Last Friday’s pop in the 10-year Treasury yield was cited by some analysts as the end of the recent slide. But this week’s trading so far through Thursday (July 15) suggests otherwise.

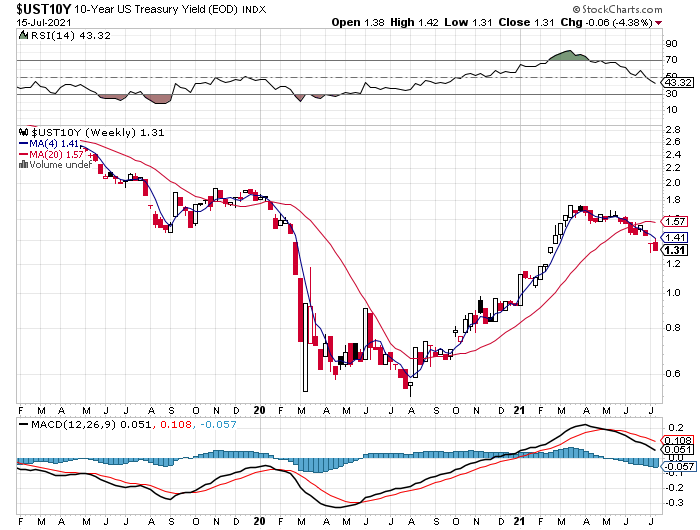

The benchmark rate fell to 1.31% today, comfortably under Friday’s 1.37% and just one basis point above the five-month low set last week. The decline persists despite this week’s hot inflation data. There may be limits to how far Treasury yields will continue sliding in the face of higher than expected inflation numbers, but for now those limits appear to be nowhere on the immediate horizon.

Note that in the weekly chart above, the 4-week average for the 10-year rate continue to fall further below its 20-week average, suggesting that downside momentum is building.

One reason, or at least one reason that seems to be gaining traction in the market: the crowd is pricing in softer economic growth in the second half of the year and beyond. As I wrote last week, a key macro question that’s topical: How Fast Will US Growth Decelerate In 2021’s Second Half?

Unclear, but the market appears to be estimating some degree of deceleration. The 10-year/2-year Treasury yield curve is certainly looking flatter lately, which implies that economic growth is cooling. Recession risk is still low and probably far off on the horizon, but the second-quarter GDP report that’s due later this month is a good candidate to mark peak growth for this cycle.

Whatever the explanation, the sentiment is a boon for the bond market. The iShares 7-10 Year Treasury Bond ETF (IEF) rallied again today and returned to last week’s rise to a five-month high.

Tomorrow’s US retail sales data for June (Friday, July 16) has a decent chance of strengthening the rally. Economists are expecting another monthly decline in spending, which would mark the first back-to-back declines this year. ■