The ETF Portfolio Strategist: 16 Oct 2020

No Way But Up? The US stock market continued to confound the bears as shares rose for a third week. Vanguard Total US Stock Market (VTI) posted a thin gain—a slim 0.1% advance for the trading week through today’s close (Oct. 16), but that was enough to lift the fund to a record close based on week-end numbers. (On a daily basis, VTI is 1.6% below its record Sep. 2 close).

What’s driving US stocks higher? Expectations that the economic turbulence in recent months will give way to a relatively clear growth path in 2021 is one theory kicking around. Today’s retail sales data for September offer support for this idea. Spending rose substantially more than expected last month: +1.9% over August. That’s the strongest gain since June and the fifth straight monthly increase. The stronger pace of consumption on Main Street pushed total retail sales to a new record and, notably, above the pre-pandemic high. There’s plenty of economic worries lurking, but for the moment the American affinity for spending shows no sign of fading.

Manufacturing, on the other hand, is another story. Although survey data for this cyclical corner of the economy has been upbeat lately, the hard numbers for the manufacturing component of the Federal Reserve’s industrial production report turned lower in September for the first time since the dark days of April.

Economic data overall is still a mixed bag, as today’s updates suggest. But US equity investors still appear inclined to look through the various risk factors, including the upcoming Nov. 3 election, and assume that economic growth and something approximating normal will prevail next year.

Much depends on how the pandemic evolves, of course. On that score, the recent rise in new reported cases for the US is worrisome. It appears that the country is in the early stages of a third wave of rising infections. The good news: the trend in fatalities is still trending lower and so perhaps that’s the more relevant dataset for the US equity market.

US bonds, meanwhile, continued to tread water. The two US investment-grade proxies for US fixed-income funds in ETF-PS’s global benchmarks and proprietary strategies edged up slightly for the week but remain stuck in a tight range. For example, the iShares 7-10 Year Treasury Bond (IEF) ticked up 0.2% this week as iShares iBoxx $ Investment Grade Corporate Bond (LQD) added 0.3%. But as IEF’s chart below reminds, the trend is flat as a Kansas cornfield.

Global Headwinds: Optimism in the US, if you can call it that, wasn’t mirrored in global markets this week. Four of the five ex-US regions targeted in our global benchmark lost ground, although one slice bucked the trend.

The upside outlier in the equity space for our ex-US stock funds this week: VanEck Vectors Africa (AFK), which posted its third weekly advance.

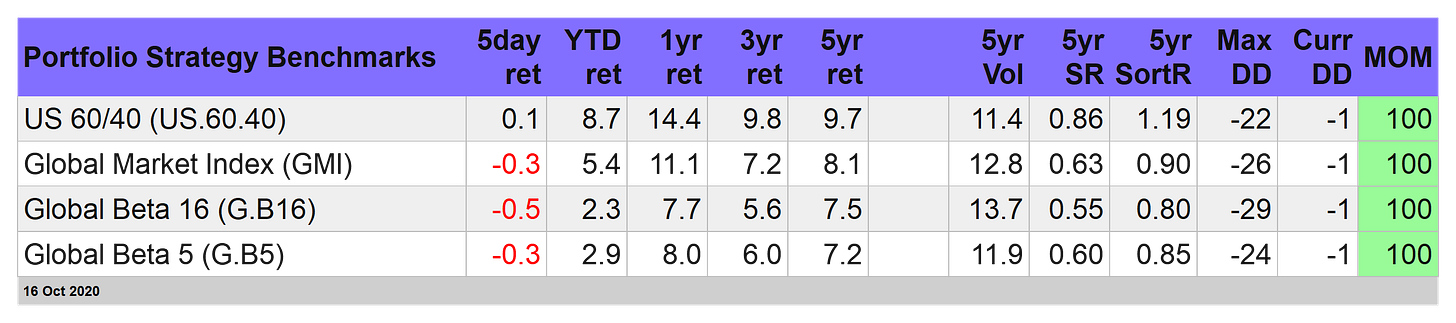

Turning to the portfolio results, our global 16-fund global benchmark was pinched with a 0.5% loss for the week, based on Global Beta 16 (G.B16). The US 60/40 stock/bond mix is the outlier, advancing 0.1%. (For details on all the strategies and benchmarks, see this summary.)

Two of our three proprietary strategies, which target all the 16 funds in G.B16, weren’t spared from red ink. Although Global Managed Volatility (G.B16.MVOL) and Global Managed Drawdown (G.B16.MDD) have substantially outperformed the G.B16 benchmark year to date, the strategies have stumbled in recent weeks.

Meanwhile, the divergent signals for risk between G.B16.MVOL and G.B16.MDD roll on. G.B16.MVOL continues to reflect risk-on across the board while G.B16.MDD still has several risk-off positions. That includes three new risk-off positions for G.B16.MDD as of today’s close: European equities (VGK), government bonds in emerging markets (EMLC) and foreign property shares (VNQI). US corporate bonds (LQD), on the other hand, were the lone fund in G.B16.MDD to shift to a risk-on position this week.

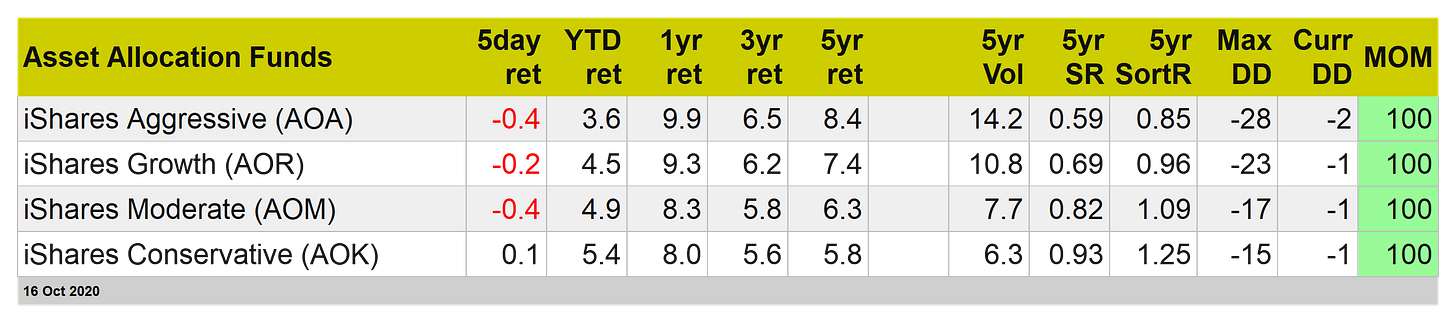

Finally, three of the four BlackRock asset allocation ETFs that are routinely monitored on these pages took it on the chin this week. By contrast, the most conservative of the bunch turned out a fractional 0.1% gain. In fact, iShares Conservative (AOK) is leading the BlackRock quartet so far in 2020.

Conservative doesn’t normally win the horse race for asset allocation, but this isn’t a “normal” year. The question is whether we’re flying into even more abnormal times? ■