The ETF Portfolio Strategist: 20 OCT 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

For those of us who live in the Northeast US, the weather gods have been unusually kind over the past week and swathed the region with a pristine run of brilliant blue sky, golden sunlight and moderate temperatures. In short, it’s about as good as it gets from a meteorological perspective. One could say the same for global markets of late.

The trading week that just ended wasn’t perfect, but in the wake of a robust upswing for globally diversified portfolios since risk appetite revived anew in early September it’s fair to say that market conditions are bullish in a non-trivial degree.

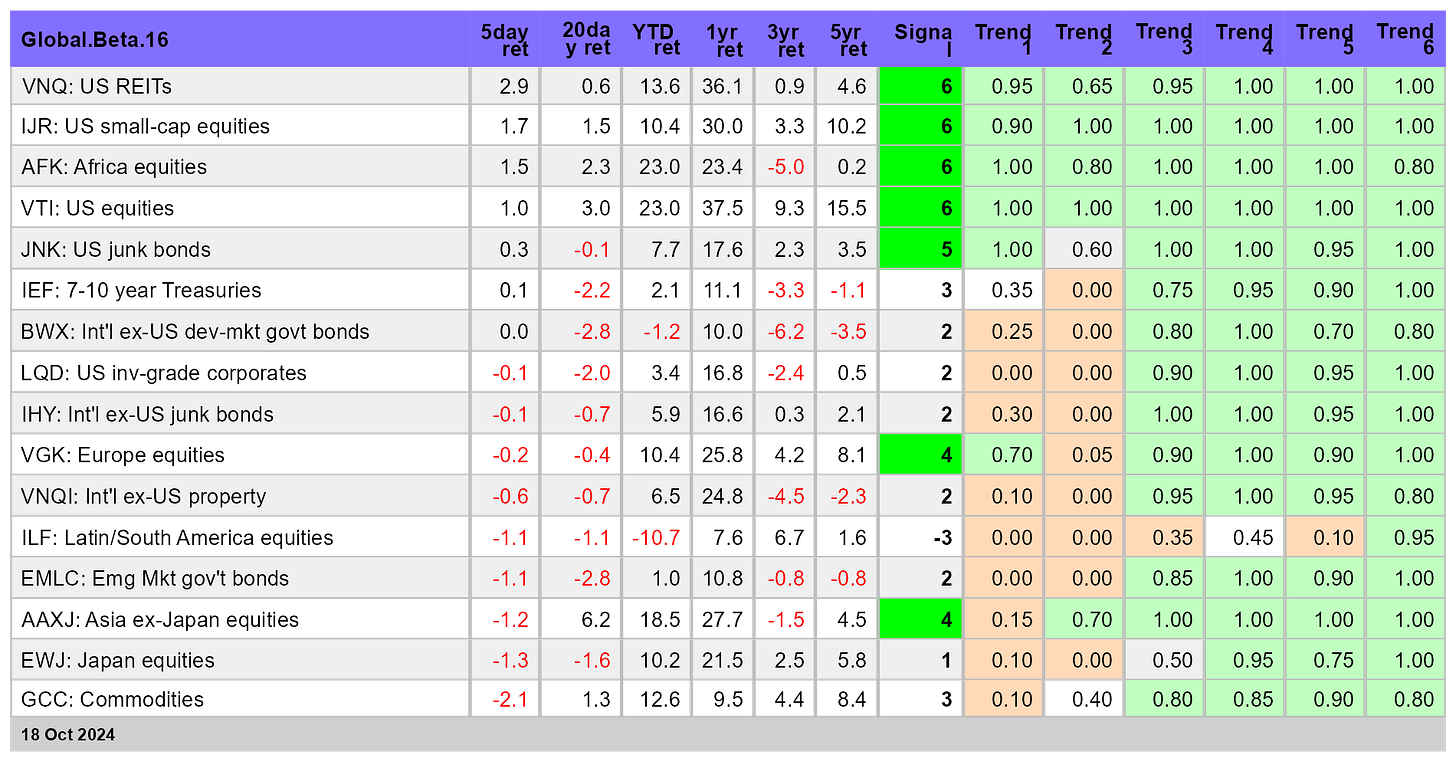

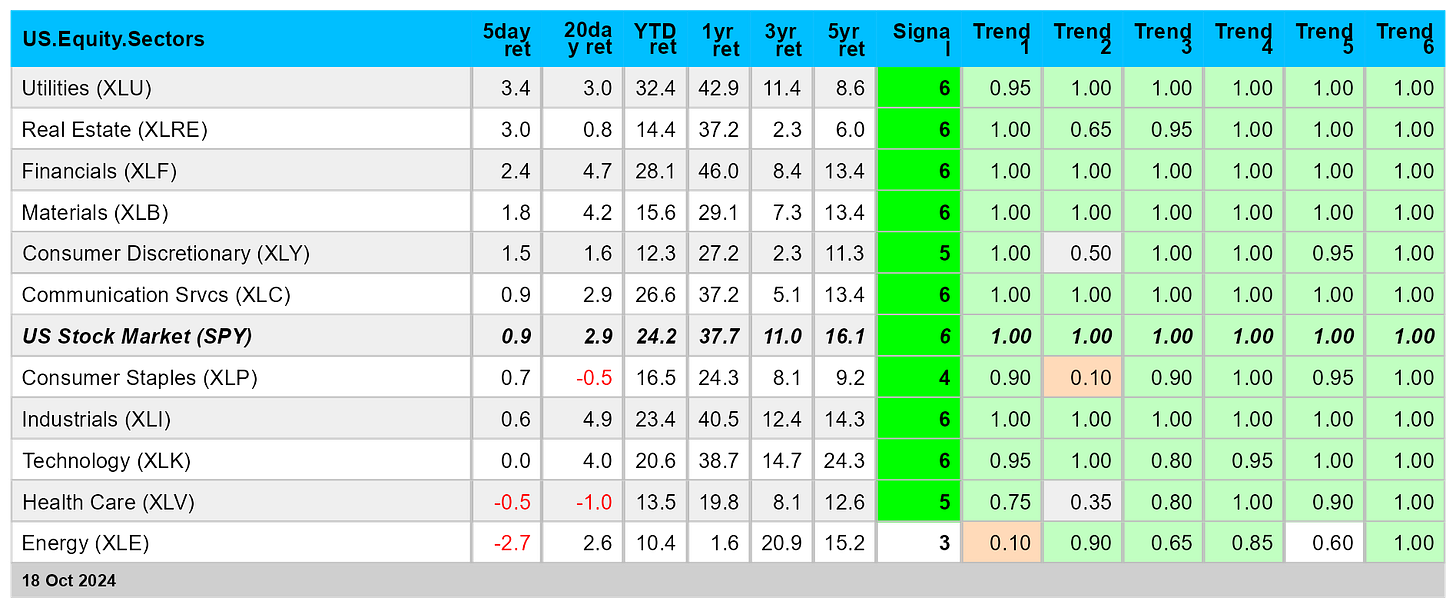

Our standard set of ETF asset allocation proxies posted solid gains last week and enjoy bullish Signal scores. Positive momentum, in short, rolls on. The party could, as always, end at any time, but until the numbers start telling us to be cautious it’s reasonable to assume that the trend is our friend. See this summary for details on the metrics in the tables.

The upside trend is as clear as the sky these days via the Global Trend Indicator (GTI), our homegrown benchmark that summarizes the directional bias for the four asset allocation ETFs listed above. GTI’s recent breakout to a new high puts a cherry on this cake. For the moment, all systems are go.

US real estate (VNQ) and US small-cap stocks (IJR) are currently leading the rally, with strong support from shares in Africa (AFK) and US equities broadly defined (VTI). The weakest slice of global markets: stocks in Latin America (ILF). Otherwise, varying degrees of a bullish tailwind prevail.

Within the US equities space, the trends continue to enjoy a strong upside bias via sectors. Energy (XLE) is the lone exception with a modestly positive trend.

Your editor is still musing over why the dark headlines that continue to flow out of the Middle East are effectively ignored by Mr. Market. Will the week ahead and beyond be any different? Hold that thought as new reports of Israel’s pending attack on Iran rattle nerves in the region.

According to leaked documents, Israel appears laying the groundwork for a strike against Iran. The news follows a drone attack by Tehran’s Lebanese proxy Hezbollah on Israeli Prime Minister Netanyahu’s private residence. Although the prime minister wasn’t at home when the strike occurred, Israeli politicians vow that Iran will “pay a price.”

Middle East violence continues to escalate but global markets have largely shrugged off the news as a largely contained risk factor. Perhaps that’s what it is, but the expanding regional conflict still threatens to draw the US and other nations ever deeper into this quagmire. Meanwhile, a solution, diplomatic or otherwise, is nowhere on the immediate horizon.

One analyst who studies the geopolitics of the Middle East suggests a strategic denouement may be near. Iran has “come to the conclusion that Israel wants to eliminate all of its threats,” says Vali Nasr, a Middle East expert and senior professor at the Johns Hopkins School of Advanced International Studies, said of the leadership in Tehran. “That includes Hamas, Hezbollah and Iran.”

The markets’ chill attitude to date to the Middle East powder keg could face its biggest test yet. Judging by the last week’s trading, Mr. Market is barely paying attention. That could be because the collective wisdom of the crowd sees the war as mostly noise a la Russia’s invasion of Ukraine. The alternative theory: the crowd is asleep at the switch. ■