The ETF Portfolio Strategist: 14 JUNE 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

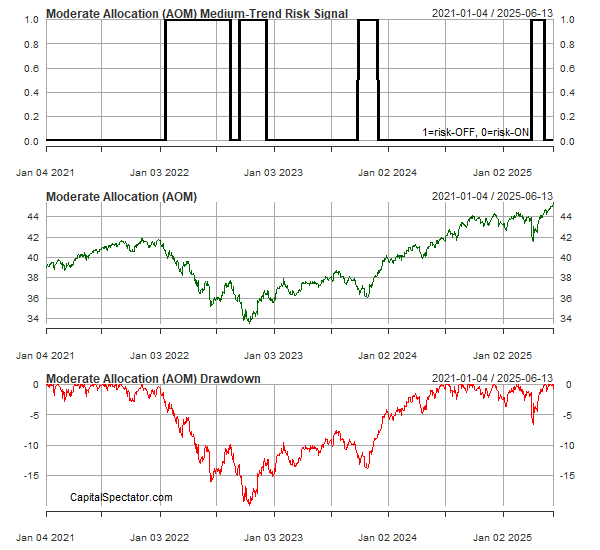

The headlines are ugly, but the impact on the trend (so far) is negligible.

Markets only had one trading day to digest the news of Israel’s attack on Iran (and the latter’s response), and so it remains to be seen how or if this new risk factor in the Middle East affects market sentiment. The initial reaction from the vantage of global asset allocation was slight. The aggressive strategy (AOA) ticked down this week while the conservative (AOK) and moderate (AOM) allocations edged up and the growth (AOR) mix was flat. Meanwhile, the trend signals remain risk-on. If you weren’t reading the news reports, you’d be hard pressed to think the week’s trading was something another than “normal”.

The recovery from the tariff tantrum in April is still unfolding, although by one measure we’re nearly back to an average profile in terms the 1-year return spread for the aggressive allocation (AOA) less it’s conservative counterpart (AOK).

All of which leaves us with the now-familiar task of imagining what could go wrong to spoil the outlook. Unfortunately, there are no shortage of narratives. The two that strike your editor as the more plausible risk factors are the Israel-Iran conflict and the tariff-related inflation.

No one will take comfort from the news that attacks by Israel and Iran continued for a second day. Iran’s influence and power has weakened considerably over the last couple of years, in no small part due to Israeli attacks on Tehran’s proxies and Iran directly. The increased asymmetry in the ability to project power in favor of Israel may act as a constraint on Iran, although if Tehran feels backed into a corner it may be tempted to unleash more daring attacks.

Perhaps the critical variable is Israel’s confidence that it has successfully degraded Iran’s ability to develop a nuclear weapon. Michael Leiter, Israel’s ambassador to the US, on Friday said: “The entire operation really has to be completed with the elimination of Fordow,” one of Iran’s primary nuclear enrichment facilities.

Keep in mind that Iran has been hobbled by a series of miscalculations over the last couple of years, including reports that Tehran didn’t expect Israel to strike on Friday before another round of scheduled nuclear talks with the US for this weekend. Given that history, it’s not obvious that the theocracy will make savvy choices that minimize the risk that the conflict widens into a larger conflagration. Pair that with Israel’s determination to succeed on defanging Iran’s nuclear capabilities and it’s easy to remain wary on the outlook over the next several days.

As for inflation, the numbers to date suggest that pricing pressure remains modest. Economists are still expecting that inflation will pop due to tariffs. Why the delay? Several explanations are in play:

There are lags with inflation shocks and so it’s still too early to see the effects in the data.

The build-up in inventory before “Liberation Day” has softened the blow, but this effect will fade.

Exporters and importers are absorbing the tariffs — a plausible explanation, although here, too, the shelf life is limited and offset merely delays the inevitable.

If markets are worried, it’s not obvious, at least not yet. This, too, may be a result that’s not long for this world, but for now the price trends for the primary slices of the world’s markets continue to skew positive.

The week ahead could be a crucial test for deciding if markets will shrug off the latest incarnations of Middle East and inflation risk factors. Meanwhile, keep an eye on next week’s Federal Reserve policy announcement and press conference (Wed., June 16). The crowd is expecting no change in interest rates, and so the main events will be Chairman Powell’s commentary and the release of new economic forecasts.

It feels a bit like the proverbial calm before the storm. But if we can get through next week relatively unscathed, there’ll be a somewhat stronger case for arguing that markets are downplaying the turmoil of current events. ■