The ETF Portfolio Strategist: 13 Nov 2020

Small-Caps Rally: Stocks of the small-cap variety in the US have been trailing their large-cap brethren this year, but Mr. Market threw out the script this week. That, at least, is the narrative for this week’s strong rally in the lesser realm of capitalization — a rally that suggests that a rotation into smaller firms may be at hand.

All the usual caveats apply, of course, but for the week just ended there was no mistaking the bullish wave washing over small caps. The iShares Core S&P Small-Cap ETF (IJR) topped results for our fund proxies representing the major asset classes: the fund surged 7.4%, closing on Nov. 13 near its highest level since February.

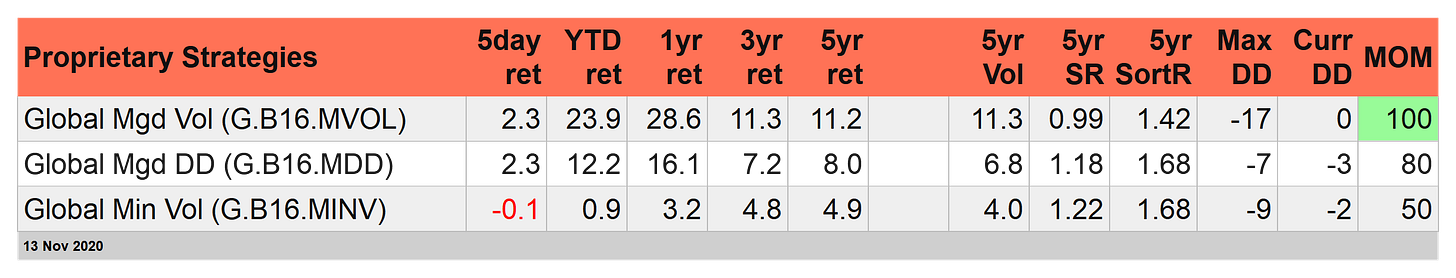

Not surprisingly, bullish momentum is red hot for IJR, based on our proprietary trend score (MOM), as show in the table below. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

Upside momentum, in fact, is strong in most corners of global markets. All but two of the funds in table above enjoy 90 or 100 MOM scores. The main outlier for bearish momentum: medium-term Treasuries via iShares 7-10 Year Treasury Bond (IEF), which closed today near its lowest price since June.

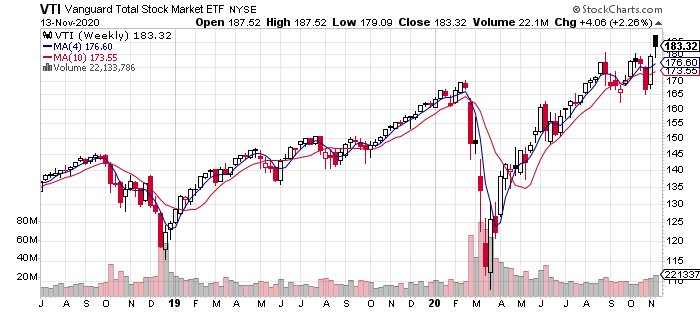

A broad measure of US stocks rallied this week, although the 2.3% gain for Vanguard US Total Stock (VTI) was relatively middling vs. the rest of the field. But that doesn’t chip away at the fact that VTI bolted ahead this week into record territory and is currently just below an all-time high.

Broad-Based Global Rally Lifts Portfolio Benchmarks: The widespread gains in global markets this week continued to blow favorably for our standard portfolio benchmarks that track risk assets worldwide. The Global Beta 16 (G.B16) benchmark posted the strongest gain, rising 2.4% for the week. Year to date G.B16 is up 6.2%. (G.B16 is comprised of all the ETFs in quasi market-value weights, targeting the major asset classes, as shown below.)

Two of three proprietary global portfolio strategies rallied this week, too. Global Managed Drawdown (G.B16.MDD) and Global Managed Volatility (G.B16.MVOL) each posted a 2.3% increase. (Both strategies use the G.B16 opportunity set.) Our global minimum variance strategy (G.B16.MINV), however, ticked lower and is now barely ahead for the year so far.

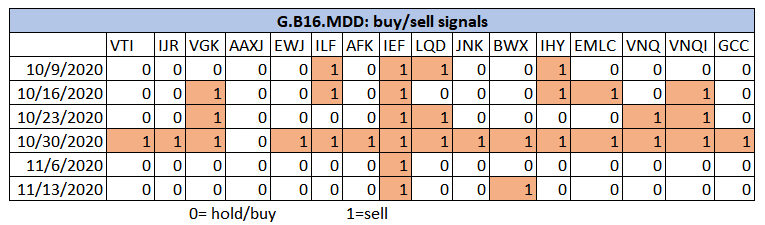

G.B16.MDD added a new sell to its risk-off list: SPDR Bloomberg Barclays International Treasury Bond ETF (BWX). As a result, G.B16.MDD now has two risk-off positions.

G.B16.MVOL, by contrast, remains in full risk-on mode, as it has been since the market rebound started in the spring following the coronavirus crash in March.

BlackRock’s global asset allocation funds had a good week, too. Once again, the top performer is iShares Aggressive (AOA), posting a 2.3% increase on the week and rising 7.4% year to date (after factoring in distributions). For the moment, higher risk exposure continues to pay off.

The question is whether rising coronavirus risk in the US, Europe and other regions will derail the bulls? So far, that’s been a losing bet. But as the numbers for reported cases, fatalities and hospitalizations trend up, it looks like it’s going to be a harsh winter.

The US is in a “very difficult situation” with Covid-19 at the moment, says Dr. Anthony Fauci, the nation’s top infectious disease expert. He added, however, that the prospects are encouraging for a vaccine. The markets appear to be pricing in no less. ■