The ETF Portfolio Strategist: 18 Dec 2020

Latin America’s Winning Streak Continues: Stocks in Latin America extended their bull run for a seventh straight week through today’s close (Dec. 18). The iShares Latin America 40 (ILF) added 2.5% in this week’s session. Although the fund pulled back on Friday, the selling still leaves ILF close to a 10-month high.

Optimism on coronavirus vaccines remained a positive factor propelling shares higher throughout the southern hemisphere. The sinking US dollar provided an extra boost to foreign assets: US Dollar Index fell to a 2-1/2 year low this week. Although ILF is vulnerable to profit taking after its upside streak, the fund’s momentum profile continues to suggest that even greater heights lie ahead.

The star of the week for our standard global opportunity set is VanEck Vectors Africa (AFK), which surged 5.8% in the five trading days through today’s close. After taking a breather from its own bull run of late in the previous week, AFK came roaring back and settled at a 2-1/2 year high on Friday.

The only loser for weekly results: US government bonds via ishares 7-10 Year Treasury Bond (IEF), which edged lower by 0.4%. The weakness isn’t surprising at this late date. ILF has been trending lower since August and our proprietary momentum score for the ETF reflects a weak 20 print, which suggests that we’ll see even lower prices in the weeks ahead. (For details on all the risk metrics as well as the strategies and benchmarks, see this summary.)

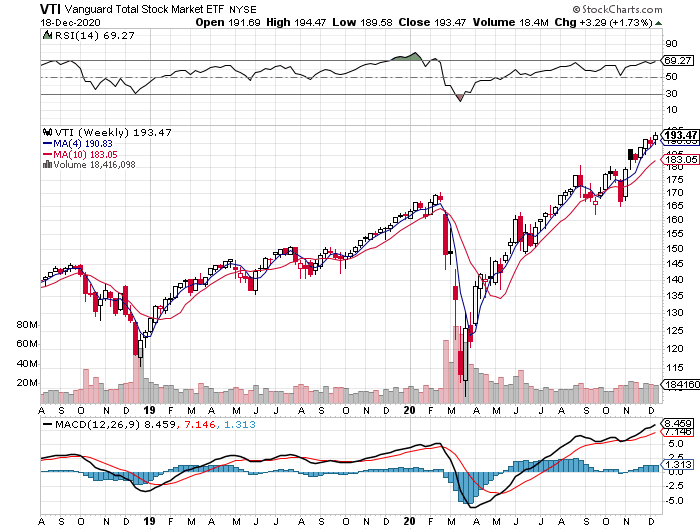

Otherwise, gains prevailed across the board for our global opportunity set. That includes a 1.7% weekly gain for US stocks via Vanguard Total US Stock Market (VTI), which forged new record terrain this week before edging down on Friday.

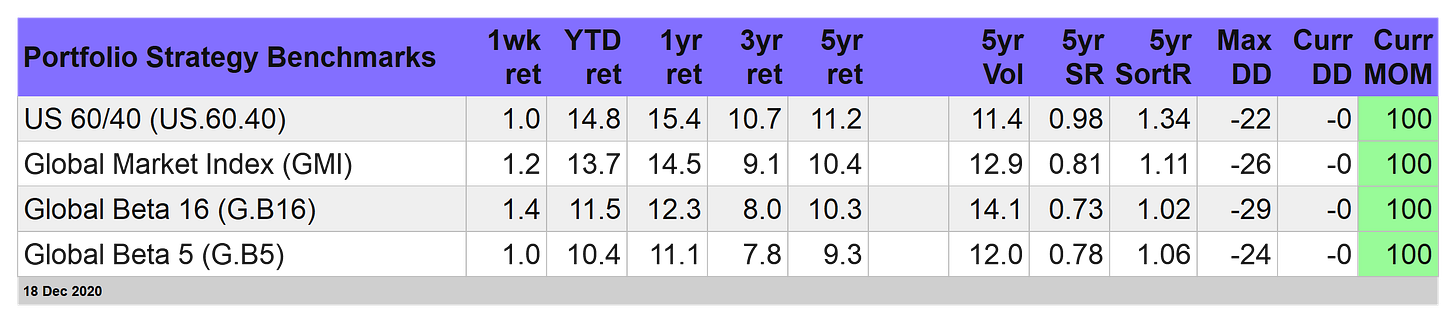

Benchmarks Rebound: The widespread gains this week lifted our main benchmarks, led by the broadest, most granular measure of global risk assets: Global Beta 16 (G.B16), which covers the major asset classes with market-based-influenced weights. After edging down in the previous week, G.B16 bounced back with a solid 1.4% gain.

With just two trading weeks left on the 2020 calendar, our main quartet of benchmarks remain on track to deliver strong gains this year, led by the US 60/40 stock/bond yardstick, which is currently leading the pack with a 14.8% year-to-date total return.

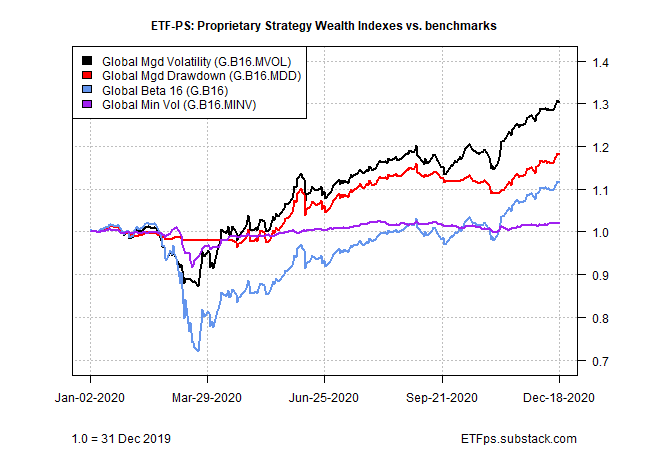

Risk Management Continues To Win Big: Two of our proprietary strategies are also looking at a strong calendar-year run for 2020. Global Managed Volatility (G.B16.MVOL) in particular is enjoying a stellar run and is currently ahead by more than 30% so far this year. With slightly lower volatility vs. its benchmark (G.B16) for the past five years, G.B16.MVOL has more than tripled the performance of the benchmark in 2020. (Note: G.B16.MVOL targets the same 16-fund opportunity set as G.B16.)

Extending its stance since G.B16.MVOL’s risk-off signals ended in the spring, the strategy continues to reflect an all-out risk-on position for all 16 fund holdings.

By comparison, Global Managed Drawdown (G.B16.MDD), which also targets G.B16’s 16-fund opportunity set, remains nearly all risk-on — except for an ongoing risk-off position in iShares 7-10 Year Treasury Bond (IEF).

BlackRock’s four flavors of asset allocation strategies also had a good week. All generated gains, ranging from a 0.4% weekly advance for the conservative mix (AOK) to aggressive’s 1.3% rally (AOK). For the year-to-date ledger, the four ETFs are posting increases: 8.8% to 12.0%.

The main takeaway: losing money in 2020 has been difficult. That is, unless you sold during the dark days in the spring and assumed (incorrectly) that a pandemic would derail a market recovery.

Finally, US markets remained anxious on Friday as uncertainty about whether Congress would pass a new stimulus bill to soften the economic blow from the ongoing employment fallout for millions of Americans. Markets were also on edge over concerns that a government shutdown loomed as Republicans and Democrats haggled over funding details. But a shutdown was narrowly averted late today, at least temporarily after Congress voted on Friday to a two-day extension for government funding.

Presumably the stimulus and government-funding legislation will pass muster in the days ahead. But with partisanship sky-high and market valuations rich, betting the farm on Washington forestalling a major dose of macro risk factors may be pushing it with regards to assuming that Beltway politicians will come to their senses and favor the better angels of their collective nature. ■