The ETF Portfolio Strategist: 2 October 2020

Pricing In Election Risk: A contentious debate between President Donald Trump and his opponent, Joe Biden, on Tuesday night unleashed a sea of commentary and concern that an already unusual election year was running off the rails. Just to keep things interesting, late on Thursday news broke that President Trump had tested positive for coronavirus, followed by this afternoon’s announcement from the White House that the commander in chief was being moved to Walter Reed Military Medical Center as a ‘precautionary measure.’

Where this is headed is anyone’s guess, but Mr. Market decided to sell first and ask questions later in the course of today’s session. It didn’t help that this morning’s jobs report from the Labor Department shows that growth in payrolls continued to slow, suggesting that the economy could face headwinds in the fourth quarter.

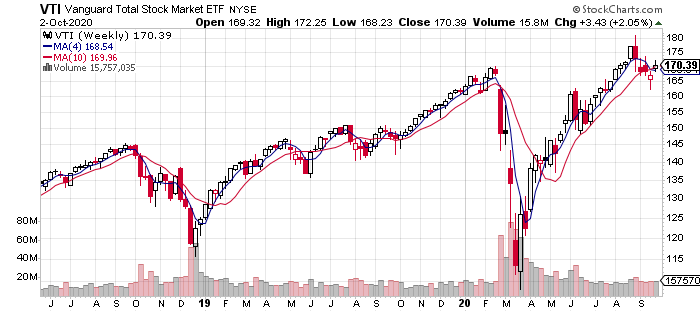

For the week, however, equities regained some of the ground lost in recent weeks, albeit all due to pre-Friday trading. Vanguard Total US Stock Market (VTI) rose 2.1% this week, posting the first weekly gain in the last five.

What’s in store for next week? News from Walter Reed will no doubt be a determining factor. Meantime, the markets will be chewing on the question of how the week’s events will influence the election outlook. The old rule that it’s best to ignore politics when managing money may be headed for a stress test in the weeks and months to come.

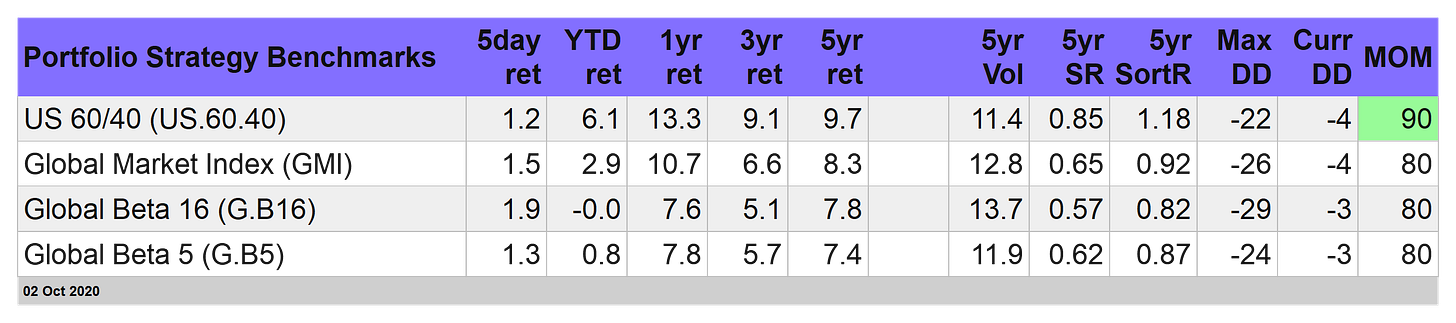

Beta Bounce: Our four portfolio benchmarks rebounded this week following last week’s losses. Leading the way higher for the benchmarks: Global Beta 16 (G.B16), which added 1.9% for the trading week through Oct. 2. This passive strategy that holds a broad set of global betas (and is rebalanced every Dec. 31) enjoyed a relatively strong week, but it’s struggling so far this year with a flat performance. (For details on the strategy rules for the proprietary and benchmark portfolios, along with information on the risk and return metrics in the tables below, see this summary.)

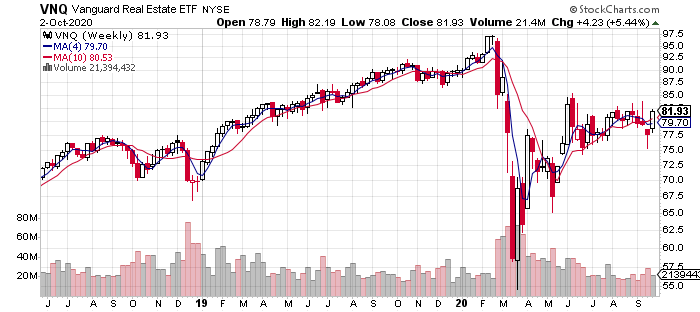

Most of G.B16’s components rose this week. The top performer: US real estate investment trusts: Vanguard Real Estate (VNQ) surged 5.4% by the close of Friday’s trading and recovered all the lost ground of the previous four weeks.

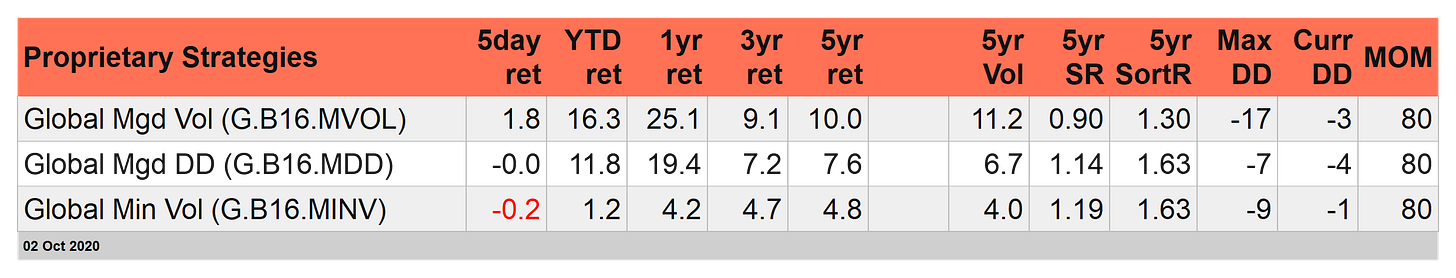

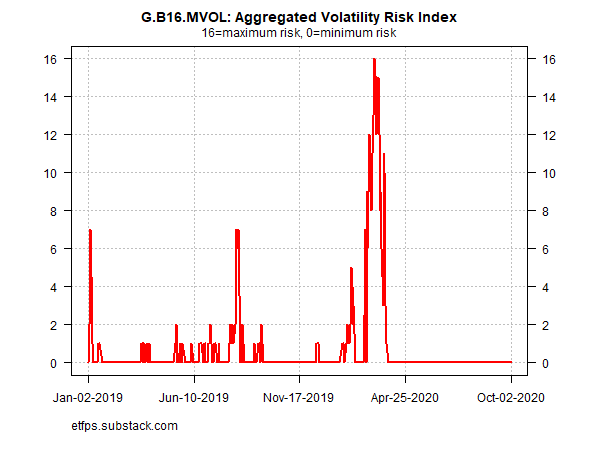

Mixed Messages For Portfolio Risk: For our proprietary strategies, the week dispensed mixed results. The winner: Global Managed Volatility (G.B16.MVOL) rallied 1.8%, courtesy of its ongoing risk-on posture.

As the chart below shows, the aggregated signals for G.B16.MVOL remain full-out risk-on across the board for the 16 funds in the portfolio (the same set of funds used in the benchmark G.B16).

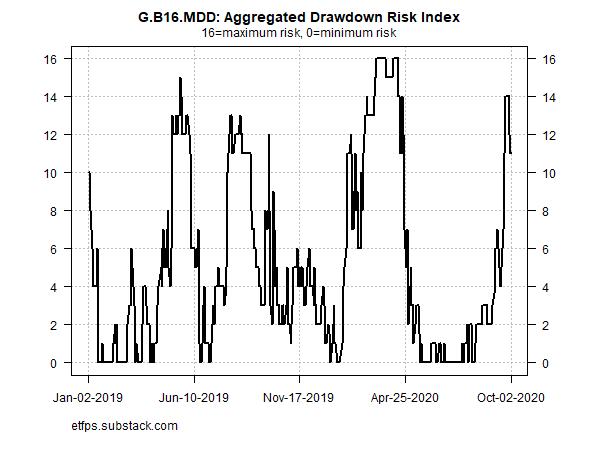

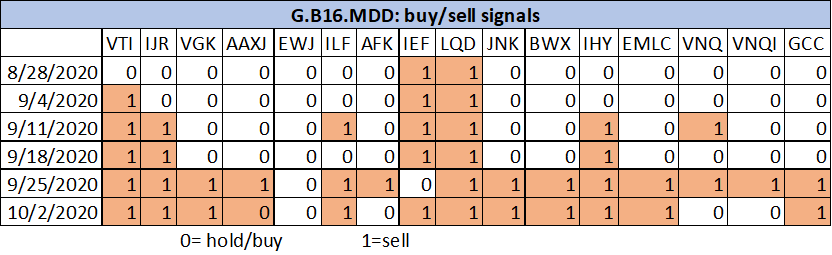

Global Managed Drawdown (G.B16.MDD), by contrast, remains mostly defensive. That cautious profile keep the strategy flat this week.

Here’s how the current line-up of risk-on and risk-off signals line up for G.B16.MDD’s holdings:

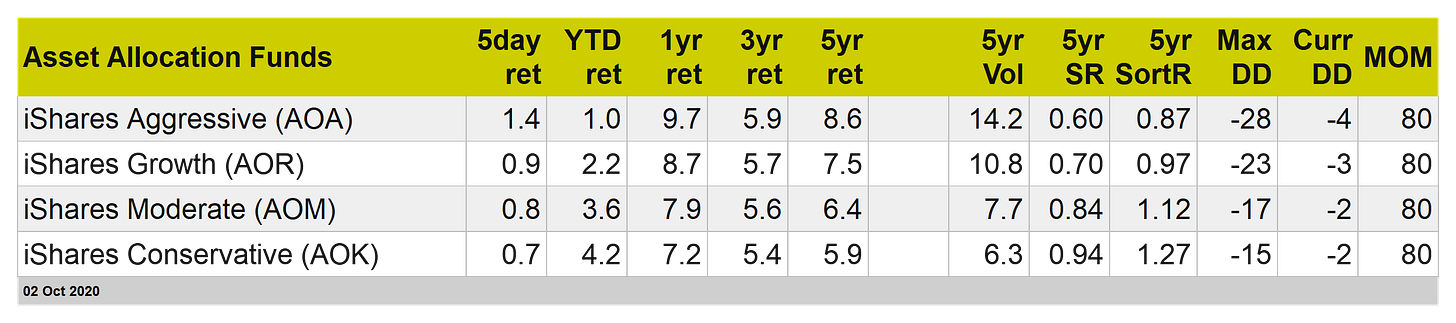

Finally, four BlackRock asset allocation funds had a good week with across-the-board gains gracing the various flavors of strategy risk.

In what may be a telling reversal of the usual routine for 2020 (and the near-term beyond?), iShares Conservative (AOK) is outperforming the most aggressive version of its brethren (AOA) year to date: 4.2% vs. 1.0%. ■