The ETF Portfolio Strategist: 23 JUN 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Please note: Another summer break is scheduled for The ETF Portfolio Strategist. The next issue is scheduled for July 7.

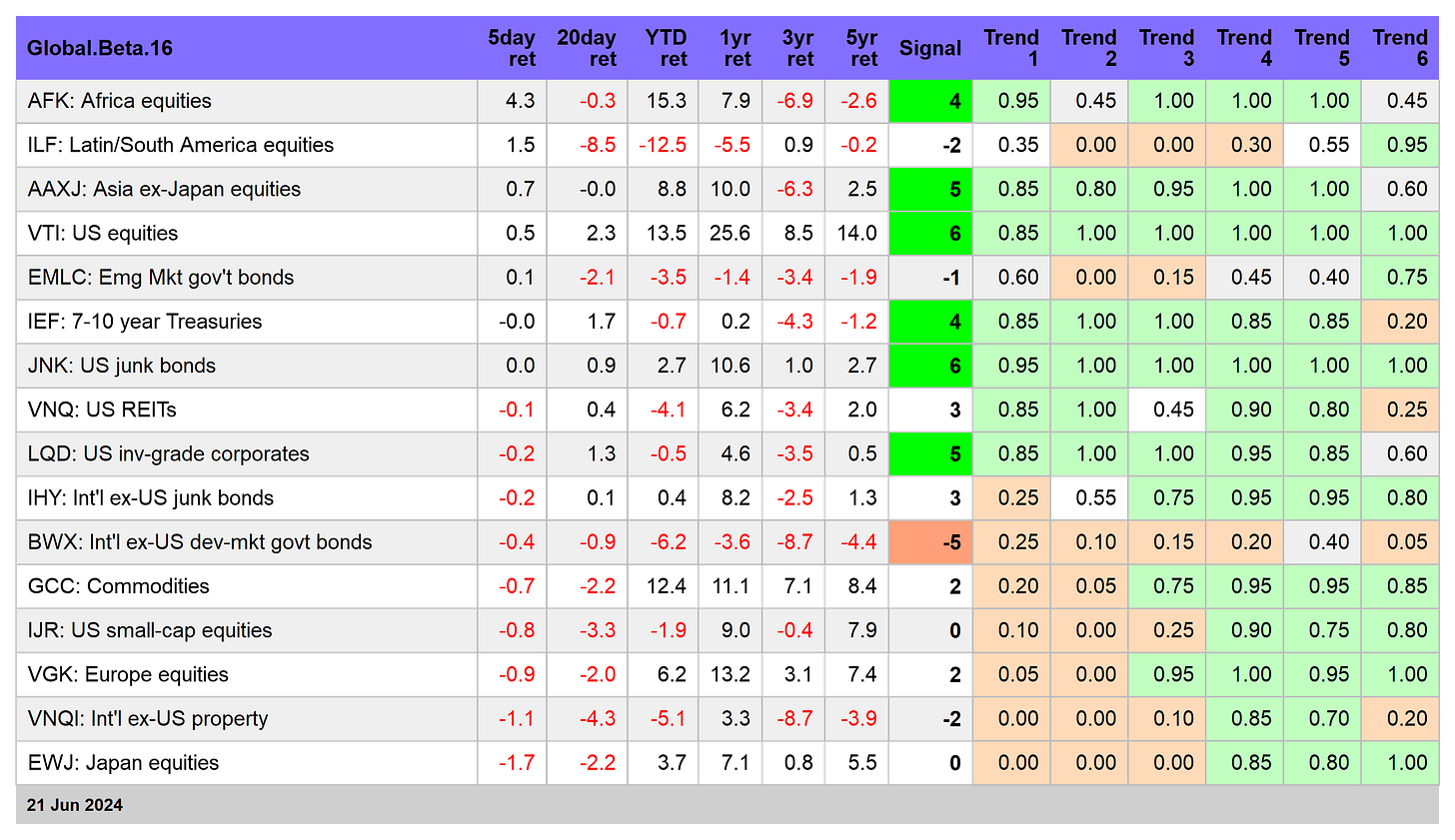

Global markets rose for a third straight week. Although talk of a tech-driven bubble is becoming worrisome, there’s no sign of trouble in a set of asset allocation ETFs from a trending perspective. As the table below shows, a bullish bias remains intact across the board.

Notably, the Signal score for all four funds is a strong 5, which is one notch below the highest-possible reading. Until there’s a persistent deterioration in the Signal score, it’s reasonable to assume that the animal spirits that are lifting markets will continue. Investors comfortable with contrarian trading, or a low risk tolerance/short time horizon, may think differently at this stage. But for portfolios designed for the medium term or beyond, current conditions still suggest it’s premature to shift to a defensive posture. See this summary for details on the metrics in the tables below.

The iShares Aggressive allocation ETF (AOA), for example, closed at yet another weekly high on Friday.

The momentum profile at a top-down level remains bullish, but a more granular review of markets still reflects a mixed picture. US large-cap equities (VTI) remain strong, as do US junk bonds (JNK). Stocks in Asia ex-Japan (AAXJ) are also posting strong upside results lately. Meanwhile, US investment-grade corporate bonds (LQD) and US government fixed income (IEF) are starting to show renewed strength.

Laggards include government bonds issued by emerging-markets governments (EMLC) and their developed-market counterparts (BWX).

The long-suffering market for US real estate investment trusts (VNQ) is showing signs of stabilizing, but foreign property shares (VNQI) are comparatively weaker.

To the extent that globally diversified portfolios such as AOA can maintain a net-positive trend, much will continue to depend on how inflation expectations evolve. In turn, that will play directly into the outlook for the Federal Reserve’s plans for when to begin cutting interest rates.

From a US perspective, recent inflation data provide modest support for expecting pricing pressure will continue to ease. Fed funds futures are pricing in a 66% probability that the first cut will be announced at the Sep. 18 FOMC meeting.

Incoming data that conflicts with the latest revival of dovish expectations for monetary policy would likely weigh heavily on risk assets — large-cap US stocks in particular, which have rallied sharply this year.

The next stress test for the US outlook arrives on Friday, June 28, with the release of PCE inflation data for May. The consensus forecast sees another round of disinflation on tap, which isn’t terribly surprising given that the previously released consumer price index report for last month showed a bias for softer inflation. ■