The ETF Portfolio Strategist: 22 DEC 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Publishing note: The newsletter will be on holiday hiatus for the rest of the year. We’ll return early in 2025. Happy holidays, and thank you for reading!

Markets corrected across the board this past week. The selling wasn’t particularly surprising, given the recent strength that looked like a classic case of overbought conditions. The question is whether the drop is a healthy pullback or a warning sign for 2025? We’ll be watching markets closely in the days ahead, but given the holiday run ahead it’s likely that a genuine signal will have to wait until January, when investors are again focused on macro and markets rather than eggnog and candy canes.

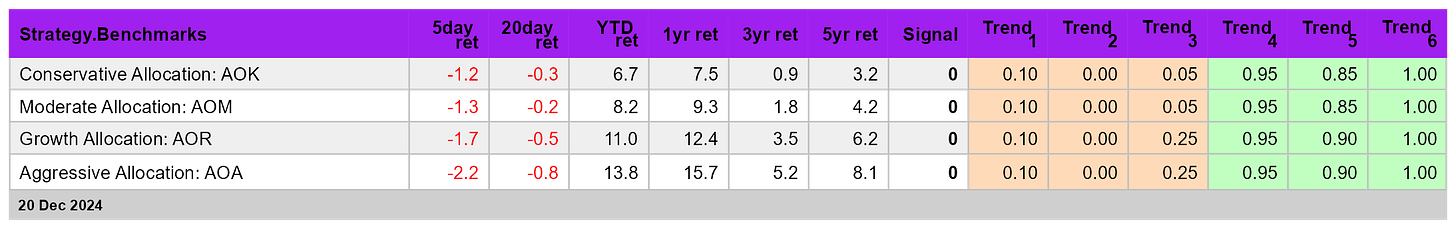

Meantime, all of our usual set of asset allocation proxy ETFs took a beating last week. The losses ranged from a 1.2% weekly decline for the conservation portfolio (AOK) to a steep 2.2% haircut for the aggressive strategy (AOA). Notably, our Signal score on all counts fell to a neutral 0 reading following a bullish run. See this summary for details on the metrics in the tables.

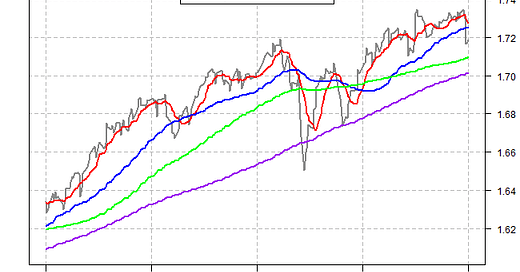

Despite the latest downshift the Global Trend Indicator is still reflecting a bullish profile (GTI summarizes the bias for all the ETFs listed above).

The change in the risk profile from all-out bullish to a so-far moderate degree of deterioation is shown by the GTI Drawdown Risk Index. The shift from an all-clear 0 reading marks the first time in more than a month that this measure of risk hasn’t been pinned to an all-out bullish footprint. For the moment, however, the deterioration is garden-variety volility. Stay tuned.

A more granular view of global markets paints a more worrisome picture. Only commodities (GCC) are posting a solid bullish Signal score. Otherwise, the rest of the field is in varying states of modestly positive readings to neutral to outright bearish. The darkest trends are currently in foreign bonds issued in developed markets (BWX) and stocks in Latin America (ILF).

The trend profile is a bit brighter for US equity sectors. Tech (XLK), consumer discretionary (XLY) and communications services (XLC) are still holding up with solid bullish readings. Healthcare (XLV), materials (XLB) and energy (XLE) are weakest sectors.

What’s the source of the latest downshift in market sentiment? Several suspects are on the short list, starting with a recognition that sticky inflation of late has reduced dovish expectations for rate cuts in 2025. The Fed still cut its target rate by a 1/4-point on Wednesday, but the central bank also signaled that it expects fewer cuts next year via the so-called dot plot outlook that summarizes each Fed official’s forecast for the central bank’s key short-term interest rate.

“I think that a slower pace of (rate) cuts really reflects both the higher inflation readings we’ve had this year and the expectations that inflation will be higher” in 2025, Fed Chairman Powell said. “We’re closer to the neutral rate, which is another reason to be cautious about further moves.”

Stock and bond markets sold off sharply on the news. The S&P 500 Index recovered some of the loss by Friday, but the benchmark still ended the week with a 2% loss. More worrisome is runup in Treasury yields, which may be a harbinger of things to come in the year ahead. The 10-year yield jumped to 4.52% by Friday’s close, the highest weekly close since April. It’s still reasonable to argue that the benchmark rate is trading in a range, but if the previous peak from the spring (~4.70%) gives way in the weeks ahead all bets may be off for assuming that bonds will behave themselves in the near term.

A key source of uncertainty that’s still lurking is what’s in store once the Trump administration takes the White House keys from Biden and company on Jan. 20. As discussed previously, several of the president-elect’s campaign promises could be inflationary, such as sharply raising import tariffs, deporting millions of immigrant workers, cutting taxes and rolling out a new wave of deregulation that juices growth.

It’s unclear how much of Trump 2.0 plans are bluster and negotiating tactics, but for the moment the bond market seems increasingly inclined to sell first and ask questions later.

The game plan for January is to read between the lines and monitor market reaction in the days after Inauguration Day on Jan. 20. Meantime, I expect markets to churn in a range, possibly with some sharp rallies and corrections, but it will likely be a prelude to the acid test post-Jan. 20. ■