In this issue:

Small-cap value stocks are sizzling this year

Commodities appear to be in a new bull market

Warehouse REITs ride the post-pandemic recovery wave

Is secular regime change afoot for small-cap value stocks? History suggests that small-company shares trading at a discount to book value (or some other measure of a company’s worth) offer some of the highest expected returns in the equity space. The last several years, however, offer a different perspective, courtesy of weak performance in small-cap value relative to the broad market. But 2021 suggests regime change may be bubbling.

Using the iShares S&P Small-Cap 600 Value ETF (IJS) as a proxy shows a sharp turnaround in relative performance vs. the overall market, based on SPDR S&P 500 (SPY). As the chart below shows, IJS has soared recently relative to SPY. The question is whether this is a game of catch-up that will soon fade?

Small value was hit especially hard by the pandemic last year, falling substantially more than SPY and recovering less ground initially. But the tide has turned in IJS’s favor. It’s not yet clear if the IJS rocket is merely closing the performance gap that widened vs. its larger-cap counterparts.

The alternative narrative: the IJS rebound is the first installment of an extended run of outperformance fueled by an economic expansion that appears to be heating up. All the more so in the wake of today’s approval by the House for Biden’s $1.9 trillion stimulus/relief bill. One more reason to think that the case is strengthening for expecting IJS to maintain its red-hot run for the foreseeable future.

Raw (materials) appeal: Maybe it’s all the inflation talk. Or the brightening economic outlook. Or both. Whatever the catalyst(s), commodities continue to show a strong upside trend. Using an equally weighted mix of four broad-minded commodity sectors tells the story.

After trending down for nearly a decade, WisdomTree Continuous Commodity Index Fund (GCC) has been pushing higher for much of the past year. The dramatic bounce has had temporary setbacks, but for the moment the upside bias remains intact.

The buying may be overdone on a near-term basis, but the macro stars are still aligned in favor of higher prices. Short of some major event that raises fresh doubts about the economic outlook, GCC is poised to rise further, supported by the upgrading of growth forecasts for the global economy.

As Reuters reported yesterday, “the world economy is set to rebound this year with 5.6% growth and expand 4.0% next year, the Organisation for Economic Cooperation and Development said in its interim economic outlook.”

Warehouse properties are in demand: The pandemic raised questions about the viability of commercial property – office real estate in particular. As more workers turn their bedrooms into offices, the outlook for office space is a bit sketchy these days. Industrial and warehouse properties, by contrast, are in high demand amid surging business for e-commerce. Al

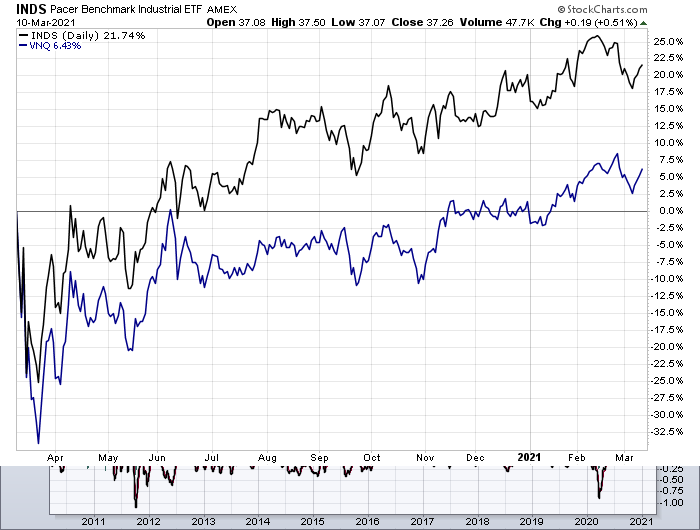

Consider the Pacer Benchmark Industrial Real Estate SCTR ETF (INDS). Over the past year, this fund has trounced the office-laden Vanguard Real Estate ETF (VNQ). INDS is up 21.7% over the past 12 months vs. a mild 6.4% gain for VNQ.

As pandemic risk fades, thanks to the ongoing rollout of vaccines, office real estate may avoid the worst-case scenarios that some analysts are projecting. But a safer bet is expecting that warehouses, storage facilities and related properties will continue to shine as the world learns to go deeper and broader with all things e-commerce related.

The shift is having real-world effects in the industrial property market. Consider Duke Realty (DRE), the top holding for INDS. DRE reported for its fourth-quarter that it was able to raise rents on some leases by nearly 13% in 2020. Not too shabby in a year when a pandemic left the world economy in crisis. ■