The ETF Portfolio Strategist: 10 NOV 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Markets cheered Donald Trump’s election victory. Measured by our standard ETF proxies for global asset allocation, the pre-election apprehension about the near-term future has given way to a full-throttled endorsement of Nov. 5’s outcome. The burst of optimism may be premature, as discussed below, but the crowd’s initial read is that they like what they see. The future, as a result, is arguably Trump’s to lose from a markets/macro perspective.

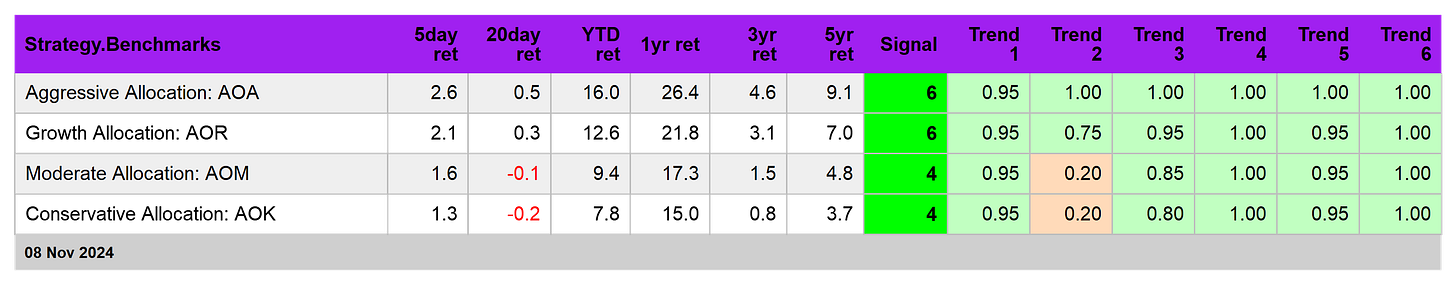

All the global asset allocation ETFs posted solid gains last week, led by the aggressive mix (AOA), which popped 2.6%, catapulting the fund to a new high before ticking slightly lower at Friday’s close. Year to date, AOA is up a sizzling 16.0%.

Judging by the trend profiles, an upside bias looks set to roll on. Our Signal scores are again running at varying degrees of strong net-bullish states. See this summary for details on the metrics in the tables.

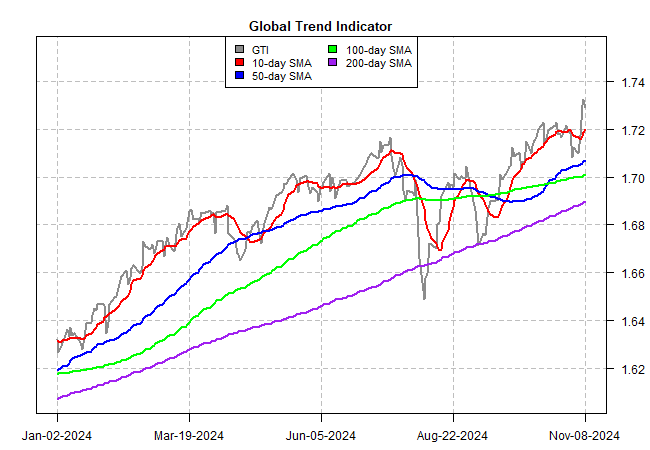

The Global Trend Indicator (GTI) rebounded last week, surging to a new peak before easing a bit at the close. This index summarizes trend behavior for all four asset allocation ETFs listed above and the current read, despite some recent wobbles, remains firmly in a full-speed-ahead mode.

Reviewing a more granular measure of global markets shows that most of the primary market categories set gains last week. The downside outliers: property shares ex-US (VNQI), stocks in Europe (VGK) and Africa (AFK), last week’s big loser. Otherwise, rallies prevailed.

Note, however, that the strongest trend profiles are concentrated in US assets — US small cap stocks (IJR), large caps (VTI), US real estate (VNQ) and US junk bonds (JNK). The lone non-US asset class with a strong trend profile: high yield ex-US (IHY0, which is posting a moderately strong +4 Signal score.

Within the US equity space, strong upside trends also dominate. Even the weaker sectors are still enjoy net-positive trend profiles.

The numbers are strong and the future looks bright, according to trend behavior. What could go wrong?

On a macro basis, the potential revival of reflation risk is on the short list of troublemakers to watch. It’s still too early to throw out the disinflation forecast that’s prevailed (correctly) in recent history, but there are hints that reflation may be re-emerging.

One reason to reserve judgment on this risk is the uncertainty surrounding how and when Trump will pursue his campaign pledges — tariffs, tax cuts and promises to deport millions of immigrant workers. This trio of policy changes will almost certainly strengthen a reflationary tailwind. How much and how long depends on how deep and how far a Trump administration pursues his policy platform.

Keep in mind that a Trump White House will inherit a US economy that’s still growing. Meanwhile, the Fed is still expected to cut interest rates again at next month’s policy meeting: futures are currently pricing in a roughly 65% probability of a 1/4-point cut on Dec. 18.

The combination of a growing economy, less hawkish monetary policy and raising import tariffs, cutting taxes and reducing the labor force at a time of low unemployment could reignite inflation’s fire.

A lot can change between now and January 20, when Trump is inaugurated. Meantime, speculation will rage about his policy agenda, and what it does and doesn’t mean for the US economy (and economies around the world).

Against this backdrop, keep an eye on US Treasury yields and inflation expectations for gauging how the crowd’s pricing in reflation risk. Although yields have run up over the past two months, the rates are still middling relative to the ranges this year. The policy-sensitive 2-year yield, for instance, closed at 4.26% on Friday. That’s up from ~3.50% in late-September but well below the ~5.0% briefly reached in May.

Where yields go from here is anyone’s guess, but this much is obvious: the bond market is awake to a possible revival of reflation. The bond vigiliantes, in other words, are back and looking for trouble. The key question: Will they find it? ■