The ETF Portfolio Strategist: 23 FEB 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

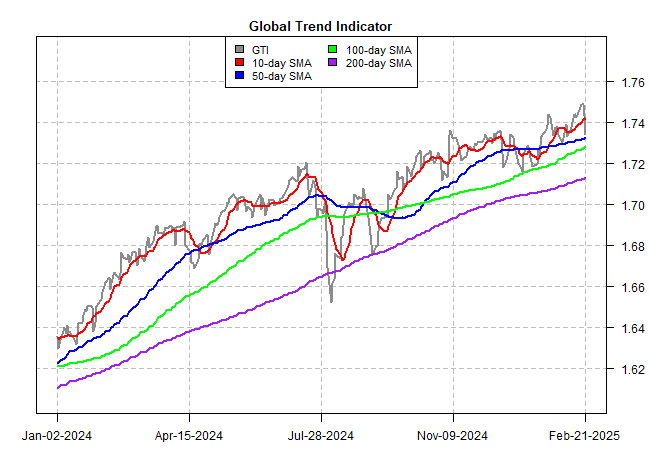

Stocks tumbled last week, but for the moment the pullback doesn’t register from a risk perspective via-a-vis a globally diversified, multi-asset-class portfolio. Markets overall are still showing upside trend strength, and so it’s premature to read too much into the latest bout of selling in the equities market, which was primarily a one-day event on Friday.

Perhaps this a turning point for the worse, but it’s too early for strategic-minded investors to make that call. For those inclined to speculate, have at it. Meantime, last week’s retreat was a mild affair in the broad scheme of asset allocation.

The conversative strategy for global asset allocation (AOK) was the top performer over the trailing 5-day window, posting a flat performance, based on our usual set of ETF proxies. (Note that Mon., Feb. 17 was a US trading holiday and so the 5-day window starts on Fri., Feb 14.) The rest of the field lost ground. But the pullback barely made a dent in the Signal scores, which continue to reflect a strong upside bias. See this summary for details on the metrics in the tables below.

The Global Trend Indicator (GTI) took a hit, but for now the drop ranks as garden-variety volatility. (GTI summarizes and aggregates the technical states for the four ETFs listed above and its latest profile continues to reflect a strong upside bias that’s prevailed in recent weeks.)

The GTI Drawdown Risk Index was even less reactionary and remains pinned at 0, which implies a nil level of drawdown risk for the near-term future.

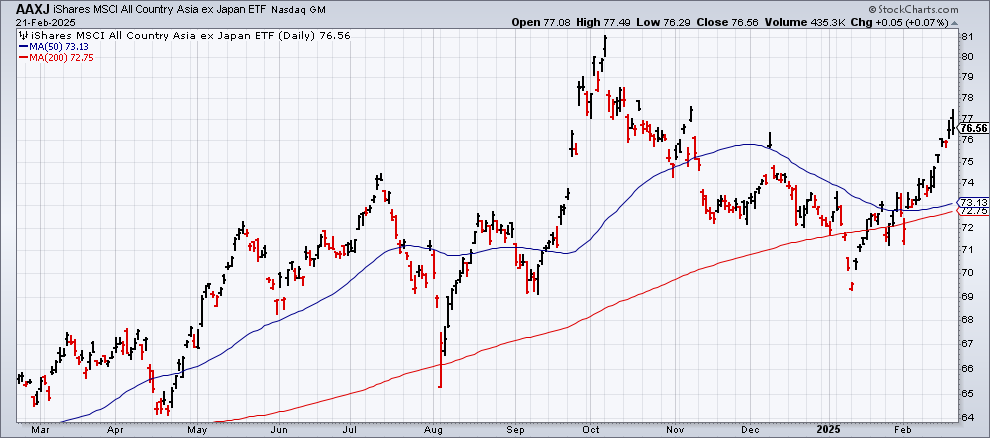

The winners over the past five days for the major slices of world markets were limited to bonds, with one exception: Asia ex-Japan equities (AAXJ), which rallied.

A key factor in AAXJ’s rise: a hefty allocation to China stocks (roughly one-third of the portfolio, according to Morningstar). That tilt has provided a solid tailwind as shares in China have rebounded sharply in recent weeks. A new tailwind: China tech stocks have been rallying sharply in the wake of last month’s news that the launch of DeepSeek, a low-cost AI model developed that poses a threat to US tech firms in this space.

Note, too, that foreign stocks generally are outperforming US shares this year. In the table above, all five flavors of foreign equities are ahead of the American stocks (VTI). The leading performer so far in 2025: Latin America shares (ILF) with a sizzling 12.2%.

The case for global diversification, in other words, is looking up these days. As for the US, it’s fair to say that some turbulence is running through market sentiment as the Trump White House engineers a variety of changes on multiple fronts. The changes that have received the most attention from a macro perspective are plans for import tariffs. The concern is that tariffs could juice inflation and create new headwinds for the Federal Reserve, which has been struggling to achieve its 2% inflation target.

Are rate hikes more likely now? No, at least not yet. Fed funds futures are (still) pricing in high odds that the central bank will leave its target rate unchanged at the next FOMC meeting on Mar. 19.

Meanwhile, the policy-sensitive 2-year Treausury yield closed on Friday, trading modestly below the median effective Fed funds rate (EFF). That’s a hint that the market is possibly, maybe becoming a bit more comfortable with the idea that the sticky inflation data of late is temporary and/or the current Fed policy stance is sufficient to maintain a disinflationary bias humming.

The 2-year-yield/EFF spread offers a useful proxy for market sentiment vis-a-vis monetary policy expectations. On that front, sentiment has recently returned to a more or less neutral position.

It’ll be interesting to see how or if this spread changes in the days ahead leading up to, and after, this Friday’s release (Feb. 28) of PCE inflation data for January — data that the Fed tends to favor for evaluating pricing pressure. Economists are forecasting that headline and core PCE inflation will tick down in year-over-year terms to 2.5% and 2.7%, respectively. If correct, the news will bring a bit of encouraging data vis-a-vis the Fed’s stalled efforts of late to reach its 2% inflation target. As a bonus, an encouraging PCE report will take some of the sting out of the consumer price inflation numbers for January, which painted a relatively worrisome picture by showing a pickup in the year-over-year price trend.

The Treasury market (IEF) could use some good news in the wake of the late-2024 correction, from which Treasury prices have yet to recover. Perhaps the rally since mid-January is a sign that optimism is returning. An upbeat PCE report on Friday would help.

But then there’s the uncertainty related to tariffs, which could juice inflation. Consumer sentiment took a hit this month, “in large part due to fears that tariff-induced price increases are imminent,” reports the University of Michigan’s latest survey.

Navigating the bond market in the days and weeks ahead, in other words, will be tricky, to put it mildly. Unless you’re confident about how White House policy plays out in the near term — and how it influences inflation, monetary policy, and the economy — it’s probably best to err on the side of shorter maturities until there’s more clarity (or any clarity) about where we’re headed vis-a-vis Washington’s blizzard of policy shifts.

“These days, higher tariffs and immigration policies are often discussed and thought likely to increase prices, cool aggregate demand and possibly soften employment,” St. Louis Fed President Alberto Musalem said last week. “From the standpoint of monetary policy, it could be appropriate to ignore or look through an increase in the price level if the impact on inflation is expected to be brief and limited. However, a different monetary policy response could be appropriate if higher inflation is sustained, or long term inflation expectations rise.” ■