Fed and several of its key counterparts around the world are still playing catch-up with monetary policy tightening and so there’s a long road ahead.

The case for risk-on, in short, looks weak for the foreseeable future. That doesn’t preclude periodic rallies, but Mr. Market is still struggling to wrap his head around what how the various risk factors roiling sentiment will play out in the summer and beyond.

Broad market weakness is now clearly weighing on our strategy benchmarks. The losses this week are broad and deep. The darkest shade of red is a steep 4.4% loss in the Global Market Index (GMI), an unmanaged portfolio of all the major asset classes allocated in market weights. For details on the benchmark designs, see this summary.

The equal-weight Global Beta 5 EW (G.B5.ew) is still holding up relatively well, thanks to a relatively robust holding of commodities. But here, too, the deterioration is becoming increasingly conspicuous.

Short of some unforeseen event that reverses or at least minimizes the negative aura stalking global markets, our strategy benchmarks look set to fall below recent lows, a break that will raise the odds that significantly lower levels are coming in the weeks and months ahead. ■