The ETF Portfolio Strategist: 13 APR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Is there light at the end of the tunnel? Yes, with one very large caveat: No one knows when the “end” of the current turmoil will arrive. That’s always true, but in the current environment the case for an extra helping of humility is recommended.

Before we get into some of the details, let’s start on a positive note and review the numbers for various flavors of global asset allocation strategies, based on the usual set of ETF proxies highlighted on these pages.

Recovery mode was in play last week, led by the aggressive strategy (AOA), which surged 3.5%. Notably, the conversative portfolio (AOK) didn’t participate. This is significant because AOK’s weakness reflects new concerns for bonds — US Treasuries in particular, which account for a hefty share of AOK’s portfolio. Loading up in US government bonds is normally the investment equivalent of watching grass grow. These days, by comparison, the apt metaphor is closer to a white-knuckle ride on a roller coaster.

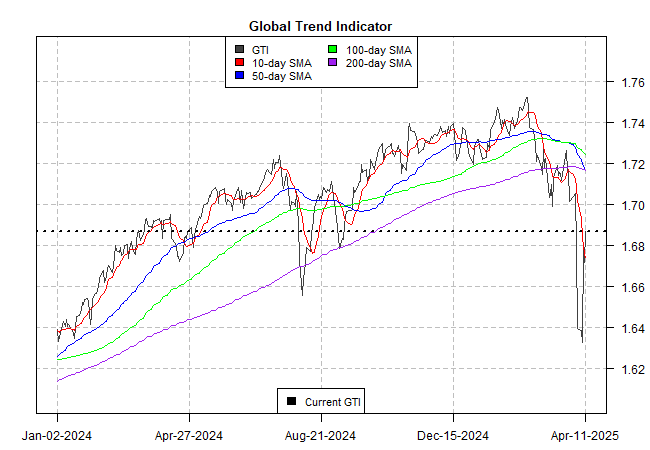

The extent of the rebound for global asset allocation strategies generally is shown by the huge rally in the Global Trend Indicator (GTI), which aggregates the technical profiles of the four ETFs listed above. The bounce isn’t terribly surprising since it was preceded by an even larger drop the week before. Assets don’t fall, or rise, in a straight line and so it’s no shock to see a hefty rise following the previous week’s steep decline.

GTI’s advance has trimmed its drawdown, which is again approaching the “normal” range.

Similarly, the 1-year return spread for the aggressive strategy (AOA) less its conservative counterpart (AOK) — a measure of risk appetite — has rebounded to roughly a flat reading as of Friday’s close.

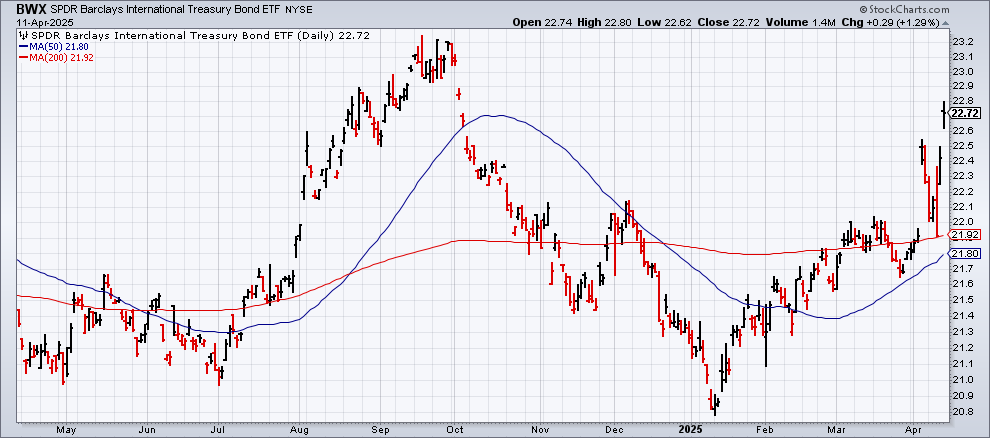

When you look through the noise, recent history continues to highlight the renewed allure of global asset allocation. Note that the strongest components of the global market so far this year remain concentrated in assets ex-US, led by stocks in Europe (VGK) and government bonds in developed markets ex-US (BWX). US equities (VTI), by contrast, remain under water in 2025 by a non-trivial degree.

US Treasuries (IEF) are still posting a moderate gain for the year, and our trend indicators continue to flash green for this slice of global markets. But this lagging optimism could soon give way to storm clouds gathering on the horizon for the world’s leading “risk-free” asset.

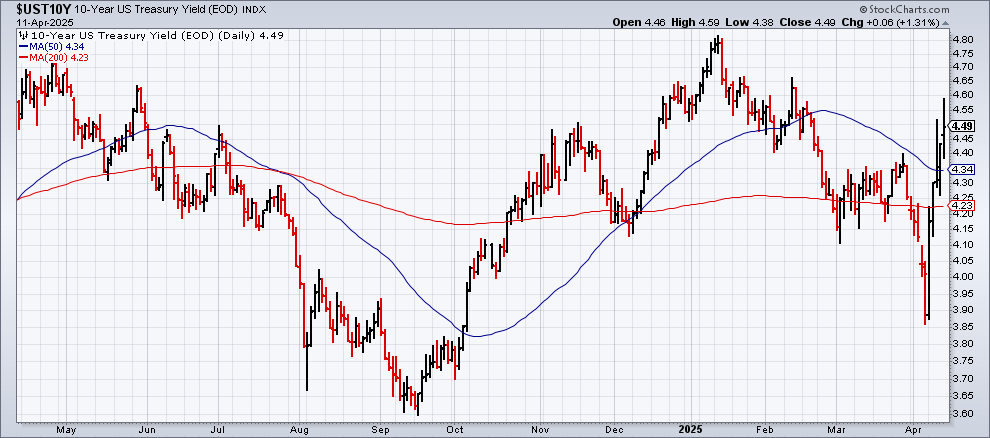

Turmoil last week in the Treasury market was hard to miss. The sharp rise in the US 10-year yield was dramatic and unusual in both the speed of the jump and the degree of the increase.

Let’s go back to Friday’s close (Apr. 4), when the 10-year end the week at roughly 4.0%. The key factor driving the yield down: expectations that US economic growth is slowing and so a recession may be brewing later in the year. When investors worry about economic contraction, Treasuries usually benefit, which is to say that the crowd bids up bond prices, which pushes yields down. The slow-growth/recession trade was in full swing in the first week of April — normal business-cycle logic.

But the calculus changed last week and the 10-year yield soared to nearly 4.60% at one point before pulling back to end at 4.49% on Friday — a rise of nearly 50 basis points, the biggest rise over such a short period in decades.

By Treasury-market standards, the sentiment shift is huge. Note, too, that the rise in the 10-year had nothing to do with a change in economic expectations — slow growth/recession risk is still bubbling.

What did change is the perception of Treasuries as an absolute rock of safety in the global macro ecosystem. Granted, the skepticism is slight and Treasuries are still, by far, the best choice for a “risk-free” paper asset in the world. But the unquestioned supremacy that US bonds have enjoyed over the decades is under scrutiny, if only on the margins.

The combination of confusion surrounding the White House’s agenda and goals for implementing tariffs, along with the hefty size of the import fees, has increased uncertainty, triggering a dramatic shift in perceptions about risk. This time, Treasuries aren’t immune. It’s premature to draw conclusions, but the fact that we’re even talking about the possibility of a higher level of risk associated with Treasuries is a sign of how quickly expectations and assumptions have changed in the past week.

The fallout has necessarily spilled over to the US dollar, which fell to a 3-year low on Friday. “The market is reassessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarization,” advises George Saravelos, the head of foreign exchange research at Deutsche Bank, in a note on Friday. “Nowhere is this more evident than the continued and combined collapse in the currency and US bond market as this week comes to a close.”

Jack McIntyre, a bond-fund manager at Brandywine Global, says: “US assets are losing some of their safe-haven status.”

The common theme is the spike in policy uncertainty driven by US tariffs. Raghuram Rajan, a former governor of the Reserve Bank of India and an ex-chief economist at the International Monetary Fund. observes: “There is a worry about how volatile and unpredictable US policy has become, as well as increasing fears that if the high level of tariffs are to stay, the US will head into a recession.”

As a result, the market is demanding a higher yield premium for Treasuries. The question is whether the premium continues to rise? What is an appropriate yield to reflect the change in risk assumptions? To be determined as the market grapples with the new world order.

For the moment, the 10-year yield is still trading in a middling range that’s prevailed for the past year or so. But if the benchmark rate continues to rise, and tests the previous high of ~4.80%, market sentiment generally will probably deteriorate further.

Investors are looking for alternatives to Treasuries and developed-market government bonds are on the short list. Fueled by a falling dollar and growing demand for safe-havens ex-US$ has triggered a spike in the SPDR Barclays International Treasury Bond ETF (BWX).

The critical variable in all of this, of course, is President Trump. Unfortunately, the administration’s turbulent decision-making process isn’t helping. On Friday, Trump announced an exclusion of tariffs for smartphone, computers and other electronic devices. But earlier today, Commerce Sec. Lutnick said in a TV interview that the tariff exemptions are temporary.

Only Trump can reduce the uncertainty by revising his tariff policy and outlining a clear plan, including a set of goals and the path forward to reach the objective. Ideally, the plan will reflect input from economists from beyond the President’s inner circle.

Perhaps the bond vigilantes will continue to impose discipline. Last week’s yield spike was an initial effort, one could say, to persuade the White House that it needs to rethink its strategy… fast. ■

Nice summary, thanks. Similar in flavor to what other good writers are deducing.