The ETF Portfolio Strategist: 12 MAY 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Note: Due to travel plans, The ETF Portfolio Strategist will not publish next weekend. We’ll return with a new issue on May 26.

And that makes three — three weeks of mostly higher prices for global markets, based on a set of ETF-based asset allocation proxies. The rallies for this suite of global funds was led by the aggressive strategy (AOA), which jumped 1.4% last week. The ETF has recovered nearly all of its recent losses and closed on Friday just fractionally below its record high of Mar. 27. See this summary for details on the metrics in the tables below.

Now comes the real test, namely: Will AOA and its counterparts break higher and close at new record highs? That looks likely, given the recent upside momentum. But a new peak will only be convincing if it holds and so the struggle between bulls and bears in the days ahead could be fierce.

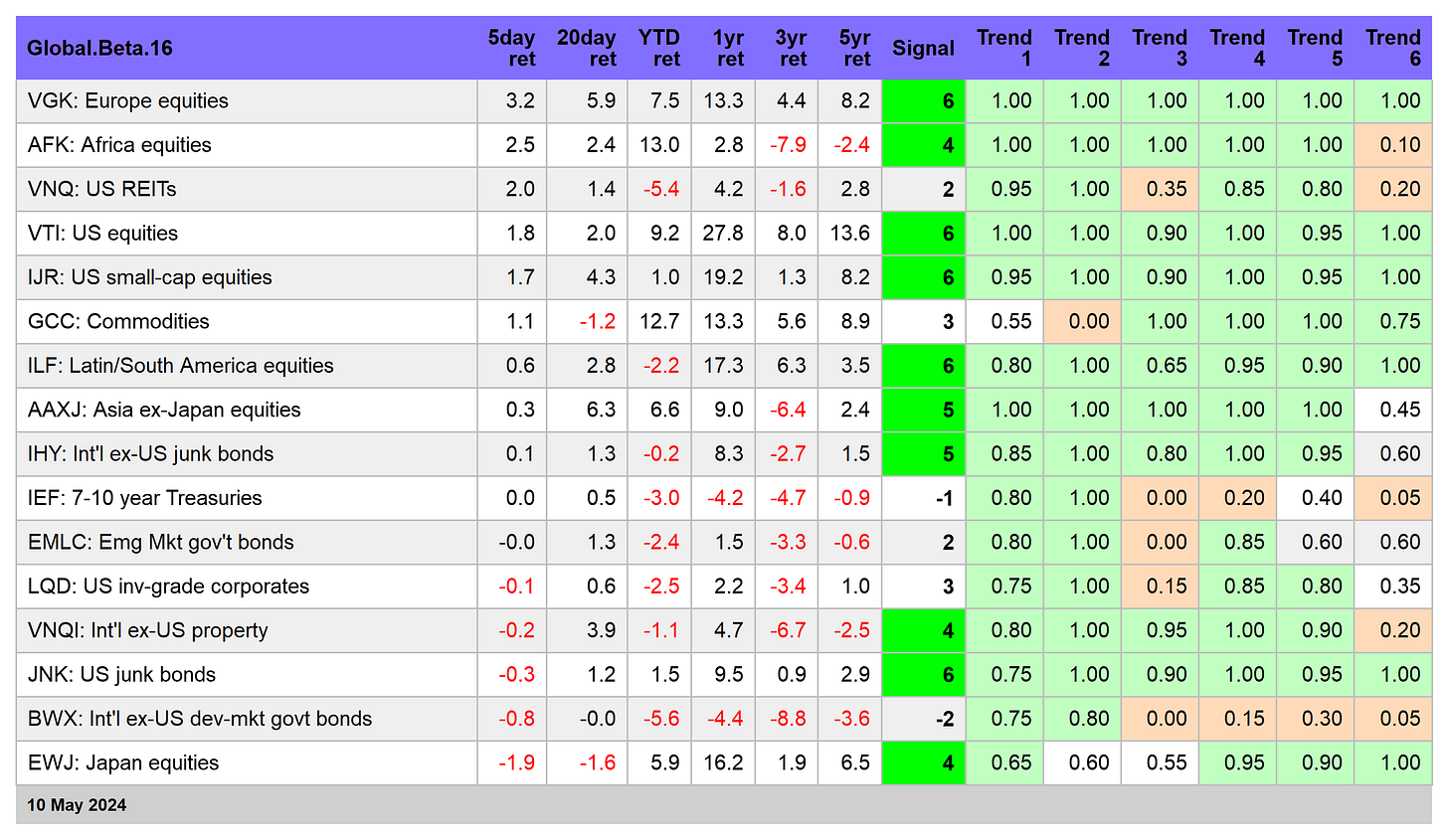

The bulls have momentum on their side in multiple markets, as the chart below reminds. As the table below shows, the Signal scores for most of the world’s key asset classes are in the green, which is to say in bullish territory.

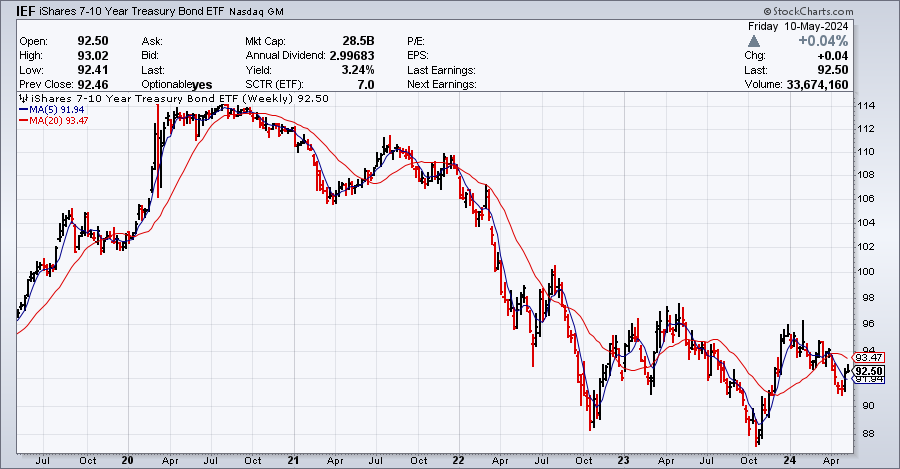

A conspicuous exception: government bonds. US Treasuries (IEF) are currently posting the weakest Signal score: -1, a modestly bearish reading. Par for the course with US government debt securities these days. Indeed, IEF has been sliding for more than three years. But the crowd is starting to wonder: Have we seen the bottom?

Cue up this week’s consumer inflation report for April (Wed., May 15), which will likely move the bond market for good or ill. Economists are expecting upbeat news. Notably, the one-year change in core CPI is projected to edge down to 3.6% from 3.8% through March. If correct, the news will probably go a long way in repairing some of the recent sentiment damage unleashed by sticky inflation data.

Core CPI was unchanged at a 3.8% year-over year rise through March, igniting concern that disinflation had stalled. The market pushed expectations for the first rate cut to the Sep. 18 FOMC meeting, based on Fed funds futures.

The threat is that the bond market could take a heavy blow if we see another sticky inflation report in Wednesday’s CPI release. Yet some analysts advise that the worst has passed and that the bond market has seen its low for this cycle.

A key factor for expecting rate cuts relies on optimism that housing inflation will cool. But as The Wall Street Journal reminds: “It has been waiting for that slowdown for 1½ years now, and it still hasn’t arrived. The slowdown might simply be delayed. But some analysts worry it’s not going to happen because of changing dynamics in the housing market. If so, that would significantly weaken the case for lower rates.”

All of which leads us back to the three-week rally in global markets, primarily in stocks. If Wednesday’s CPI numbers disappoint, will risk assets be able to look through the news and rally for a fourth week? Put me down as a “no.”