Sharp losses this week bring most markets into the red for year-to-date results

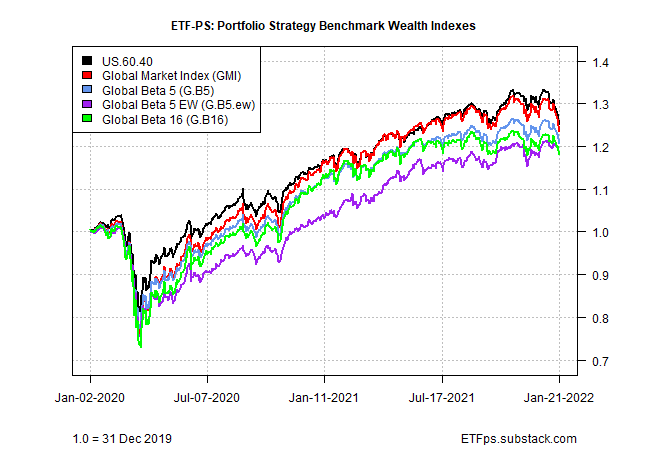

A rough week for all our portfolio strategy benchmarks

Widespread losses… with a few places to hide: Risk assets took a hit this week, or at least most did. But some corners of the global market were havens.

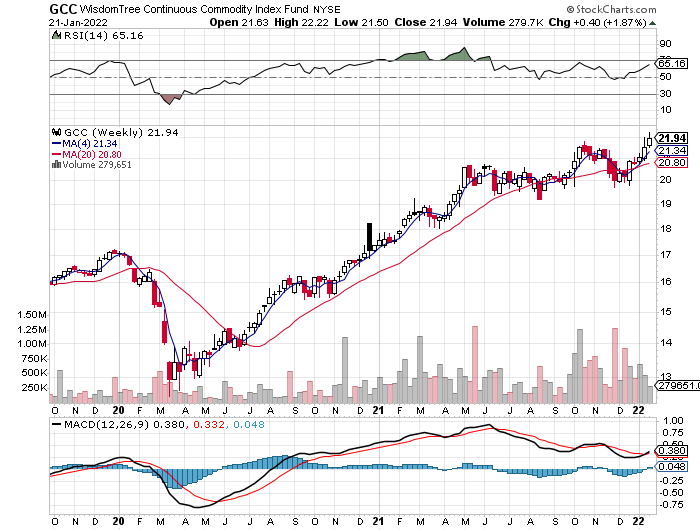

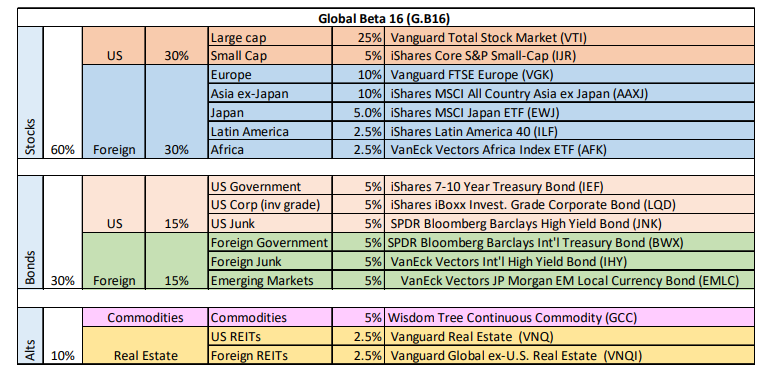

The main upside outlier: commodities. For a third straight week, WisdomTree Continous Commodity Index (GCC) rallied, rising 1.9% through today’s close (Fri., Jan. 21). The gain was by far the best performance for our standard 16-fund global opportunity set (see this summary for the metrics in the table below).

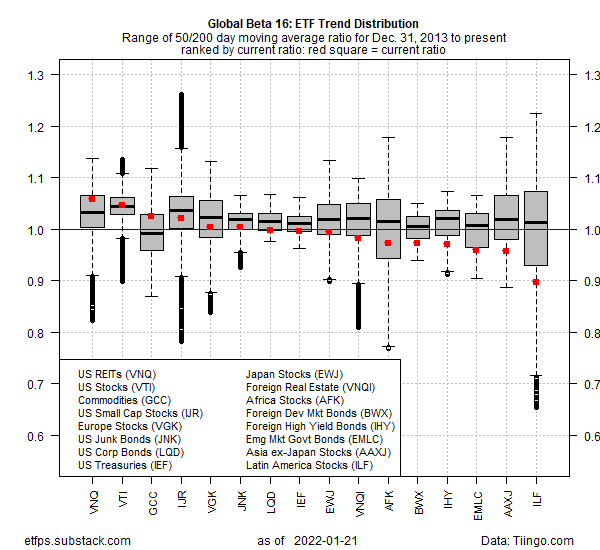

In 2022 so far, commodities are the second-best performer. Note, too, that GCC’s risk profile continues to look quite bullish. Our proprietary momentum score (MOM), current short-term volatility (VOL.st) and current drawdown risk (DD.st) are all reflecting strong risk-on profiles at the moment. That’s the only trio of green for the ETFs in the table above.

Earlier this week, Morningstar’s Ben Johnson asked: “Do Commodities Have a Place in Your Portfolio?” Investors and speculators seem increasingly inclined to answer “yes.” It’s debatable if a permanent carve-out for raw materials is warranted, as Johnson discusses. But so far this year, at least, it’s a winning decision.

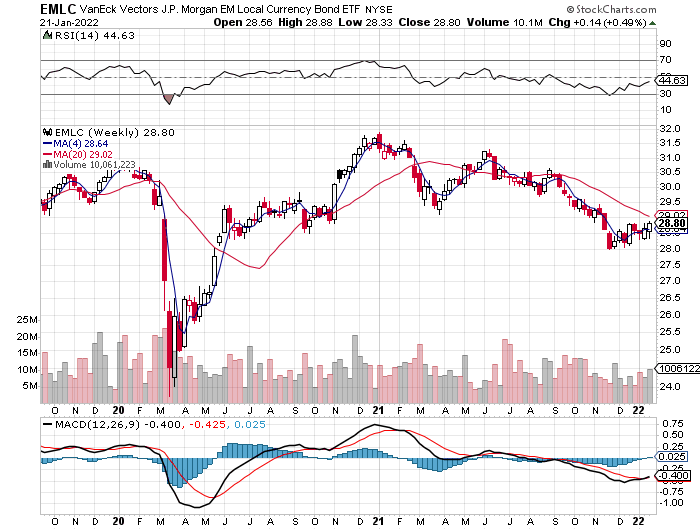

The second-best performer for our opportunity set: the long-suffering realm of emerging-markets government bonds. VanEck Vectors JP Morgan EM Local Currency Bond (EMLC) edged up 0.5% this week. It’s too soon to declare that the fund’s year-long slide has ended, but there are hints that a revival may be in its early stages. Stay tuned.

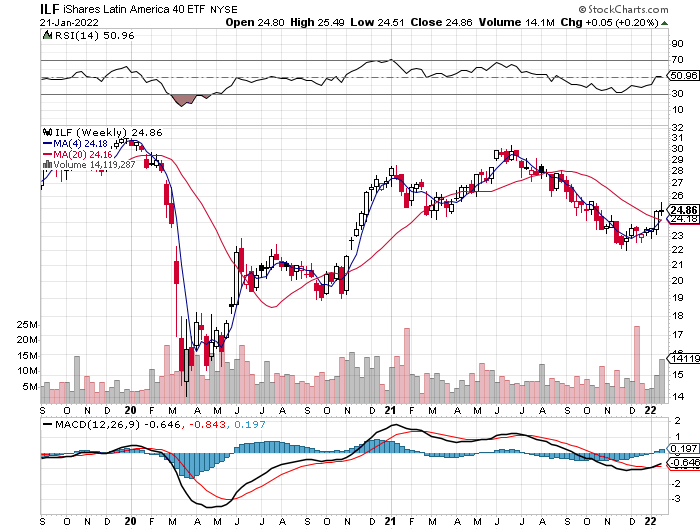

Another winner this week: stocks in Latin America via iShares Latin America 40 (ILF), which ticked up 0.2%. That’s a trivial gain, but it’s the fourth weekly pop in a row. When equities generally are taking a dive, even a slight increase attracts attention.

As noted on these pages more than a week ago, ILF looked like an intriguing candidate for a mean reversion play, in part due to its unusually steep relative and absolute decline in recent history. Despite the latest gains, ILF still ranks as one of the weakest performers for our global opportunity set, in relative and absolute terms, as shown in the chart below:

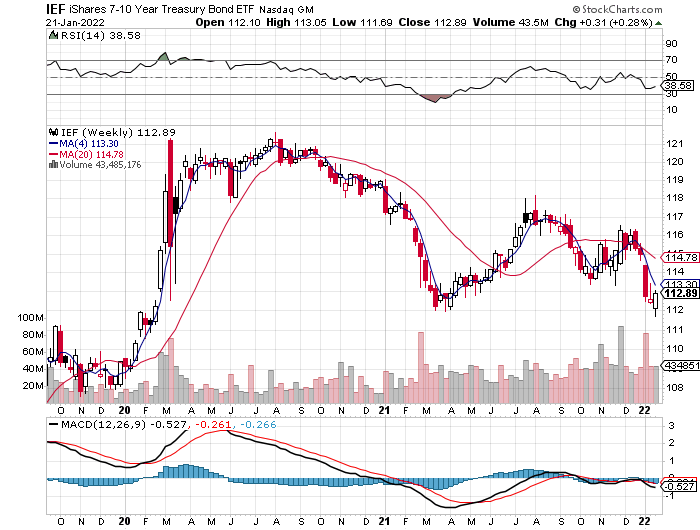

But let’s not lose sight of the fact that it was a risk-off week for the most part. Unsurprisingly, the appetite for US Treasuries revived anew as the crowd looked for a safe haven. The iShares 7-10 Year Treasury Bond ETF (IEF) rose 0.3% this week. That still leaves the fund close to its lowest level in two years, but for now, at least, the allure of Treasuries shines a bit brighter amid the backdrop of a fading risk appetite.

Geopolitical risk is also on everyone’s mind lately, too, courtesy of rumors of war as Russia musters troops near the Ukraine border. “Clearly if the Ukraine story was to go wrong there would be quite a significant bid for Treasuries, and this notion of the 10-year getting to 2% would be put on hold until we really understand what the implications of such a move would be,” says Padhraic Garvey, regional head of research, Americas at ING.

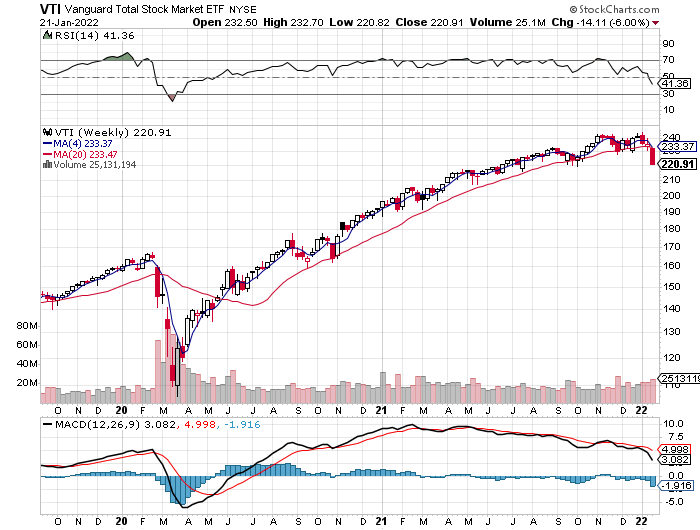

Overall, the losses for global markets reached far and went deep. US stocks suffered the worst drubbing among for our opportunity set. The broad market (VTI) shed 6.0% while small-cap shares dove 7.7% this week.

Analysts cite the Federal Reserve as a leading excuse to sell these days. “The Fed’s policies basically got the current bull market started,” observes Ed Yardeni, a Wall Street veteran who now runs his own consultancy. “I don’t think they are going to end it all now, but the environment is changing and the Fed is responsible for a lot of this.”

Whatever the catalyst, investors are starting to wonder if the current correction finally marks a turning point for the long-running bull market. It’s getting easier to entertain the idea. US stocks have dropped for three straight weeks and the latest rout is the deepest in five years.

For now, we’re inclined to see the drop as a healthy correction that takes out some of the froth that’s been building in recent months if not longer. But that’s a view that’s contingent on the US economic expansion rolling on. That still looks like the path of least resistance, but we’re on high alert for any changes to the macro outlook (for weekly updates on our macro analysis, see The US Business Cycle Risk Report).

This week’s losses played havoc on our strategy benchmarks: It was an unusually painful week for all our portfolio benchmarks. The kindest cut was posted by the equal-weight global mix: Global Beta 5 EW (G.B5.ew) was down a relatively soft 1.6% for the trading week, leaving this benchmark lower by 2.2% for the year so far. (For a summary of all the strategy benchmarks and their rules, see the details here.)

It gets worse from there. The deepest loss for the benchmarks: the unrebalanced, market-value-weighted Global Market Index (GMI), which tumbled 4.1% this week and is now nursing a 5.6% year-to-date decline.

Global diversification will likely ease some of the pain if risk-off sentiment persists. But the details matter and so how you structure asset allocation — and how often you rebalance, or don’t — may be destined as unusually influential investment decisions this year relative to recent history. ■