Commodities, US stocks and bonds, rallied this week

Strategy benchmarks continue push higher

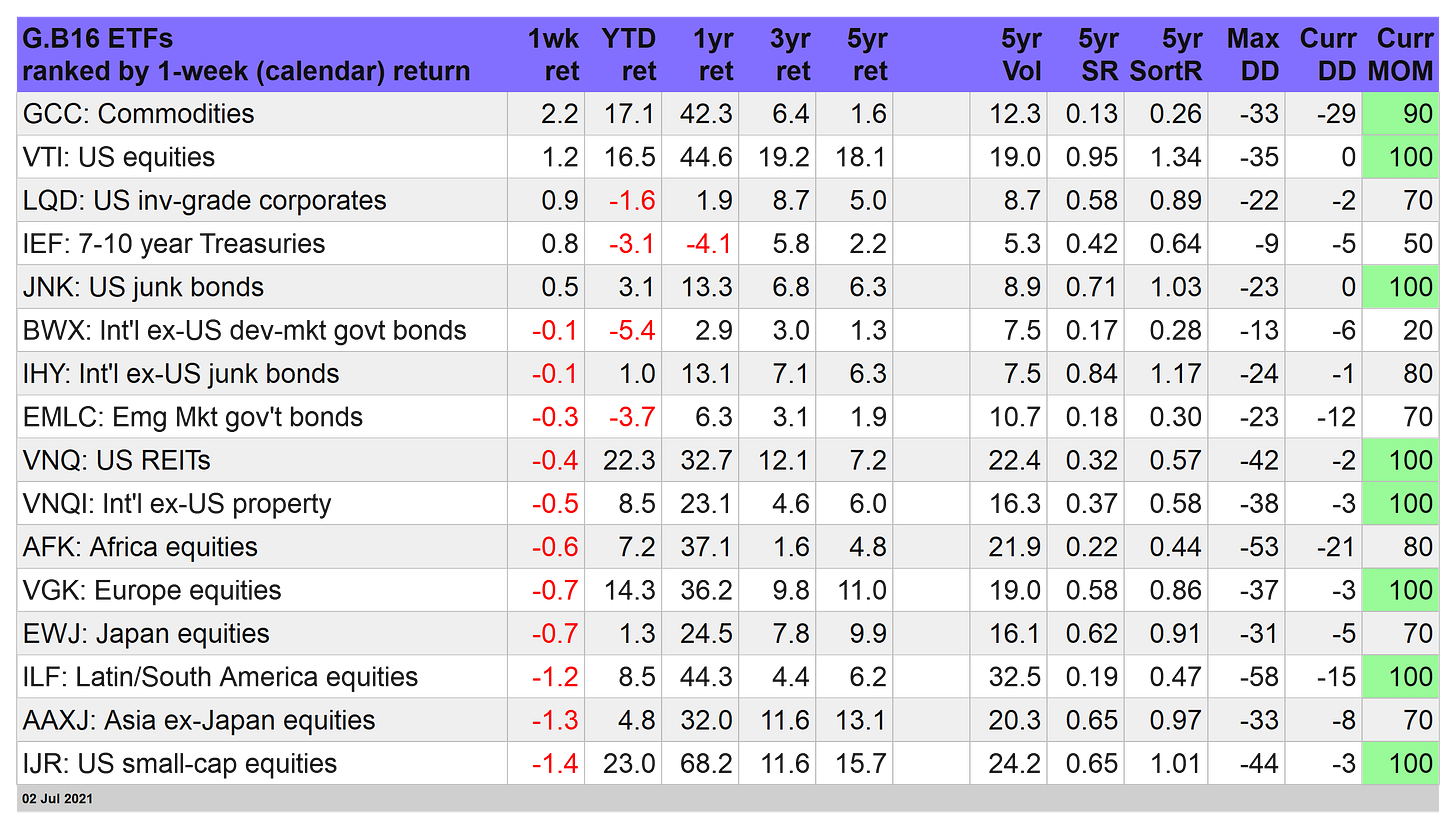

Commodities led this week’s gainers: It wasn’t even close. WisdomTree Commodity (GCC) topped the performance ledger for trading through Friday, July 2 for our 16-fund opportunity set, which proxies for the major asset classes. There were other gainers, but GCC stole the show with a 2.2% weekly advance that left the rest of the field in the dust. For details on all the strategy rules and risk metrics, see this summary.

US stocks were in second place, albeit well behind GCC. Vanguard Total US Stock Market (VTI) rallied 1.2%, lifting the fund to a new record high.

Meanwhile, US bond prices continue to rise, courtesy of the ongoing slide in Treasury yields. Despite worries that inflation will run hotter for longer, the Treasury market seems to be pricing in a more stable run of pricing pressure that’s in line with the Federal Reserve’s transitory narrative. The benchmark 10-year yield ended this week at 1.44%, the lowest since March 2 and it’s not obvious that the downside bias has yet run its course.

Is it time to declare that the fixed-income market is in a new bull market? Or will inflation soon prove to be more persistent than the Federal Reserve expects, thereby ruining the party? Unclear for now, but there’s no doubt that bond prices are on a roll. US investment-grade corporates look strong, for example. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) rose to a new pandemic high today.

US junk bonds are showing even more upside strength. Although the yield spreads in this realm over Treasuries have slipped to levels at or near record lows, that hasn’t stopped these securities from setting new highs for prices. SPDR Barclayrs High Yield Bond (JNK) set yet another record this week by edging up 0.5%.

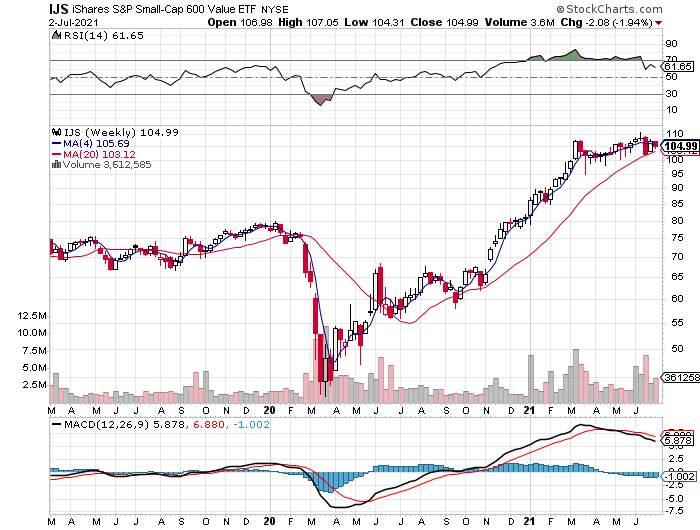

There were more losers than winners this week, primarily in foreign markets in unhedged US-dollar terms. But the biggest setback for our opportunity set was in US small-cap stocks. The iShares S&P Small-Cap 600 ETF (IJS) continues to trade in a range with a mild downside bias, losing 1.4% this week. It’s premature to say that the recent recovery for this corner of equities has ended; the optimistic spin is that small-caps are merely consolidating recent gains.

Strategy momentum continues to err on the side of the bulls: Although most slices of the opportunity set posted losses this week, all of our multi-asset-class portfolio benchmarks rose.

The big winner: the US 60/40 stock/bond mix, which increased 1.0%. The laggard: our primary strategy benchmark via Global Beta 16 (G.B16), which owns all the 16 funds listed in the table above, per the weights shown below.

G.B16 barely kept its head above water this week via a 0.2% gain, but that’s enough to keep this benchmark comfortably in the lead year to date vs. the other benchmarks.

How long can the rally off the pandemic low last? By some accounts, the upside momentum’s shelf life is long past expiration. Maybe, but bullish momentum still suggests otherwise.