The ETF Portfolio Strategist: 18 MAY 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

The rebound in markets last week leans into the view that the tariff-related selling was noise rather than the start of an extended drawdown. Yes, there’s still a lot of uncertainty ahead, largely because of you-know-who. But investor sentiment continues to recover and there’s a bit more reason to upgrade the case for cautious optimism.

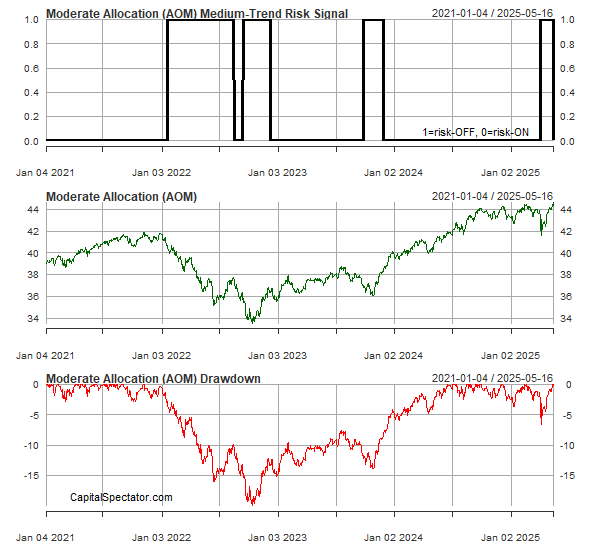

Consider the return of green to two of the four ETFs we use to track global asset allocation strategies. The moderate (AOM) and conservative (AOK) portfolios returned to risk-on signals for short-, medium- and long-term trend horizons. Their aggressive (AOA) and growth (AOR) counterparts aren’t quite there yet, but they’re on the mend and may soon switch to all-green as well.

Note that the long-term trend signal for all four allocation funds remained risk-on through the recent turmoil, offering a real-time profile that cast doubt on the idea that investors with sufficiently length time horizons needed to derisk their portfolios.

And if that’s not enough to quell your inner bearish demons, all the funds in the table above closed on Friday at prices comfortably above levels that prevailed before tariff turmoil struck.

There’s also ongoing support for expecting that a much-discussed US recession remains nowhere on the near-term horizon. The Atlanta Fed’s GDPNow model on Friday estimated that economic activity is on track to rebounded to a solid +2.4% for GDP, which amounts to a sharp reversal of Q1’s slightly negative 0.3% decline.

Our sister publication — The US Business Cycle Risk Report — continues to advise subscribers that recession risk remains extremely low, per the newsletter’s primary indicator:

Most of the main slices of global markets are again tilting heavily in favor of a positive-trend bias.

If you kept your head and stood firm over the past two months, there’s not a compelling argument to do anything different now. Sure, it could all go off the rails in a heartbeat for a thousand reasons. But the prevailing theory on these pages is that trend matters, even if it’s not infallible. Compared with everything else, trend is usually the least-worst metric in an investor’s toolkit. It’s even more valuable when you align time horizon with a comparable trend profile.

But no matter how you interpret recent history, the familiar risks still apply, albeit in a relatively kinder, gentler degree following the US-China trade talks a week ago. That’s a step in the right direction, and markets certainly reacted favorably to news that the two largest economies dialed down tariffs. But that was the easy part.

By contrast, the administration’s goal of signing 90 deals in 90 days with dozens of countries remains as elusive today as it was when announced in April. No surprise, then, that Treasury Sec. Bessent today suggested the White House was now refocusing on negotiating deals with a shorter list of countries and consolidate talks into regions:

My other sense is that we will do a lot of regional deals — this is the rate for Central America, this is the rate for this part of Africa — but what we are focused on for right now is the 18 important trading relationships.

The hard reality is that import tariffs remain in place for the US economy, even if the levels have come down relative to the “Liberation Day” announcement. As a result, upward pressure persists on a wide array of consumer and commercial goods. Walmart said last week that prices for a wide range of products it sells could increase in the near term. “We’re wired to keep prices low, but there’s a limit to what we can bear, or any retailer for that matter,” said Chief Financial Officer John David Raine on Thursday.

The uncertainty that triggered the selloff in markets, in other words, is still lurking. The initial reaction by investors may have been excessive, but it’s still unclear how the global trade war evolves. Markets are effectively pricing a better-than-expected outcome, but only relative to the darkest days in April. The question is whether that relative shift can keep risk sentiment bubbling?

Your editor is half-expecting that a retest of April lows is more than a trivial possibility. The good news is that the return of a positive trend bias in most markets suggest that optimism is still the path of least resistance. Let’s see if the crowd can extend the cheery outlook for the week ahead, which would strengthen the view that the recent bounce reflects a fundamental attitude adjustment that can weather the tariff uncertainty that’s likely to prevail through the summer. ■