The ETF Portfolio Strategist: 19 JAN 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Markets rebounded last week, providing some relief from the recent weakness. All four ETFs used as proxies here for global asset allocation posted strong gains, led by the aggressive strategy (AOA), which soared 2.5%. The rally offers some breathing room for assessing where we go from here. But with a new era set to start tomorrow at 12 noon eastern, when Donald Trump is sworn in as the 47th US president, this is no time to make sweeping judgments about where markets are headed.

The president-elect has made a number of promises for significant policy changes — changes that, if implement, will ripple across America and the world. From immigration and regulation to tax rates and a more US-centered foreign policy, there’s a wide-ranging debate about what it all means for the economy and markets. Given the potential for significant change that’s brewing on several dimensions, it will be interest to see how investors writ large react during the first week of trading during the launch of Trump 2.0.

Meantime, global markets start the dawn of regime change in Washington on an upbeat footing. Signal scores for all four asset allocation funds returned to strong bullish readings last week. See this summary for details on the metrics in the tables below.

The Global Trend Indicator (GTI) surged, recovering much of the loss booked in recent weeks. (GTI summarizes the technical profile for the four ETFs listed above). For this moment, this metric continues to recommend reserving judgment about the implications of recent correction.

The GTI Drawdown Risk Index ticked lower, marking a pause in the recent run higher, which signals rising risk. The current reading shows a moderate rise in market risk, but at a level that’s still mild compared with the summer’s correction. Until this index rises above 0.6-plus level, it’s reasonable to see the recent volatility as a garden-variety pullback.

A closer look at markets last week shows rallies across the board, led by US property shares (VNQ) and small-cap stocks (IJR) led the winners last week. The weakest performer: bonds in emerging markets (EMLC), which edged up 0.4%.

Note the ongoing strength in commodities (GCC), which posted an upside breakout last week. This corner of global markets has enjoyed a persistent uptrend in recent weeks, marking a bullish outlier. The week ahead may be a crucial test for commodities as these markets deliver first impressions of pricing in change vis-a-vis Trump 2.0.

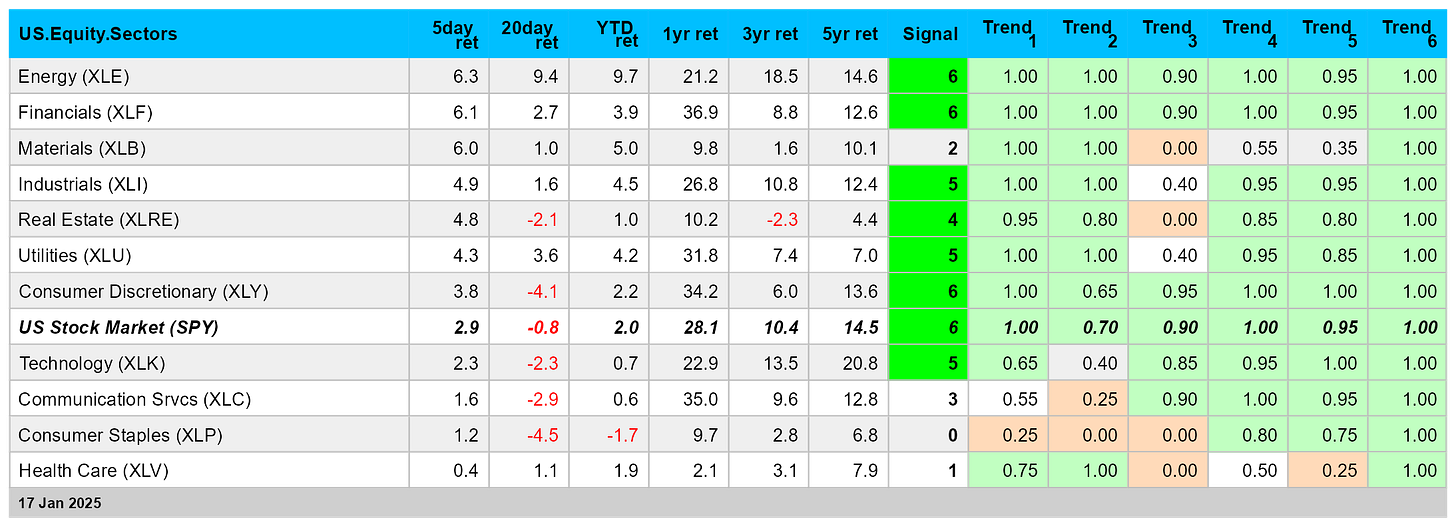

The internals of US stocks via sectors is looking stronger after last week’s rally. Note the performance leaders: energy (XLE) and financials (XLF). An early sign of what a Trump 2.0 rally will look like? Stay tuned. ■