The ETF Portfolio Strategist: 19 APR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Markets continued to recover in the shortened trading week through Thursday (Apr. 17). But this is probably a temporary bounce in what still looks like an ongoing correction as investors continue to reprice assets for a tariff shock. No easy task for evaluating a US policy shift that’s unprecedented in the post-war era for both its scope and lack of clarity re: objectives and process.

Some of the repricing is currently showing up as a preference for defensive strategy postures. Notably, the conservative strategy (AOA) for global asset allocation led its riskier cousins this week with a 1.2% gain. More telling is AOA’s leadership for year-to-date results via a flat performance vs. losses elsewhere.

The bearish trend profiles are being contained so far to the short and medium windows, but the battle between the bulls and bears is still in play and so the long-term trend may soon give way.

The trend deterioration writ large suggests that the recent weakness for global strategies will continue, based on the Global Trend Indicator (GTI), which aggregates the technical profiles of the four ETFs above. The current reading for GTI takes a bite out of the view that the recent selling has run its course. The 50-day average has slipped below the 200-day average for GTI, which implies that the negative trend of late is strengthening.

GTI’s drawdown eased, but the downside bias for the index suggests we haven’t yet seen the bottom for the peak-to-trough decline for this cycle.

The spread for the aggressive (AOA) allocation less its conservative counterpart (AOK) remains decisively negative, offering another clue for thinking that markets will continue to test the downside.

Bonds continue to benefit from the risk-off vibe. Foreign bonds in particular are posting strong relative and absolute strength.

Government bonds in developed markets ex-US (BWX) have rallied and are close to fully recovering losses since the previous high in September. Year to date, BWX is up a solid 8.0%.

In some respects, foreign junk bonds are even more impressive. VanEck Vectors International (IHY) rose above its recent high and is approaching its all-time high in 2021.

US Treasuries (IEF) are holding on to a modest 3.4% year-to-date gain, but the outlook for American government bonds is becoming complicated. Tariffs threaten to slow growth and raise inflation — the dreaded stagflation scenario. In that case, Treasuries will loose some of the safe-haven appeal.

Another complication is the concern that the blunt application of US tariffs around the world will reduce demand for Treasuries. That’s no small factor when roughly 30% of US government bonds are held by foreigners.

It doesn’t help that President Trump, who claimed this week that the US has “essentially no inflation,” is publicly pressuring Fed Chairman Powell to lower interest rates at a time when the central bank is watching to see if inflation picks up due to tariffs — a shift that could trigger rate hikes, at least in theory.

The case for reducing maturity for US government bond allocations is compelling in the current environment until there’s more confidence on the outlook for US tariff policy and Fed policy. The strong positive trend in short-dated Treasuries (SHY) suggests that the crowd agrees and is continuing to transition to safer shores.

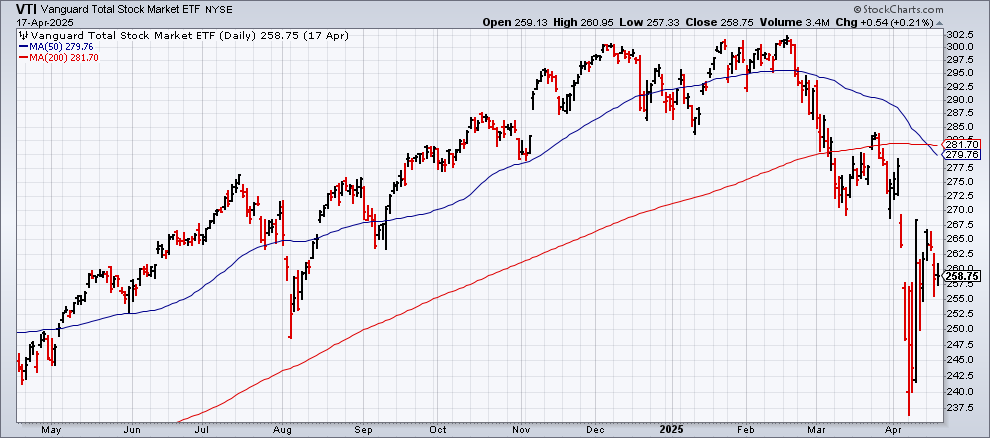

Meanwhile, the technical profile for US stocks remains negative. Expectations for slower economic growth will continue to weigh on equities.

“The level of the tariff increases announced so far is significantly larger than anticipated,” advised Federal Reserve Chairman Powell this week. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

It’s worth pointing out that the surge in uncertainty re: tariffs could quickly fade if the President finds common ground with trading partners. On Thursday, during a White House meeting with Italian Prime Minister Giorgia Meloni, Trump expressed optimism for negotiations with Europe. “There will be a trade deal, 100 percent,” he said. “Of course there will be a trade deal. They want to make one very much, and we are going to make a trade deal, I fully expect it, but it will be a fair deal.”

Whether such comments amount to a compelling reason to raise allocations to US stocks at this point is open for debate. The answer largely rests on how much confidence you have in Trump’s willingness and ability to steer trade policy toward a net-positive for American equities and the economy in the near term.

The challenge looks formidable, except from the perspective of Team Trump. “So we're going to run 90 deals in 90 days. It's possible,” White House trade adviser Peter Navarro said last week.

The glitch is that trade deals are complicated, especially with the largest economies, such as the European Union.

“Trade negotiations can be brutal, and they can take years,” said Warren Maruyama, who worked on trade deals during the George W. Bush administration as general counsel for the Office of the U.S. Trade Representative. “I don’t think this is going to be anywhere near as easy as some people are spinning it.”

There’s also the question of whether trade deals will revive the goodwill that’s been lost recently in international circles. Will US allies return to pre-“Liberation Day” views, assumptions and expectations in the event of trade deals?

Put down the president of the European Commission, Ursula von der Leyen, in the skeptical camp. “The West as we knew it no longer exists,” she said this week. ■