The ETF Portfolio Strategist: 18 September 2020

US Shares Lose Ground For A Third Week: US stocks fell this week at the close of trading on Sep. 18. Vanguard Total US Stock Market (VTI) was off fractionally this week, slipping two basis points. Trivial, although the setback was enough to mark the ETF’s first run of three straight weekly declines so far in 2020.

VTI’s latest slide leaves the fund precariously perched just below its 50-day moving average—the first dip below that gauge since April.

International equity diversification took some of the edge off this week’s setback in US shares. Foreign stocks in developed markets edged higher for a second week: Vanguard FTSE Developed Markets (VEA) rose 0.7% by today’s close vs. last Friday.

Emerging markets shares posted a gain, too: Vanguard FTSE Emerging Markets rose 1.5%, the fund’s first weekly advance in the past three.

US Treasuries were mostly lower this week, although short maturities continued to eke out a gain. Corporates in the U, on the other hand, continued to post a mild recovery after sharp losses in August. The iShares iBoxx $ Investment Grade Corporate Bond (LQD) ticked up 0.3% this week – third weekly gain in a row.

Property shares were mixed this week. Vanguard US Real Estate (VNQ) ticked down for a third week while Vanguard Global ex-US Real Estate (VNQI) added 1.4%. Both ETFs, however, continue to churn in a relatively tight trading range.

Commodities, on the other hand, are perking up. WisdomTree Continuous Commodity (GCC), which equal weights a broad set of commodities, posted another weekly increase, rising 1.5%. The latest pop lifted the fund to its highest close since February. Adding to the allure, GCC’s 50-day moving average continues to rise further over its 200-day average, suggesting that bullish momentum is heating up.

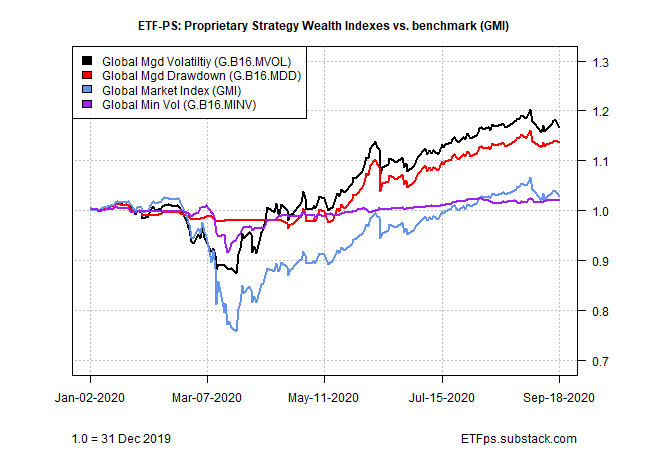

A Winning Week For Global Strategies: The benefits of risk management and broad, global diversification was front and center this week. Our set of global benchmarks posted gains as did two of our three proprietary strategies.

Let’s start with the year-to-date leader for our trio of in-house risk-managed portfolios. Global Managed Volatility (G.B16.MVOL) rose 0.4% for the week, boosting year-to-date performance to a strong 16.7%. (For details on the strategy rules for the proprietary and benchmark portfolios, along with information on the risk and return metrics in the tables below, see this summary.)

G.B16.MVOL continues to remain in a risk-on posture across all 16 fund holdings. The reason: the dramatic surge in volatility during the coronavirus crash in the spring continues to linger in the strategy’s algorithm.

G.B16.MVOL’s risk-on/risk-off process is governed by the relationship between short-term volatility vs. medium-term vol. The latter remains sky high, although it’s gradually sliding. Until short-term vol rises above its longer-term counterpart, risk-on prevails for this portfolio. The unusually wide gap between short- and longer-term vol is fading and at some point in the near future the relationship will normalize, opening the door for a return of risk-off trades. Meantime, the strategy is still living in the shadow of the March crash. So far, that’s been a plus.

By contrast, Global Managed Drawdown (G.B16.MDD) continues to favor a moderate degree of risk-off. As of today’s close, five of the strategy’s 16 funds are risk-off, although that’s down from seven a week ago. (Keep in mind that all three of proprietary strategies use the same 16-fund opportunity set, as outlined here.)

For a visual summary, here’s how our three strategies stack up this year against the Global Market Index, an unmanaged portfolio that holds all the major asset classes via ETF proxies. As the chart below reminds, our brand of risk management remains in the winner’s circle these days relative to GMI, albeit after an unusually rough ride.

Here’s a bit of detail on benchmarks, including a set of BlackRock asset allocation funds that offer a variety of risk flavors.

Finally, a quick housekeeping note: The ETF Portfolio Strategy will soon roll out another volatility managed strategy, which offers less frequent trading activity while maintaining an encouraging record on generating risk-adjusted performance. The strategy is inspired by a highly regarded research study of recent vintage. Stay tuned for details. ■