The ETF Portfolio Strategist: 22 SEP 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Global markets were mostly higher last week, providing fresh support for arguing that the recent volatility is noise. Everything could change in a heartbeat, of course, but from a trend perspective the numbers continue to indicate that an upside bias persists.

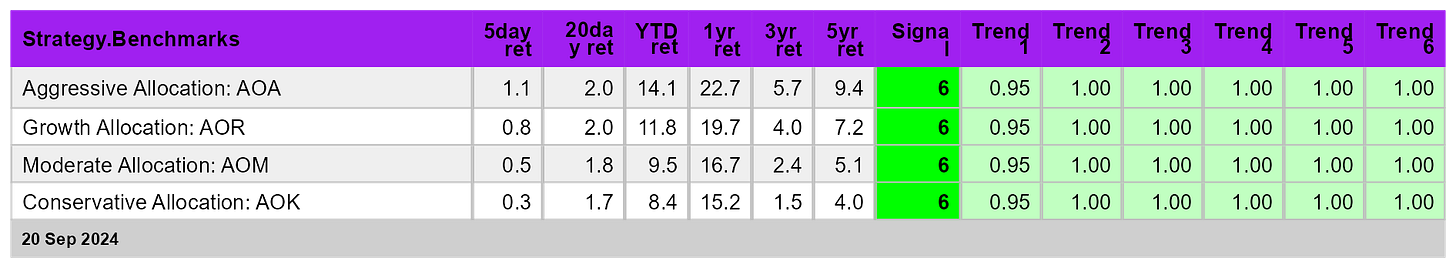

Last week once again delivered gains for all of our proxy ETFs tracking varying degrees of risk exposure for global asset allocation. Notably, all the funds remain pinned at Signal scores of 6 — the highest level of bullish conditions. See this summary for details on the metrics in the tables.

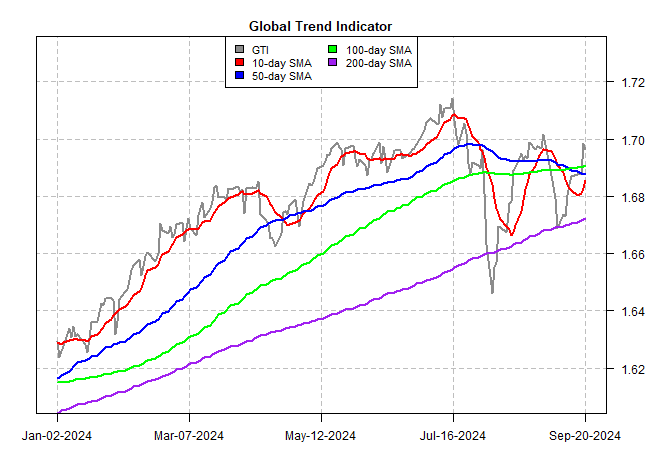

There was also a rebound in the Global Trend Indicator (GTI), which summarizes the trend for the four ETFs in the table above. The daily GTI is now well above its various moving averages. Despite the renewed strength, the GTI profile still leaves room for debate on whether the recent downturn is noise or signal.

For a clearer view, let’s zoom in on recent activity. The recent decline of the 50-day average below the 100-day average may be a warning sign that the broad trend is rolling over. But the debate stays open as long as the 50- and 100-day averages hold well above the 200-day average. On that basis, the longer-term trend still looks bullish and so the recent market wobbles may reflect a period of consolidation rather than the start of an extended bear market.

The main takeaway: Investors with time horizons of 3 years-plus will rightly remain skeptical that it’s time to fold up tents and seek safer ground in a meaningful degree. The previous dip of the 50-day average below its 100-day counterpart turned out to be a brief affair, and one that, with the benefit of hindsight, was a buying opportunity for the strong bull run that’s lifted markets for much of this year.

Nonetheless, GTI’s recent volatility and a series of lower rebound peaks since July is mildly concerning. For low-risk tolerance investors with shorter time horizons it’s reasonable to reposition portfolios defensively in some degree.

The pushback is that a more granular profile of global markets still reflects risk-on conditions overall. As the table below shows, bullish Signal scores dominate.

One school of thought argues that the start of rate cuts by the Federal Reserve will provide more fuel to drive markets higher for the near term. With mounting evidence that US inflation is still trending lower and US recession risk remains low, the crowd remains optimistic that the good times will endure for the near term.

That’s a reasonable view, and perhaps one that will drive markets higher. So, then, what are the risks? Geopolitics remains on the short list. The news this weekend that the Israel-Hezbollah/Lebanon border war is ramping up feeds the concern that a wider Middle East war is unfolding.

Meanwhile, the Ukraine-Russia war persists while China is testing red lines in the South China Sea with provocations targeting Filipino ships — provocations that are ultimately a test of US credibility vis-a-vis a mutual defense treaty between Washington and Manilla. US-China tensions are also on the rise due to a recently deployed US missile system in the Philippines — a system that can strike China, which in turn has triggered a sharp response from Beijing that the deployment “seriously threatens the security of regional countries and intensifies geopolitical confrontation.”

Add in the potential for political turmoil in the US in what may be a contested US presidential election in November and it’s easy to see a number of events that threaten the case for an ongoing bull market in risk assets.

Then again, markets have largely ignored the spike in geopolitical risks in the last several years. Is this time different? No one knows, but with markets at or near record highs and Treasury yields still offering a respectable real (inflation-adjusted) payout, the case for erring on the side of caution is looking more persuasive.

Yes, that’s a contrarian view relative to market conditions. But reading the tea leaves via trend is an inexact art/science. Meanwhile, it’s clear that geopolitical risk is rising and the business cycle, although possibly benign at the moment, is still very much alive.

Minds will differ on the implications for portfolio strategy, but the shorter your time horizon and the lesser your risk tolerance, the stronger the case for adopting a relatively defensive posture. ■