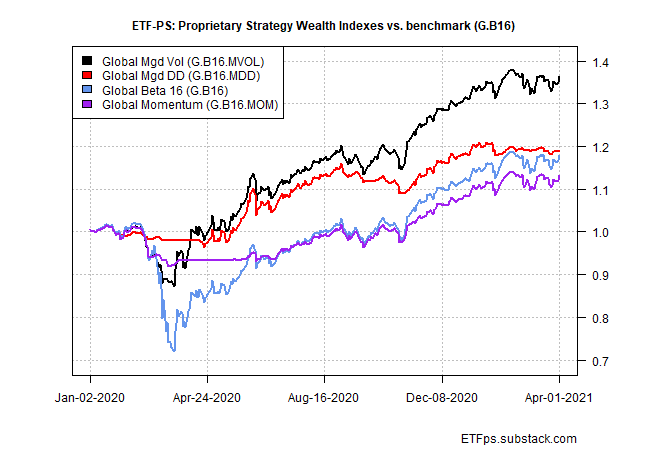

Keeping up with beta remains challenging this year. All three of our proprietary strategies are still trailing the Global Beta 16 benchmark (G.B16). That’s not to say that the prop strategies don’t add value – they do, but not in raw performance, at least not so far this year. The risk-management edge, by contrast, remains intact, albeit in varying degrees and on different fronts across the trio of prop strategies. For details on strategy rules and risk metrics in the tables below, please see this summary.

Beta maintained its advantage for the shortened trading week ended Thursday, Apr. 1. G.B16 rose 0.8% this week. Global Managed Volatility (G.B16.MVOL) came close with a 0.7% weekly gain. Ditto for Global Momentum (G.B16.MOM), which also rose 0.7% this week. Global Managed Drawdown (G.B16.MDD), however, fell further behind the curve with a relatively weak 0.2% weekly advance.

Year to date, Global Momentum is only slightly behind the benchmark in performance terms – 4.2% vs. 4.9% for G.B16. Larger gaps weigh on the other two prop strategies so far in 2021.

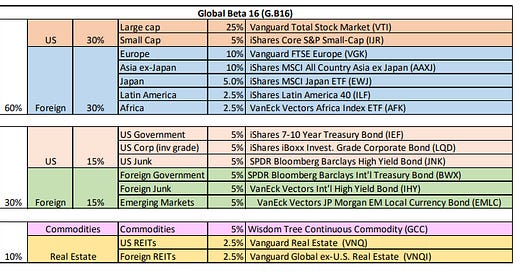

As a quick reminder, all three prop strategies use the same 16-fund opportunity set as the G.B16 benchmark, per the table below. The difference is how those 16 funds are managed re: risk-on/risk-off.

The headwind for the three prop strategies has been the various derisking episodes in recent history — derisking that continues, albeit in varying degrees for each strategy (see risk-on/risk-off tables below). For the most part, these ventures into risk-off territory have incurred a penalty with minimal payoff. Playing defense, in short, has been a losing proposition since the markets began recovering from the coronavirus crash a year ago.

Longer term, the results of the prop strategies reflect more encouraging results – particularly in risk-adjusted terms. Sharpe ratios, for example, are notably higher across the board vs. G.B16 for the trailing 5-year window, as shown in the tables above.

But that was then. What of the future? The main question is whether risk management will continue to impose a penalty in Q2 and beyond? ■