The ETF Portfolio Strategist: 12 JAN 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The recent weakness in global markets continued last week, spreading to the US equities market, which had been relatively immune to the selling. The main upside outlier: commodities. For the rest of the field, varying degrees of weak to flat trend profiles dominate.

The downside bias is conspicuous across all our usual ETF proxies for global asset allocation. The four proxy funds are down 1%-plus so far this year. Debate is still open for what comes next, or so our proprietary Signal indicator suggests. The ETFs in this quartet are posting neutral readings, which leaves room for maintaining a cautiously optimistic outlook and assuming that the recent volatility is just another rough patch that will soon return to form and resume the uptrend that’s prevailed for much of the time since late-2022. See this summary for details on the metrics in the tables below.

But let’s not kid ourselves. Change is afoot, and it’s unclear if markets will soon become comfortable, or not, with the expected shifts brewing. From sharp policy changes slated to unfold in Washington after Donald Trump takes office, to emerging clues that reflation risk is on the March in the US, the crowd is rethinking and reassessing macro and markets conditions for the year ahead.

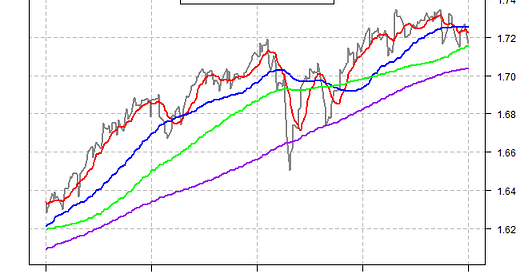

Yet there’s also a risk of over-reacting to the headlines. The current correction off of recent highs is, so far, a garden variety event. Consider the Global Trend Indicator (GTI), which summarizes the technical profile for the four ETFs listed above. GTI has stumbled to a level that’s close to the lowest in several months, but the slide is orderly and so it appears that the pullback reflects caution and prudence rather than panic and fear. Note that the 10-day average’s decline below its 50-day counterpart signals a short-term downside bias, but such changes in sentiment often come to naught. In other words, I’d need to see considerably more deterioration in GTI’s trend before ringing the alarm bells.

One metric I’ll be watching closely in the days and weeks ahead is the GTI Drawdown Risk Index. The recent rise off of the all-clear 0 reading reminds that the slide in markets is the most pronounced since the August-September correction. The pullback catches my attention, but for the moment the downturn is middling relative to what we saw in the late-summer and so the jury’s still out on what’s simmering for the weeks ahead.

Focusing on a more granular view of global markets highlights the relative and absolute strength in commodities (GCC), which rose for a second week, closing at the highest level in over two years. The red-hot 6 reading for the Signal score suggests that GCC’s rally in recent months has more room to run.

The might US equities market is still moderately bullish, but it’s taken a hit lately. The correction in American shares may turn out to be a buying opportunity, but until we’re well on the other side of the Jan. 20 inauguration, and have a clearer sense of how Trump 2.0 will unfold and how markets will react, there’s too much fog on the road to make bold calls about where we’re headed.

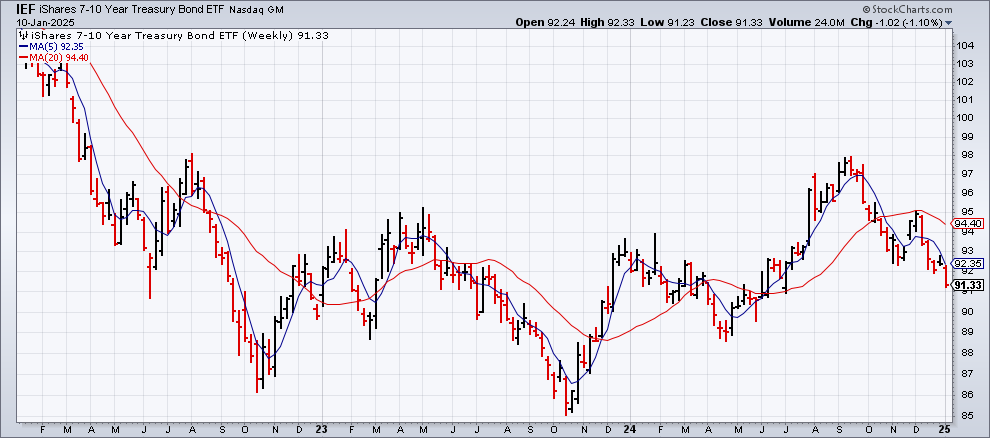

On that note, pay close attention to US Treasuries. Inflation jitters are again roiling investors, who sold government bonds aggressively last week. The iShares 7-10 Treasury Bond ETF (IEF) slumped 1.3% last week and fell to its lowest price since July. The downside bias looks quite strong at the moment and so I suspect we haven’t seen the bottom yet for IEF.

On a related note, keep a close eye on this week’s update on US consumer prices for December (Wed., Jan. 15). Economists are looking for a slightly higher pace for headline CPI’s year-over-year trend to 2.8%—moderately above the Fed’s 2% target. If correct, the news will mark the third straight month of firmer year-over-year comparisons, albeit gradually so. Not a disaster, but hardly a reading that will persuade investors that the bond-market’s correction has run its course.

Finally, it’s telling that most of the US equity sectors are at or near a neutral to mildly bullish condition via the Signal score. Watching and waiting, in other words, the favored state for now. ■