The ETF Portfolio Strategist: 13 OCT 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Global markets writ large have fully recovered from the turbulence of August and September and pushed on to new highs. The continuing strength has humbled those of us who’ve remained cautious lately. Indeed, markets are again downplaying elevated geopolitical risk (especially in the Middle East) and instead focusing on what can go right for growth.

US bonds, however, have suffered a setback in recent weeks, albeit modestly so far. In turn, relatively defensive asset allocation strategies with robust bond weights have taken a hit from the backup in yields.

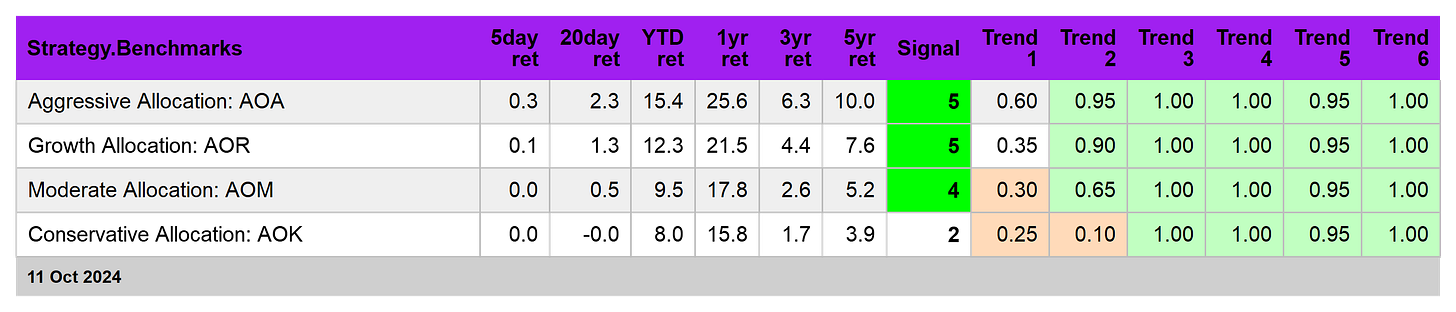

As a result, momentum for the iShares Conversative Allocation ETF (AOK) has stumbled recently while its more aggressive counterparts with lower bond holdings have trended higher. Note the outlier status in the table below for the conservative allocation ETF (AOK), which has slipped to a middling Signal score in sharp relief to robust bullish readings for the more aggressive allocation funds. See this summary for details on the metrics in the tables.

The bulls clearly hold the commanding heights at the moment, based on the Global Trend Indicator (GTI), which summarizes the directional bias for the four asset allocation ETFs listed above. GTI ended last week at a new record high, taking out the previous peak in the summer. Taking this momentum profile at face value suggests that greater heights lie ahead for the near term. Recall that in recent weeks your editor has been wondering about the implications of the recent turbulence and trading range. In the wake of last week’s results, Mr. Market’s speaking with relative authority and clarity. As always, he reserves the right to change his mind on the fly, but for now it’s hard to dismiss his self-assured posture.

A more granular look at global markets offers a mixed profile. US equities (VTI and IJR) continue to enjoy a spot among the upside momentum leaders while US Treasuries (IEF) have slipped to a middling rank.

Starting with this issue, we’ll occasionally highlight Signal scores for specific slices of markets. Today’s feature: US equity sectors. Other than the middling scores for consumer staples (XLP) and real estate (XLRE), strong, positive momentum prevails — a reminder that the overall strength for the US equities market draws on a broad base. In turn, that suggests the upside momentum will continue.

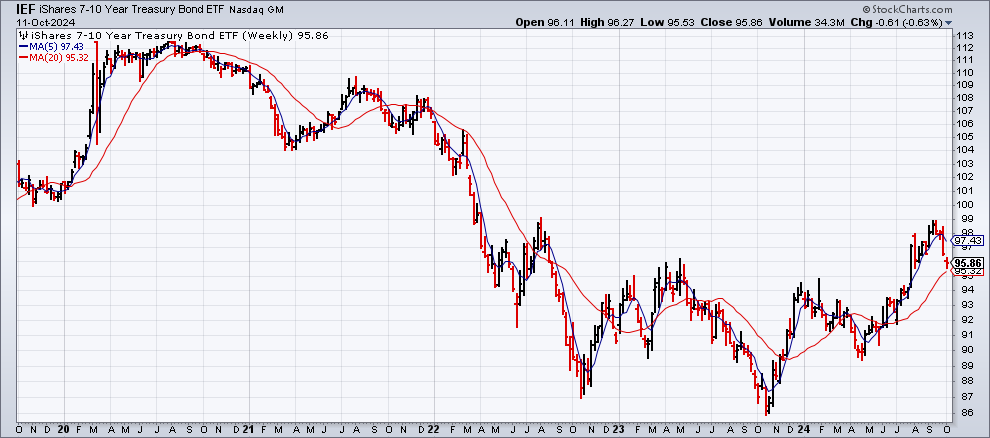

A key focus for the week ahead and beyond is monitoring the trend for US Treasuries (IEF). It’s premature to assume that the current leg of the bond market rally that started in the spring has hit a wall, but the thought arises after IEF posted its fourth straight weekly decline at Friday’s close.

What’s changed in recent weeks for bond momentum? Mainly an attitude adjustment re: expectations for US recession risk. Recovering from a bout of late-summer gloom and doom from some analysts — a mind-set that fueled a runup in bond prices and sharp slide in yields — the fixed-income crew in recent weeks embraced the mounting evidence that the US economy continues to expand and appears on track for more of the same.

The crucial question now is whether US economic activity is accelerating or merely maintaining a robust speed that’s prevailed since Q2. The latter view looks more compelling to this observer. The Dallas Fed’s Weekly Economic Index (through Oct. 5), for instance, suggests that the recent pace of solid economic growth will continue.

In sum, recession risk is still low, but the view that growth is picking up looks like a low-probability scenario via WEI. In turn, the bond market may start to stabilize until/if there’s new data that makes a stronger case for expecting economic activity to strengthen in a meaningful degree.

A key update for adjusting the calculus (or not) is Thursday’s US retail sales report for September. Economists are expecting a mild pickup in monthly growth that indicates the spending trend will remain positive but moderate — news that, if correct, will calm the bond market. ■