The ETF Portfolio Strategist: 14 JUL 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The trend is your friend, until it’s not. Alas, it’s difficult if not impossible to predict exactly when a trend, bearish or bullish, will reverse. Fortunately, there are tell-tale signs that provide us with context for making reasonable, albeit flawed calculated-risk assessments.

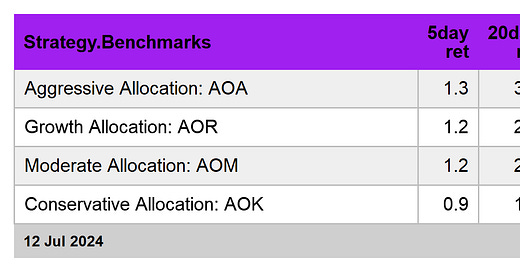

On that point, let’s review what we know to be true: The trend remains favorable for globally diversified asset allocation strategies, based on the ETF proxies shown below.

All four funds posted solid gains (again) last week, extending the recent run. In addition, all four funds are posting strong Signal scores — 6 is the highest bullish reading. The not-so-subtle implication: the positive trend still has room to run. See this summary for details on the metrics in the tables below.

There’s no need for fancy analytics to see what’s obvious. As the weekly chart of the iShares Aggressive Asset Allocation ETF (AOA) shows, this train continues to run.

There’s also more green on the screen for a more granular profile of global markets, per the table below. For the first time in recent memory, there are no net negative Signal scores. The weakest corners, in relative terms: Latin America stocks (ILF) and goverment bonds in developed markets ex-US (BWX). But even here, the net change overall is modestly postive.

The question for most investors is whether there’s been too much of a good thing recently? The answer is almost certainly “yes” in the sense that the strong returns are borrowing from future performance. The bigger question is what, if anything, to do about it? That’s where the calculus gets tricky, mainly because the answer relies on the specifics of each investor.

For some of us, rebalancing and shifting to a more defensive posture looks compelling. For others, rebalancing back to target weights is a better choice. Meanwhile, for investors with relatively long horizons and/or a high tolerance for risk, letting it ride has appeal.

In other words, there are no “wrong” decisions for managing asset allocation, but there are different investors and so the challenge — indeed the central goal in wealth management — is matching each investor with a relevant portfolio strategy at various points through time. That includes applying the right risk management strategy at the right time.

From a tactical perspective, the case for leaning into a more defensive strategy generally via bonds looks a bit more intriguing these days. Disinflation rolls on, which means that US Treasury yields have probably peaked and are likely to drift lower. All the more so if macro clues continue to show softer growth ahead for the US economy. Meanwhile, the crowd is growing more confident that the Fed will start cutting interest rates at the Sep. 18 FOMC meeting—Fed funds futures are now pricing in a ~90% probability that policy will ease in two months.

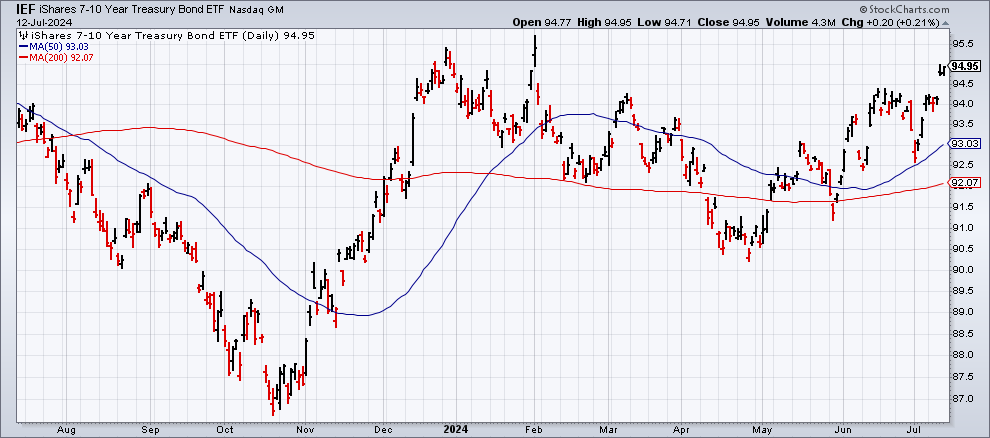

The recent rally in US Treasuries (IEF) accelerated last week. If IEF can break above it’s late-2023/early highs, we may be looking at an extended bull run for government bonds.

Meantime, you’re still being paid a decent yield — the 10-year Note, for instance, closed at 4.19% on Friday. That’s well below the previous peak at 4.71% in late-April, but it’s also well above the 3.0% inflation rate via the year-over-year change for US consumer prices through June.

Some investors are well positioned to make minimal portfolio changes in the wake of this year’s bull run, but for those who lean more toward a wealth-preservation vs. growth profile, current conditions still look ripe for taking some profits. ■