The ETF Portfolio Strategist: 14 Oct 2020

Calm Before The Storm? The markets continue to churn but most of the major asset classes continue to go nowhere fast. Surprising? Not really. With the US election less than a month away the markets seem to be holding their collective breath and ponder what may lie in wait on the other side. That starts with the obvious: Who will be president? A worthy question, but that’s just the opening bid.

Perhaps the bigger and immediate uncertainty lurking: How will the election results be processed? In a normal election year, the Electoral College votes would be tallied and the results dispensed in due course. End of story. But this isn’t a normal election year by any stretch of the imagination.

The possible scenarios run the gamut this season and several are more than slightly plausible, including a contested election in which neither side backs down and instead sends its army of legal warriors into the fray to litigate an outcome, perhaps state by contested state, at some unknown date.

Another path that’s getting more attention from analysts: A stalemate in the Electoral College results for one reason or another and the process is thrown to the House of Representatives. In that case, the decision-making could get murky fast, courtesy of the Constitution’s vague outline on such matters. In this scenario, the potential for events spinning out of control are more than trivial. For some context, brush up on the 1876 election, which, to put it mildly, was a mess.

Exactly what’s on top for Nov. 3 and beyond is anyone’s guess. The markets seem to be going into hibernation until there’s a reason to reprice risk, political or otherwise.

The poster child for staying put these days is the 10-year Treasury yield, which continues to hold in a relatively tight trading range. At the close of today’s session (Oct. 14), the benchmark 10-year rate ticked down to 0.73%, or roughly the average rate relative to the upper and lower bounds of recent months.

The target asset classes on our short list for global multi-asset-class strategies are generally treading water this week. But there are hints that a few corners are testing the waters for an upside breakout. Three that arguably fall into this category: US stocks, Asia ex-Japan equities and foreign government bonds in developed markets.

Let’s start with US shares. Vanguard Total US Stock Market (VTI) continues to trade just slightly above its previous highs. It’s hard to imagine that the bulls will push VTI significantly higher ahead of the election, but pricing action this week suggests the temptation to do so is bubbling.

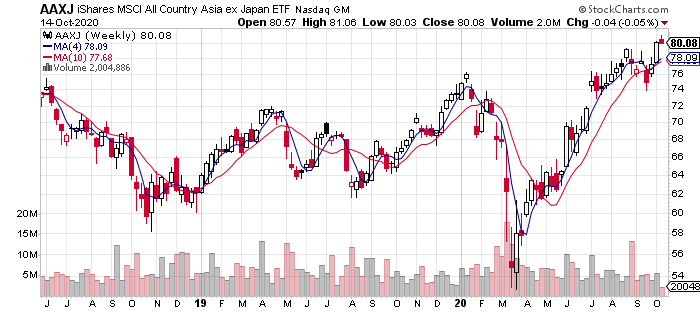

A similar narrative can be directed to iShares MSCI All Country Asia ex-Japan (AAXJ), which continues to test the upper realm of its recent trading range this week.

Ditto for SPDR Barclays International Treasury Bond (BWX), which closed today just a whisker below the highs of recent vintage.

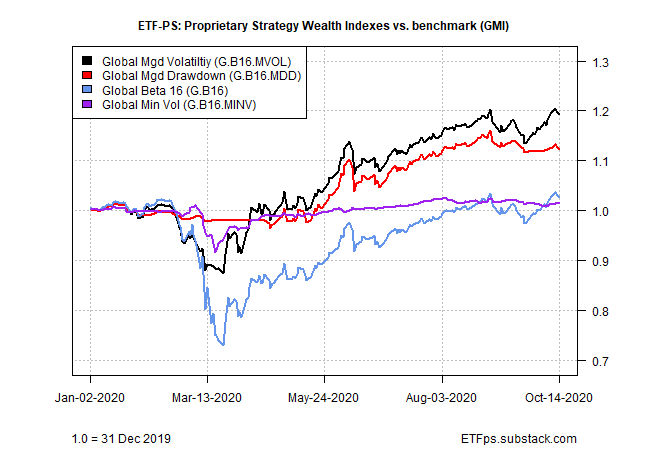

Holding patterns are also the theme for our proprietary strategies and the benchmark, Global Beta 16 (G.B16). (For details on all the strategies and benchmarks, see this summary.) The portfolios continue hold near recent highs; the question is whether there’ll be one or more catalysts ahead of the election to unleash significant moves one way or the other? I’m skeptical, but these are strange times. Perhaps incoming economic data or Covid-19-related news will deliver a surprise or two.

In the current climate it’s risky to assume that calm will prevail for long, but for the moment we’re enjoying the respite. At least until Friday, when it’s time to run re-run the numbers for possible rebalancing trades. Meantime, we’re watching the grass grow. ■