The ETF Portfolio Strategist: 13 JUL 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Sellers had the upper hand last week, but the setback was mild and the downturn doesn’t change the bullish trend writ large. Many of us are anxious as we look at record, or near-record prices for assets as uncertainty and confusion about US trade policy continues to boil. Meanwhile, one can argue that the state of trade talks is deteriorating, as this past week’s news reports highlight. In some alternative universe, the news flow would be concerning for investors. But in the realm we inhabit, the opposite endures.

As tempting as it is to manage money based on the reality we think should apply, prudence requires decision-making informed via the financial facts as we find them. On that basis, the trend still looks friendly. How long will this last? No one knows. What is clear is that price activity remains bullish, whether that profile appears reasonable or not.

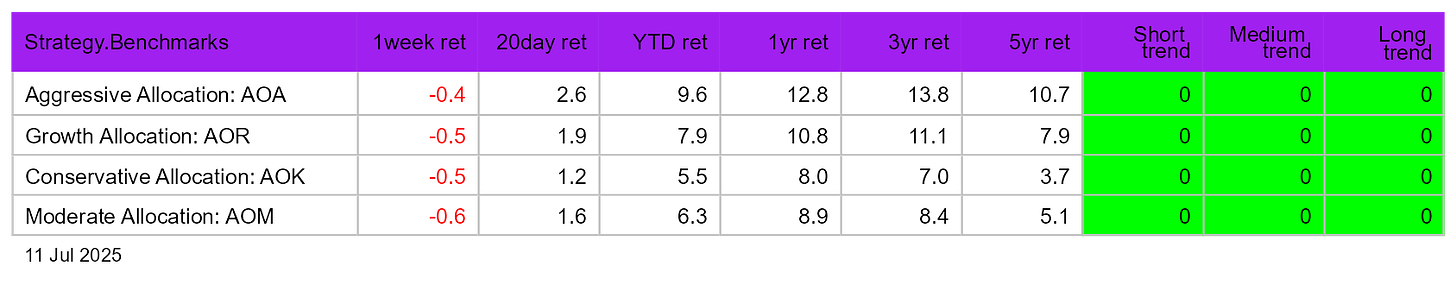

Although our set of ETF proxies for various flavors of risk in global asset allocation slipped last week, the trend profile’s flat-out risk-on persists. Since late-May, our toolkit of short-, medium- and long-term trend indicators have remained bullish.

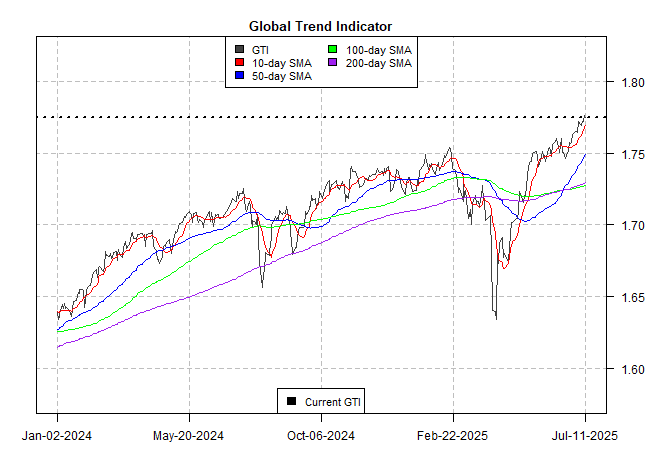

The Global Trend Indicator (GTI), which aggregates the technical profiles of the four ETFs above, ticked fractionally lower on Friday, but remains but a hair below its record high posted the day before.

For long-term investors, the message remains clear: recent market volatility was noise and so the case for riding the wave still looks compelling.

Ditto for most of the world’s primary markets, which remain heavily skewed toward risk-on postures.

For those who count themselves as contrarians, low-risk-tolerance and short-horizon investors, current conditions paint a starkly different picture. Another investor profile that may find current conditions timely to trim risk: if the portfolio’s equities weight is well above its target.

For everyone else, it’s challenging to make a case that it’s time to shift to a robust defensive position. Markets still suggest that’s a premature decision. That doesn’t mean that it won’t be profitable, but to the extent that it’s timely requires more than a trivial dose of speculation about what’s approaching in the days or weeks ahead.

For readers who entertain the idea that regime shift is near, and perhaps imminently, a trio of news items for the week ahead are worth monitoring:

Start with the US consumer inflation report for June (Tues., July 15). By some accounts, we’ll see some of the tariff inflation bubbling in the upcoming data. The consensus forecast sees the year-over-year change for headline and core CPI edging up from the May’s trend. But the expected pickup in inflation, if correct, will still leave plenty of room for debate on whether tariff inflation is finally heating up. A hefty upside surprise, on the other hand, will be another story.

The week ahead will also dispatch another round of early numbers for second-quarter earnings for S&P 500 firms. The burning question: Will the blowback from tariffs begin to take a toll on profits in Q2? Per FactSet, only 4% of S&P firms have reported Q2 results so far, of which “71% of S&P 500 companies have reported a positive EPS surprise and 81% of S&P 500 companies have reported a positive revenue surprise.” Keep your eyes peeled for clues that this trend is fading.

Meanwhile, the elephant in the room (still): the twists and turns re: trade policy news from President Trump, who dispensed another run of tariff announcements this past week. On Saturday (July 12), he said the US will levy a 30% tariff on goods from the European Union and Mexico starting Aug. 1. A few days earlier, he announced a 35% tariff on all imports from Canada starting next month. Higher tariffs, it seems, aren’t a temporary negotiating tactic, but the end goal, come what may.

Will markets continue to downplay these announcements? Recent history leans into that assumption. The week ahead will be another stress test.

While the crowd seems reluctant to reprice risk related to tariffs, global trade is evolving as countries plan for a new world order. When and how the macro shift attracts the attention of financial markets remains a guessing game. ■