The ETF Portfolio Strategist: 15 Jan 2021

In this issue:

The small-cap equity rally continues

Portfolio-strategy benchmarks take a hit

Broad-based market losses weigh on managed-risk strategies

Small-cap stocks are pricing in a rosy 2021: There are still plenty of risks lurking, including uncertainty over what the incoming Biden administration will be able to accomplish. The President-elect on Thursday outlined an ambitious $1.9 trillion pandemic relief program that, if enacted, would go a long way in juicing the economy. Whether his policy prescription survives the tortured politics of the Beltway in the weeks ahead is an open question. For now, shares in the small-cap realm appear to be anticipating a rosy year ahead (or at least one that compares favorably vs. annus horribilis that just ended).

The iShares Core S&P Small-Cap ETF (IJR) rose 1.9% this week (through Jan. 15). This slice of the US stock market is once again the top-performer for our list of fund proxies for the major asset classes (see the G.B16 table below). The bull run is par for the course in recent history for IJR, which has rallied in ten of the last 11 weeks, pausing only briefly with a mild setback in 2020’s closing week. Otherwise, it’s been up, up, up and away for U.S. shares in the lesser-capitalization bucket.

The prevailing narrative behind the small-cap rally: shares in this corner are thought to be more sensitive vs. larger firms to positive effects of the economic recovery that the Biden administration is planning to engineer through policy decisions in the months and years ahead. It’s anyone’s guess how the dynamics of Washington will play out this year in the wake of the Trump’s administration’s chaotic denouement. Forecasts aside, IJR’s upside momentum remains red hot through today’s close, which implies that it’ll take more than a few setbacks in Washington to derail the party.

Most corners of the global markets, by contrast, had their sails trimmed this week, as the table above shows. The deepest cut: Latin America stocks via iShares Latin America 40 (ILF), which slumped 3.2% for the week. The fund had been on a tear since November, thanks in part to a falling dollar. But the US Dollar Index rallied sharply this week, albeit after sliding for most of the past year. In any case, the pop in the greenback was too much for ILF to overcome.

Stocks ex-US generally retreated this week, no doubt partly due to a strengthening dollar. That appears to be a temporary affair, but for this week it interrupted the rally in foreign markets from a US investor’s perspective.

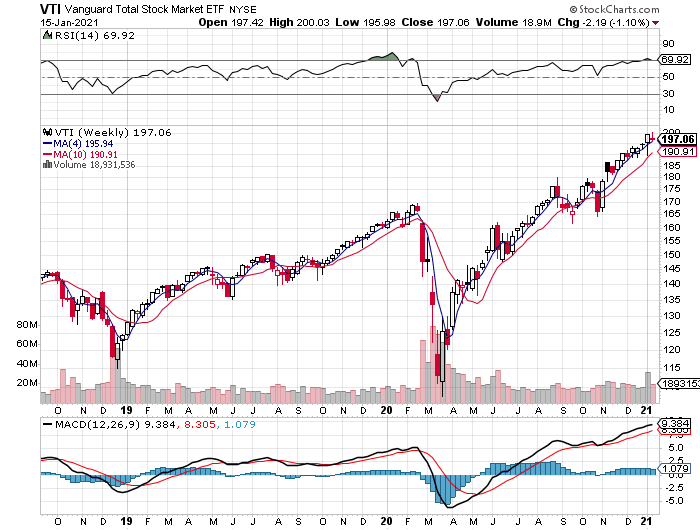

A broad measure of US shares also slumped. Vanguard US Total Stock Market (VTI) eased 1.1% at the end of trading week, posting its first weekly setback since the first week of December.

US Treasuries stopped sliding this week, but the 0.2% gain for iShares 7-10 Year Treasury Bond (IEF) doesn’t look convincing as a signal indicating that the downside bias has run its course. One reason we’re skeptical: the ETF remains the only fund with a deeply bearish momentum score in the table above, based on our proprietary MOM ranking. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

Red Ink Returns To Portfolio Benchmarks: With most slices of global markets posting losses this week, there was no relief for our portfolio-strategy benchmarks. The deepest loss was in the Global Markets Index (GMI), which fell 1.0%. After two consecutive weekly gains, this unmanaged, market-weighted portfolio of all the major asset classes succumbed to the broad-based sell-off. The setback tells us that multi-asset-class portfolios generally had an uphill week for turning a profit.

Despite the setbacks for the strategy benchmarks this week, all four are holding on to year-to-date gains and sizable one-year trailing returns. Note that Global Beta 16 (G.B16), which tweaks the mix and fund proxies held by GMI and rebalances at the end of each calendar, is the year-to-date leader at the moment. G.B16 represents the opportunity set for our proprietary strategies listed below.

Managed Risk Portfolios Feel The Heat: There was little if any advantage for our three managed risk strategies this week relative to the G.B16 benchmark, which targets the same ETF opportunity set sans any active management (other than year-end rebalancing).

Global Managed Drawdown (G.B16.MDD) posted the biggest loss this week for our in-house trio of proprietary strategies. The good news: G.B16.MDD’s -0.7% loss is in line with the portfolio strategy benchmarks. Ditto for its 1.3% year-to-date gain. Keep in mind that G.B16.MDD has recently shifted to a risk-off posture for roughly half of its target funds. That includes the addition of US stocks (VTI) to the risk-off bucket as of today’s close. Meantime, last week’s risk-off shift for US real estate investment trusts (VNQ) was reversed, suggesting that the previous week’s sell signal for the ETF was noise.

Global Managed Volatility (G.B16.MVOL), by contrast, remains overwhelmingly risk-on. The lone exception: commodities via WisdomTree Continuous Commodity Index (GCC), which shifted to risk-off today for this strategy.

BlackRock’s suite of asset allocation funds posted varying degrees of loss this week, ranging from a 1.0% slide for the aggressive strategy (AOA) to a relatively mild 0.3% drop for iShares Conservative (AOK).

All eyes now turn to next week’s presidential inauguration (Jan. 20) and the official start of the Biden administration. Many things will be different this time compared with new administrations in decades past. Perhaps the first difference will also be the most consequential: the political honeymoon is over before Biden sets foot in the Oval Office. ■