The ETF Portfolio Strategist: 11 Dec 2020

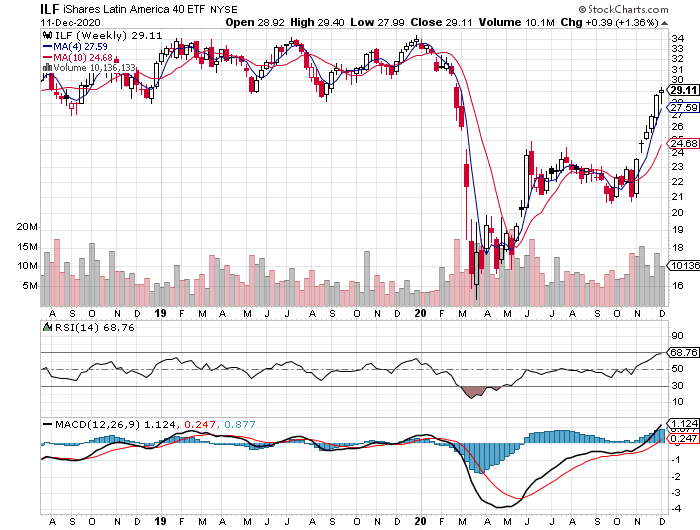

Latin America Equities Continue To Lead: Global markets delivered mixed results for the week ended Friday, Dec. 11. For iShares Latin America 40 (ILF), however, the good times roll on.

For the fourth straight week, ILF posted the strongest gain within our standard global opportunity set. The fund’s 1.4% weekly increase also marks the sixth weekly advance for the ETF. The rally is starting to look a bit overdone from a short-term technical perspective, but for the moment this slice of global shares reigns supreme for upside momentum across our standard proxy set of asset classes.

Overall, markets posted mixed results, with nine of the 16 ETF proxies for the global opportunity set retreating this week vs. eight fund gains. The biggest setback: US real estate investment trusts via Vanguard US Real Estate (VNQ), which lost 2.4%. Despite the slide, VNQ continues to hold near its best levels since the pandemic first roiled markets in March.

Medium-term Treasuries rebounded this week, delivering the first weekly gain in three weeks. Nonetheless, iShares 7-10 Year Treasury Bond (IEF) still appears caught in a downdraft and so the outlook for this corner of government bonds remains cloudy at best.

US stocks took a breather from the frenzied race higher that’s prevailed for much of the time since the market began rebounding in late-March. Vanguard Total US Stock Market (VTI) gave up 0.7% this week, but the fund remains only slightly below the record high that was set on Tuesday, Dec. 8.

Portfolio Benchmarks Take A Hit: After five consecutive weekly gains, our suite of portfolio benchmarks retreated. The setbacks were relatively mild, ranging from a 0.3% slide for the US 60/40 stock/bond mix (US.60.40) to a 0.5% decline for Global Beta 16 (G.B16), a broad measure of global asset classes. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

The rally ran out steam this week for multi-asset-class portfolios, but the solid year-to-gate gains remain intact. With three weeks left to 2020, the strategy benchmarks are sitting on roughly 9% to 14% year-to-date increases. Assuming those numbers hold, multi-asset-class beta mixes are on track to close out 2020 with impressive results.

A Good Year For Risk Management: Our aggressive risk-managed strategies are also looking at strong gains for the calendar year. Global Managed Volatilty (G.B16.MVOL) is currently ahead by nearly 29% in 2020. Global Managed Drawdown (G.B16.MDD) can’t match that year-to-date run, but no apologies are needed for a 16.2% rally so far this year. Note that both strategies use the G.B16 opportunity set listed above and on that basis the year-to-date gains on both counts reflect benchmark-beating performances.

The weak hand in our trio of proprietary strategies in 2020: Global Minimum Volatility (G.B16.MINV), which also targets the G.B16 universe. But as the slight 1.9% year-to-date increase for G.B16.MINV reminds, this particular flavor of keeping a lid on volatility has had a rough run in 2020.

Speaking of risk management, at the moment there’s very little of it in terms of the risk profile for G.B16.MVOL and G.B16.MDD. For G.B16.MVOL, risk-on for all 16 funds continues. G.B16.MDD is only slightly risk averse: except for a risk-off position for iShares 7-10 Year Treasury Bond (IEF), risk-on signals dominate in G.B16.MDD.

BlackRock’s quartet of global asset allocation ETF delivered mixed results this week. The outlier: iShares Conservative (AOK), which inched up 0.1% this week. The other three, higher-risk funds suffered setbacks, ranging from 0.2% to 0.5%.

Markets were mostly placid this week, but next week could challenge the relative calm. Several key events are on the docket, including the on-again-off-again drama surrounding the pandemic stimulus package making the rounds in Congress. There’s also a Fed meeting and November retail sales data scheduled for Wednesday (Dec. 16). Given the weak print for the US business cycle in the latest ADS Index, the crowd will be looking carefully at the hard data on consumer spending for new guidance. ■