Last week’s downside bias in global markets pinched our two proprietary strategies, which fell in line with their strategy benchmarks. Both active strategies, which follow a set of quantitative rules, are still posting year-to-date gains, but their performances trail the benchmark.

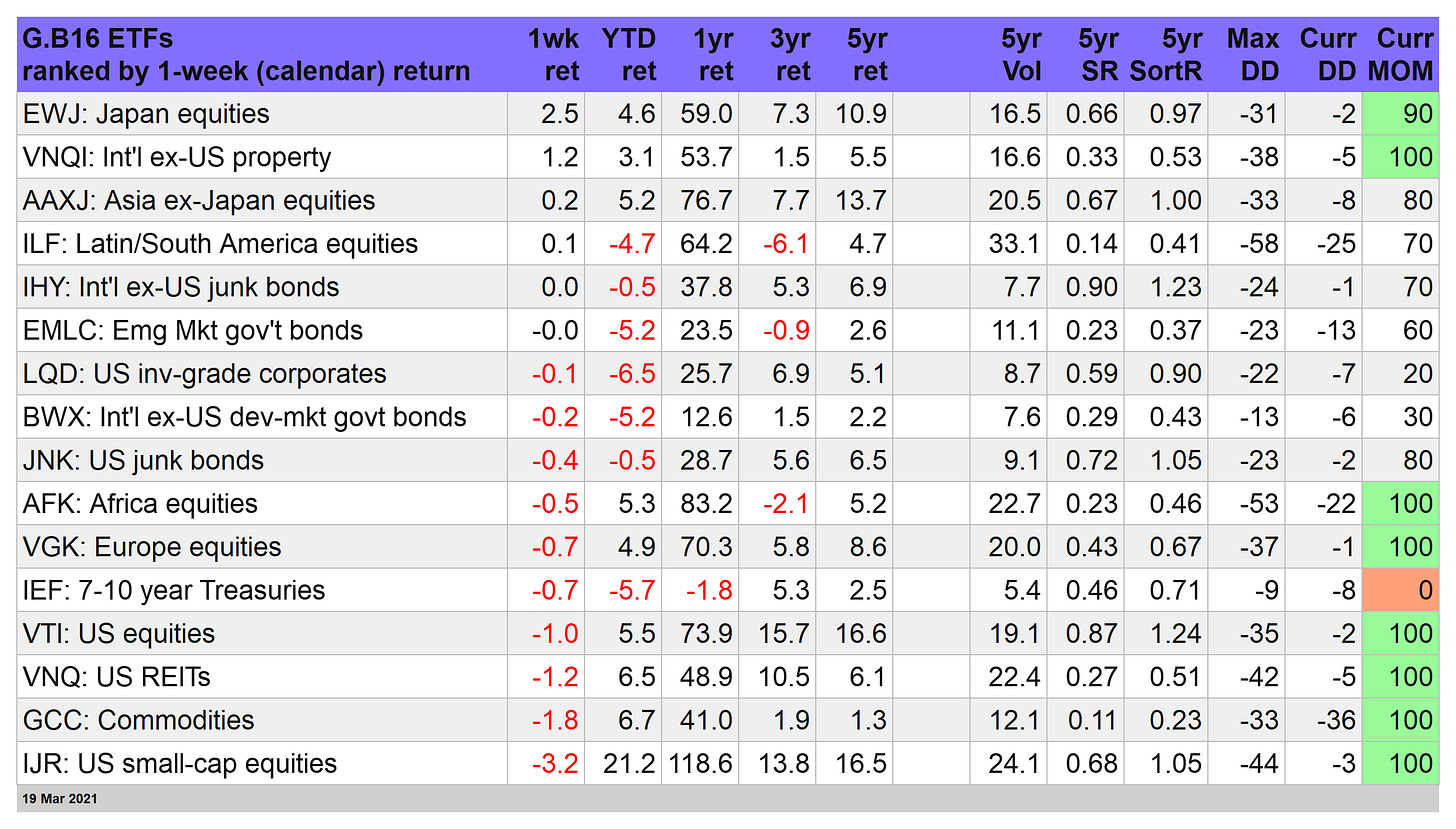

Let’s start with Global Managed Volatility (G.B16.MVOL), which fell 0.6% in last week’s trading through Friday, Mar. 19. G.B16.MVOL, which is managed based on return-volatility trends in the underlying ETF holdings, is still up a respectable 3.0% this year. But that’s modestly behind its benchmark, Global Beta 16 (G.B16), which is ahead 3.9% year to date. G.B16.MVOL and G.B16 have the same 16-fund opportunity set (see table at end of this post); only the investment rules for holdings the ETFs differ. For details on strategy rules and risk metrics, see this summary.

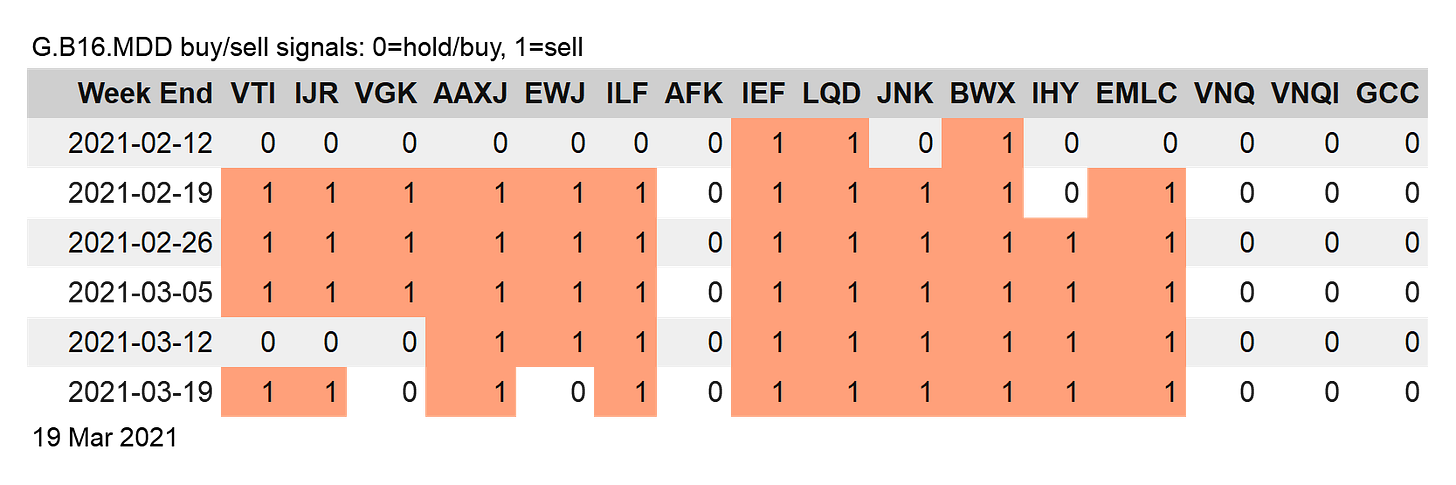

Global Managed Drawdown (G.B16.MDD) also fell 0.6% last week, matching the strategy benchmark’s decline via G.B16. Year to date, however, G.B16.MDD is up a slight 0.4% — well behind the 3.9% rise for G.B16, which is passively managed with a simple year-end rebalancing reset to target weights. G.B16.MDD uses the same 16-fund opportunity set as G.B16, but uses a different set of rules, which are based on trends in drawdowns for each of the ETF holdings.

Turning to risk exposure for the two proprietary strategies, G.B16.MVOL is in an all-out risk-on posture as of Friday’s close. This is the first complete risk-on state for the strategy since mid-February.

By contrast, G.B16.MDD became slightly more risk-off at last week’s close. Ten of the strategy’s 16 holdings are now risk-off, including both US equities funds -- Vanguard Total US Stock Market (VTI) and iShares Core S&P US Small-Cap (IJR).

Over the longer-term window, G.B16.MVOL and G.B16.MDD have delivered stronger results against the G.B16 benchmark, either in the form of higher return and/or lower risk. But so far this year, those advantages are in remission. ■