The ETF Portfolio Strategist: 16 MAR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

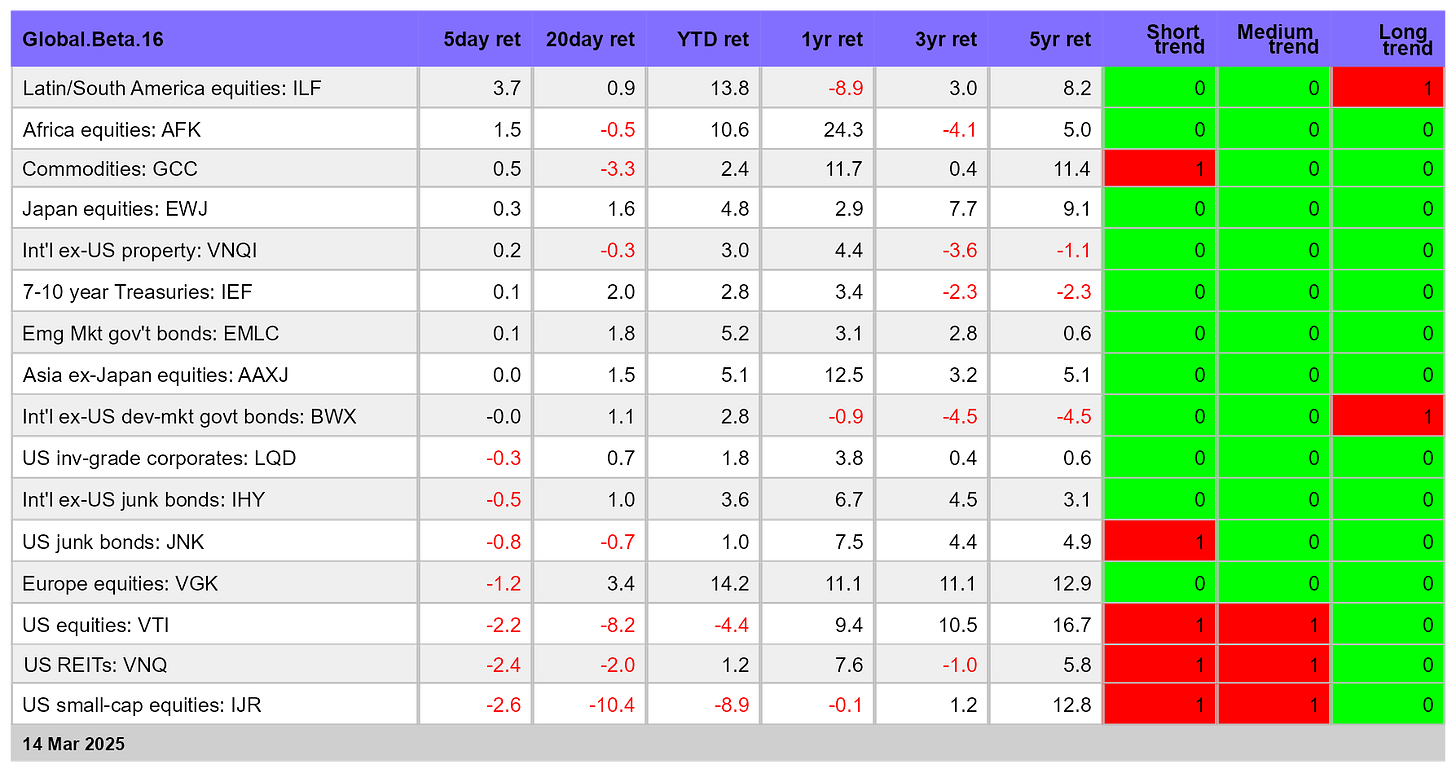

Markets took another hit last week, weighing on portfolio strategies across the risk spectrum, based on our usual set of ETF proxies for global asset allocation, shown in the first table below. The selling flipped our proprietary short-term trend indicators to bearish for these funds (indicated by red). The medium- and long-term trend readings are still bullish, but the burning question is whether we’re at a tipping point on the eve of an extended downturn?

It’s tempting to make a bear-market call, based on the headlines and the outlier weakness for US stocks. The source of the deteriorating outlook, of course, is the news flow from Washington vis-a-vis tariffs, which suggest that a global trade war of some duration is becoming more likely. That’s a genuine risk factor, and one that can’t be dismissed. But the lack of clarity on the long-game strategy, courtesy of President Trump’s capricious decisions, is keeping everyone guessing about how, when, or if the new phase of aggressive US tariff policy will evolve. Markets being markets are doing what they always do in such circumstances when uncertainty has spiked: demand a higher expected risk premium by cutting prices.

The initial reaction for many investors is to run for the hills. But from the perspective of managing a global asset allocation strategy, there’s still room for more patience, as I’ll discuss.

Let’s start with the Global Trend Indicator (GTI), which aggregates the technical states of the four ETFs listed above. GTI’s latest slide has left it in the weakest condition since last August’s correction. Will markets rebound, as they did at this stage during the last big correction in August? Or does the correction deepen, signaling a more protracted drawdown? Your editor’s still on the fence, holding out hope (perhaps naively) that Trump will pivot in some degree and find a way to dial down the global-tariff-war policy, which in turn would likely spark a relief rally. I’m not holding my breath, but neither have I fully dispatched the possibilty to the circular file of defunct hopes.

Nonetheless, the clock is ticking and the shrinking window for maintaining even a mildly optimistic outlook suggests a final tipping point may be near. Consider the GTI Drawdown Index, which quantifies the depth of the pullback for the GTI Index relative to recent history. The current slide is now approaching the deepest shade of red reached last August. If and when that previous slide is exceeded, which could be any day, the case for arguing that markets are caught in another garden-variety downturn will take another beating.

For another perspective on comparing current conditions in terms of the risk profile, the next chart tracks the rolling 1-year return spread for the aggressive asset allocation strategy (AOA) less its conservative counterpart (AOK). As of Friday’s close (Mar. 14), AOA was still posting a moderate return premium over AOK: 2.4 percentage points. That’s dramatically below recent heights, which exceeded 10 percentage points in favor of an aggressive strategy. Note, however, that the current spread is below the 5.7 percentage-point average since 2009. That’s a sign that maybe, possibly the worst of the correction is behind us. Yes, deeper spreads aren’t unprecendented, but they’re relatively rare and mercifully brief.

Another reason for maintaining strategic patience for a bit longer from a global strategy perspective: portfolios that are globally diversified across asset classes are showing a degree of resilience. As the table below reminds, the worst of the bearish sentiment to date has been contained to US equities and US real estate investment trusts. American shares overall (VTI), along with the small-cap sub-category (IJR), remain the only slices of the main components of global markets posting declines year to date. The red ink may spread, but for now it’s conspicous that US stocks are bearing the brunt of tariff-war risk, which highlights the value of global asset allocation so far in 2025.

None of this minimizes the fact that markets are struggling to price in rising odds of a global trade war. The future’s always uncertain, but the path ahead is especially cloudy for at two key reasons. One, as noted, is Trump’s arbitrary policy shifts re: tariffs. That could work to markets’ favor if he suddenly changes tack, but predicting what happens next may be the most challenging macro environment for forecasting in a generation.

The other factor weighing on markets is figuring out how a worst-case scenario plays out. Recent decades have been a period of generally falling trade barriers and expanding global trade — pro-growth trends. That era appears to be ending, and at an astonishing speed. Exactly what takes its place is a work in progress.

It’s fair to assume that in the near term a world of higher tariffs is a net-negative for the global economy in terms of lower growth and higher price inflation. The real mystery, however, is one of degree and duration. It’s possible that the global economy will soon adjust to the new regime, but turbulence in the interim is a near-certainty.

From an investment strategy perspective the main issue is one of deciding if there’s a short-term hit that soon gives way to a period when markets learn to adapt to a new world order. Or does the shock therapy kill the golden goose and usher in an era of higher macro risks and diminished return expectations — a scenario that’s only starting to be priced in?

To be determined. Meantime, global multi-asset-class strategies are betwixt and between, dancing around the blurry line that separates a “normal” correction from a deeper, extend descent. ■

Excellent summary, thanks James.