Unmanaged beta risk remains in the lead this year for generating returns relative to our three risk-managed strategies. The Global Beta 16 Index (G.B16), which represents the 16-fund opportunity set for the proprietary portfolios, still enjoys a respectable lead.

G.B16 is up 10.3% in 2021 through Friday’s close (June 11). Two of the prop strategies are modestly behind with with 9.1% year-to-date gains; a third is deep in the hole on a relative basis via a 4.6% total return this year. For details on strategy rules and risk metrics in the tables below, please see this summary.

The longer-term record of the proprietary strategies is stronger, particularly in risk-adjusted terms. The question is whether G.B16’s recent leadership will be clipped? That would require a relatively severe, broad-based markets correction. Never say never, but that appears to be a low-risk scenario.

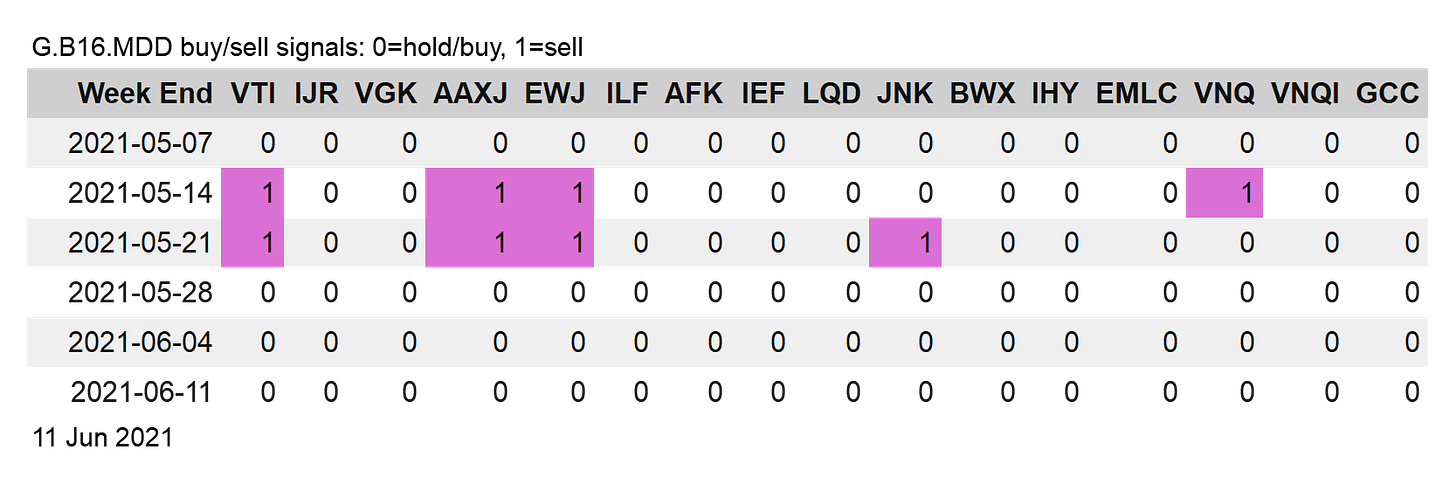

No wonder, then, that a buy-and-hold bias continues to run for the proprietary strategies. For a fourth straight week, no portfolio changes applied to Global Managed Volatility (G.B16.MVOL). Global Managed Drawdown (G.B16.MDD) drifted through a third straight week of no rebalancing signals through Friday’s close. Meanwhile, Global Momentum (G.B16.MOM), thanks to its month-end rebalancing schedule, will hold its current profile through at least the end of the month. ■