The ETF Portfolio Strategist: 11 Dec 2022

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The rally hit turbulence last week. It could be noise, but with another Federal Reserve rate hike approaching on Wednesday, Dec. 14, along the prospect of a new round of hawkish talk from Fed Chairman Jerome Powell, sentiment turned cautious.

Nearly every slice of our 16-fund global opportunity set lost ground in the trading week through Friday’s close (Dec. 9). The upside outlier: foreign property shares (VNQI). For details on the metrics in the table below, see this summary.

Vanguard Global ex-US Real Estate ETF rose for a third week and is well above its previous trough, set in mid-October. Time to buy? Maybe, but your skittish editor remains cautious. The Fed still looks poised to continue hiking rates — Fed funds futures are estimating a 78% probability of a 50-basis-points increase at Wednesday’s FOMC meeting (Dec. 14). We may be nearing the end of the policy-tightening cycle, but by some accounts the central bank will hike through the first half of 2023, albeit by smaller increments. But for yield-sensitive risk assets such as real estate/REITs, that’s still too much of a burden to dismiss.

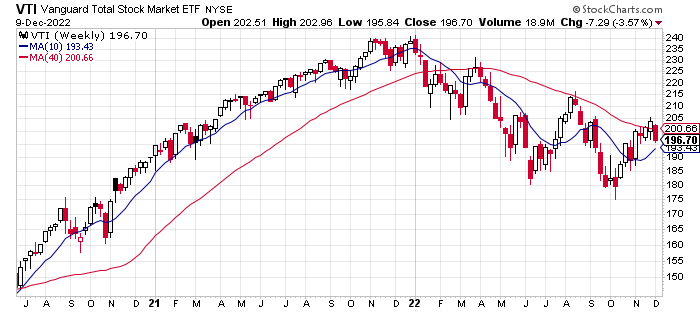

The short-term trend for VNQI and other markets may be up, but the primary trend remains bearish. Consider US equities. Vanguard Total US Stock Market (VTI) has mounted three rallies so far this year and each one has failed. The current failure is only one-week old and so it may end up as the exception. To be determined. But for now, the trend for US shares still looks bearish to these eyes and so the burden of proof remains with Mr. Market to show evidence otherwise.

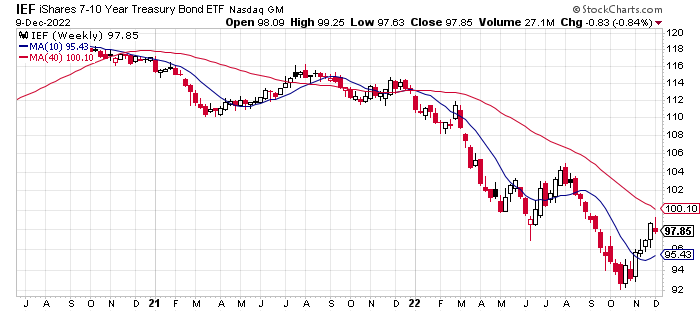

It’s a similar story for US bonds. Although iShares 7-10 Year Treasury Bond ETF (IEF) has rallied off its recent low, the fund still has a lot of repair work ahead before I’m persuaded that it’s lights out for the bear market in fixed income. Perhaps Wednesday’s presser with Jerome Powell will change my mind, but I’m not holding my breath.

Critics will complain that I’m overly cautious, and perhaps they’re right. But as I’ve discussed a number of times on these pages, the basic strategy choice is being early or late to the start of the next bull market (and, no, there’s not a third choice). I prefer to be late. Others will beg to differ and choose to be early. Each comes with its own set of unique pros and cons. Pick your poison.

When the market trend presents a compelling profile for switching to risk-on I’ll be among the first to hop on the bandwagon. Unfortunately, no one can reliably make those calls in real time and so the guessing game endures. Based on the trend data I’m looking at, staying defensive still looks compelling.

The trends for the portfolio strategy benchmarks imply that staying cautious remains credible. See this summary for design details on the benchmarks. The longer-run trend biases remain weak and the week ahead doesn’t look set to change the calculus. ■