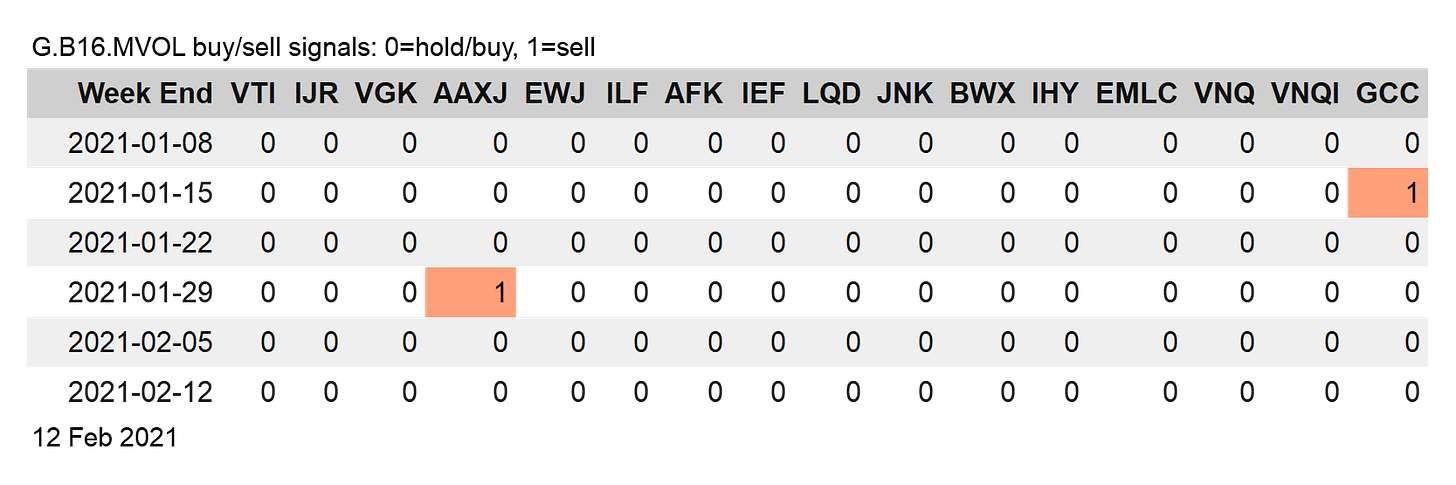

Global Managed Volatility (G.B16.MVOL) remained held to an all-out risk-on profile for a second straight week, as of last week’s close (Feb. 12). The bias continues to give the strategy a performance edge vs. ETF-PS’s two other proprietary strategies.

Year to date, G.B16.MVVOL is up 4.8% — a sizable premium relative to the 1.3% increase for Global Managed Drawdown (G.B16.MDD) or the 0.4% loss posted by Global Minimum Volatility (G.B16.MDD).

Although G.B16.MVOL is leading it’s counterparts so far this year, the strategy is underperforming its benchmark: Global Beta 16 (G.B16), which is up 5.5% year to date. (For details, see this update on portfolio strategy benchmarks.)

The last time G.B16.MVOL posted a risk-off trade: the week ended Jan. 29, when iShares MSCI All Country Asia ex Japan (AAXJ) flipped to a sell. The trade turned out to be noise and the signal flipped back to buy a week later.

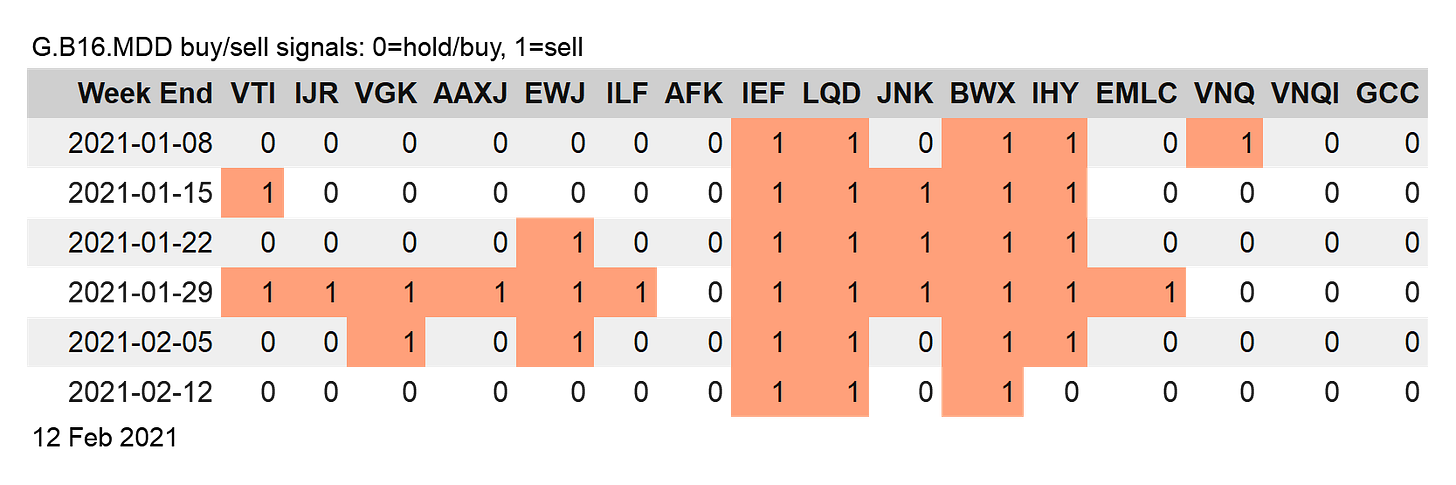

G.B16.MDD continues to struggle with processing market activity. Recent risk-off signals have been pared down to three bond funds at last week’s close: US Treasuries (IEF), US investment-grade corporates (LQD) and foreign developed-market government bonds (BWX).

G.B16.MVOL’s edge is also conspicuous in recent history. Since the end of 2019, G.B16.MVOL has outperformed its proprietary counterparts by a substantial margin.

All three proprietary strategies use the same 16-fund opportunity set:

For details on strategy rules and risk metrics shown above, see this summary. ■