In this issue:

Gold slides to 3-month low

Energy stocks continue to rally as Goldman turns bullish on the sector

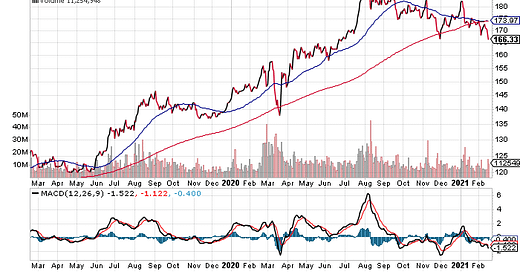

Another record high for ishares MSCI China ETF (MCHI)

Gold continues to weaken, falling to $1,772.80 an ounce (spot price for Feb. 17), trading near the lowest levels since November. The weakness pulled the 50-day average for SPDR Gold Shares (GLD), a proxy for the metal, under its 200-day average for the first time in two years – a bearish signal. “A runaway rally in global bond yields has delivered a fatal blow to gold,” advises Edward Moya, a senior market analyst at Oanda Corp. “Yields are rising on reflation bets, and that is triggering an unwind of many safe-haven trades.” Lyn Alden of Lyn Alden Investment Research says that “what gold really does is it protects you from an environment where inflation is much higher than the bond yields, and that’s what we’ve seen in 2020 is that gold over the past couple of years had a pretty big appreciation because it was protecting against that. Now, since about late summer 2020, negative real yields have been roughly flat.”

Goldman Sachs turns bullish on energy shares as Energy Select Sector SPDR (XLE) closes at the highest level in nearly a year. Alessio Rizzi, an analyst at the investment bank, writes that “adding energy equity exposure is attractive at this juncture, especially considering our constructive commodity view.”

The ishares MSCI China ETF (MCHI) ticked up to another record high today. China’s stock market “will stay bullish,” predicts Kingston Lin, managing director of the asset management department at Canfield Securities in Hong Kong. “The only matter is how much it will rise.” ■