The ETF Portfolio Strategist: 15 SEP 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Global markets rallied last week, reversing much of the pain suffered over the previous two weeks. But the broad trend for globally diversified portfolios is still flirting with a possible breakdown for the short-term outlook.

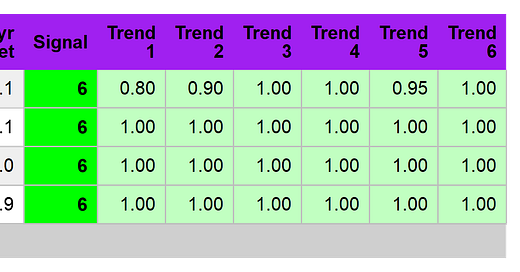

The pushback is that you have to squint to see the flirtation via our usual set of global asset allocation ETFs. In fact, on first glance, all appears well. Positive returns dominate and the Signal indicator is pinned to a maximum bullish reading across the board. To coin a phrase, What could go wrong? See this summary for details on the metrics in the tables.

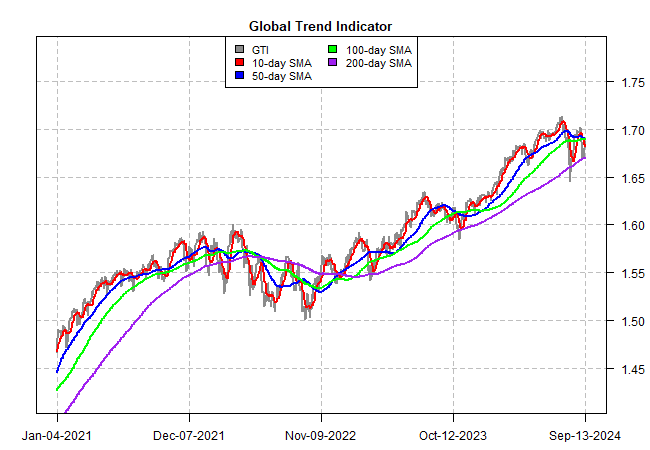

For now, nothing, or so markets are effectively saying. If you look under the hood, there’s only the barest of hints that trouble of any type is being priced in. Consider the Global Trend Indicator (GTI), a home brew prepared for these pages that summarizes the trend for the four ETFs in the table above. Technically, GTI has tip-toed into the warning zone, albeit by the barest of margins. The daily reading is ever so slightly above its 10-day average, but the other comparisons paint a weakening trend. Notably, the 10-day average has slipped below its 50-day counterpart, which in turn has ticked under the 100-day average.

The argument that this noise is supported by the fact that the 100-day average is still comfortably flying over the 200-day trend. In short, nothing to see here — move on, folks.

That’s a reasonable view, particularly for investors with medium or longer-term horizons. Your editor will re-evaluate the outlook when and if the 50-day average falls decisively below the 100-day trend. At the moment, it’s too close to call and so I await the trading week ahead for a possible clarification, one way or the other.

Even if the 50-day average drops precipitously, the last line of defense would have to give way to put a fork in the bull market: GTI’s 100-day average drops convincingly under the 200-day average. For the moment, we’re a long way from such a regime shift and so the debate about what happens for the near term remains wide open.

Turning to a closer read on global markets highlights a broad-based profile of upside trends, based on a set of proxy ETFs. Leading the way at the moment: US stocks (VTI), US real estate investment trusts (VTI) and small-cap in the US (IJR) — the top performers last week and generally strong bullish trends via the Signal indicator.

In fact, strong upside trends prevail across much of the global markets. The exceptions: Asia equities (AAXJ and EWJ), Latin America shares (ILF) and Africa shares (AFK), the last two being the weakest of the bunch.

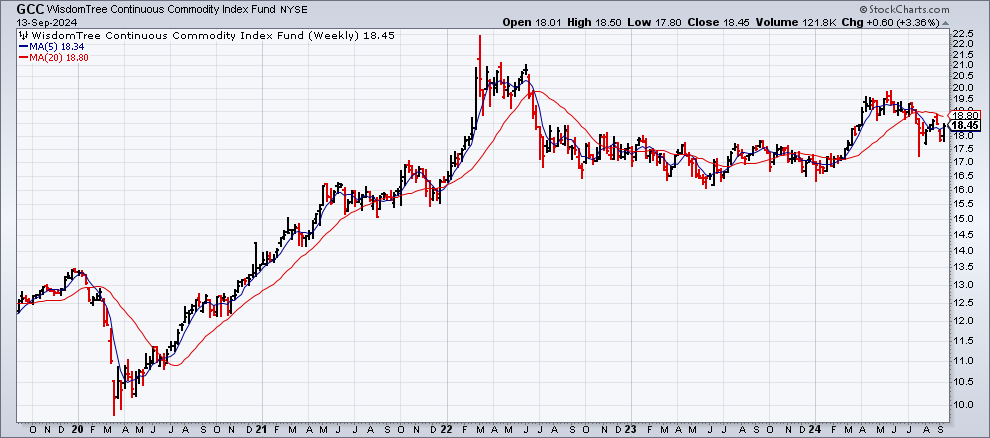

Commodities (GCC) are also not participating in the rallies that otherwise dominate the globe of late. One line of thinking is that the recent weakness in commodities is an early warning for the global economy, the logic being that softer prices for raw materials is reflects deteriorating economic activity. That’s a reasonable model, but for the moment the downshift in commodities doesn’t look deep enough to reject the possibility that the asset class writ large is still in a trading range that’s prevailed for much of the past year-and-a-half. An extended decline in commodities would change the calculus, but at present put your editor down as not terribly concerned on this front.

It’s reasonable to argue that markets overall are unconcerned about macro and geopolitical risks, of which there are many. To be clear, these risks could spoil the party at some point, and perhaps sooner than the average investor assumes. But until markets start showing a more persuasive degree of concern, I’m inclined to go along with the crowd’s view.

Reluctantly so, but since I still don’t know more than the collective wisdom of the many, I’m left with the usual set of binary choices: adopt a contrarian-minded portfolio mix or stick with the broad trend. The latter strikes me as preferable, still. Yet I’m increasingly on pins and needles as I look for more evidence that it’s timely to pull the plug on this rodeo. ■