In this issue:

Is the bond market rout over?

Is a renaissance brewing for European equities?

Can fixed income rally in Q2? Interest rates have stopped rising, providing a reprieve for the long-running slide in fixed-income portfolios. A few weeks is hardly a trend, but for the first time since January there are hints that gravity has given way to stability in the bond market, opening the door for wondering if a rebound in bond prices is brewing for Q2.

As for the here and now, iShares 7-10 Treasury Bond (IEF) appears to be on track to post a second weekly gain (as of mid-week through the close of trading on Apr. 14). There have been temporary respites before, only to watch the selling resume soon after. Could this time be different?

The answer may not be blowing in the wind but it’s bound up with the next big move for Treasury yields. On that note, consider the benchmark 10-year Treasury rate, which is dropping clues that it’s topped and starting to roll over. It could be a head fake, but for a second day the 10-year yield held at 1.64%, which is close to a four-week low. We haven’t seen this behavior in some time.

Fairly bland results, except that the calm follows yesterday’s sharp increase in consumer inflation for March. The annual pace of the Consumer Price Index rose to a 2.6% year-over-year increase – substantially higher than the 1.7% gain in the previous month. Yet the bond market shrugged.

One view is that the runup in yields in recent months already priced in hotter inflation and so the market’s on hold until new numbers offer guidance on where we go from here. But isn’t a ramp-up in CPI enough to convince the crowd that inflation is destined to run at a faster pace for longer?

Not necessarily. So-called base effects are thought to lay the groundwork for a temporary run of reflation, to be followed by a return of low-flation/disinflation. That is, unless dovish monetary and fiscal policies conspire to deliver firmer inflation that lingers.

The answer won’t be known for months. Meantime, the bond market seems to be placing a modest bet that muted inflation will soon return, which supports the Federal Reserve’s game plan of keeping rate hikes on ice for as far as the eye can see.

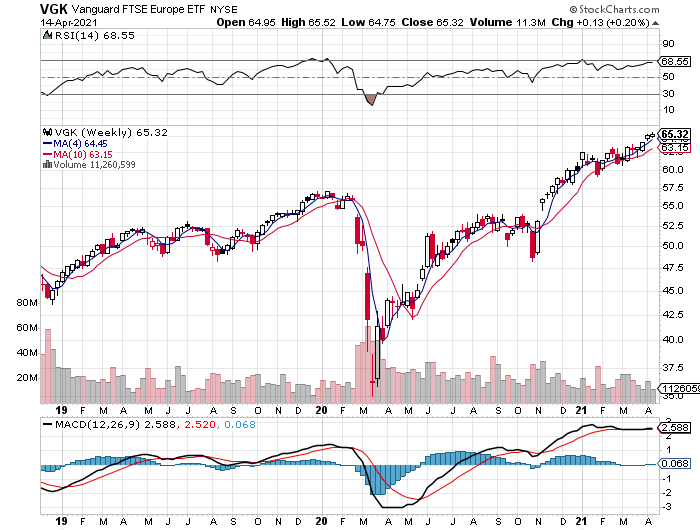

Continental appeal? European shares have in recent years taken a back seat to roaring engine that is the US equities market. In turn, that’s convinced some (many?) to assume that the second-class status is now second nature. But the gaping maw of underperformance has recently given way to rough parity. Is this an early sign that Europe is set to take the lead and revive the idea that diversifying into the Old World’s markets brings benefits to asset allocation after all?

So far this year, Vanguard FTSE Europe (VGK) has been keeping up with Vanguard Total US Stock Market (VTI). No big deal, perhaps, but it’s a conspicuous step up from previous years. In the five years through the start of 2020, for example, VTI’s performance was more than double VGK’s. By contrast, so far in 2021 the gap is relatively narrow: VTI’s up 10.5% vs. VGK’s 8.9%.

Is this a sign that VGK’s set to pull ahead of VTI on a performance basis for an extended period? That’s a high bar, in part because macro fuel is still burning hotter in the US via forecasts for accelerating economic growth. Europe’s near-term growth outlook, on the other hand, is relatively moderate.

The IMF projects that Eurozone growth will be 4.4% this year vs. 6.4% for the US. But that may be enough to keep VGK bubbling, even if it continues to play second performance fiddle to VTI.

Perhaps the bigger point is that if VGK can deliver firmer results, the prospects for international diversification may be due for an upgrade, if only on the margins. ■