The ETF Portfolio Strategist: 16 FEB 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Some of us keep looking for signs of trouble and the markets keep telling us to chill.

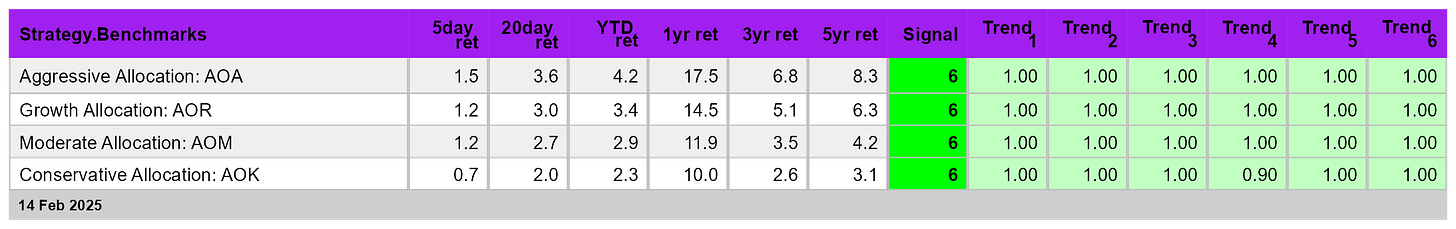

Virtually everything rose last week, extending the previous week’s rally. From the 30,000-foot view via global asset allocation ETFs, the aggressive strategy (AOA) led the winners, rising 1.5%. Its three counterparts followed suit with solid gains. Meanwhile, the Signal scores continue to hold at a strong bullish reading. See this summary for details on the metrics in the tables below.

The Global Trend Indicator (GTI) popped to a new record high before edging down slightly on Friday. GTI summarizes the technical states for each of the four ETFs listed above and its latest profile continues to reflect a strong upside bias that’s prevailed in recent weeks.

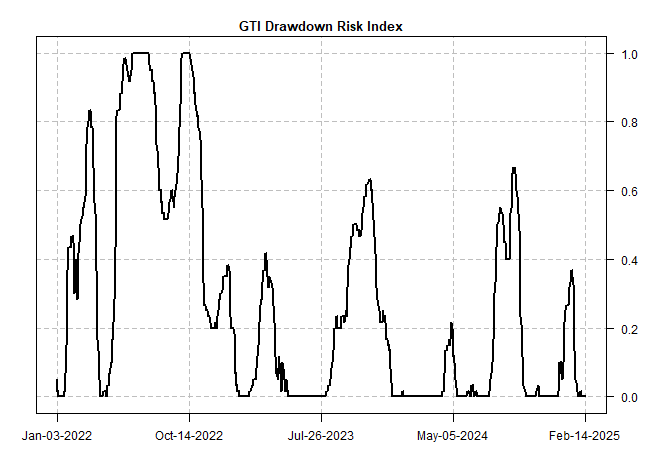

Profiling GTI from a risk perspective also indicates that the near-term path still looks clear for a bull run. This risk index is sticking near a 0 reading, indicating a nil level of signficant drawdown risk for the immediate future.

An upside bias is also conspicuous across the major segments of global markets. Last week, for example, only US small caps lost ground via a slight loss.

Investor sentiment, in short, remains broadly positive. This is somewhat puzzling given the recent rise in uncertainty for business and trade. One measure of policy uncertainty has jumped substantially since the election, although it’s fallen sharply in recent days, based on an index developed by three economists.

Sentiment metrics, however, should be viewed cautiously. As recent days for this uncertainty benchmark remind, such indicators are volatile and have a mixed record as a tool for making asset allocation decisions. Nonetheless, the recent rise in th US Economic Policy Uncertainty Index is almost certainly driven by the “flood the zone” policy changes and plans of the Trump administration, on topics ranging from federal government agencies to trade policy to geopolitical strategy. Forget about whether you agree with the changes (or planned changes); simply keeping up with the firehose of announcements and related comments is a full-time job in itself. Add in trying to analyze the macro implications and it’s easy to see why uncertainty and confusion have increased lately.

Deciding what all this means for markets and the economy is a work in progress. For the moment, there are more questions than answers. One conundrum to ponder is that the recent spike in uncertainty has, so far, been accompanied by ongoing US economic resiliance.

“Traditional uncertainty shocks happened after negative world events,” such as a recession or financial crisis, says Nicholas Bloom, a Stanford University professor and one of the developers of the uncertainty index noted above. “In this case, it’s almost like a deliberate move to surge uncertainty.”

A rise in uncertainty sentiment at a time when business optimism is high is mystifying. Small business optimism in the US, for instance, is holding on to most of its strong rise following the election.

“You’ve really got a battle between greater business optimism and greater business uncertainty, and they’re kind of opposing forces,” notes Bloom.

From the perspective of financial markets, however, optimism still appears to have the upper hand. Consider the recent rise in stocks in Europe (VGK), including last week’s 3.6% surge, marking the fifth straight week of higher prices. Perhaps this reflects a wider recognition that European shares offer a valuation discount to the long-running rise in the US market. But the acceleration in Europe’s rally last week unfolded amid Vice President J.D. Vance’s surprising — some say “shocking” — comments about the long-established US-NATO security framework.

Maybe the lesson is that markets are willing and able to distinguish business from geopolitics and evaluate risk and opportunity accordingly. But aren’t the two realms related—especially at a time of a possible regime shift for Europe’s geopolitical strategy landscape?

Markets, of course, can be wrong. Whether that caveat applies in the current climate is open for debate. Meantime, your editor prefers to make a calculated risk that as long as the trend is supportive, switching to risk-off posture in a meaningful degree is a speculative bet that reversion to the mean is near. No one can rule out that possibility, of course. But for now the technical profile of markets firmly suggests otherwise. ■

Thank you for comments, which as always are thoughtful and well presented. I have also been surprised by the markets reaction to recent events, but its hard to see how any of this is going to end well. Personally, I'm increasing my liquidity in order to lock in some of the gains from the last few years.