The ETF Portfolio Strategist: 23 MAR 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Still waiting, still wondering, still watching. But a good week.

For the first time in over a month, all four ETF flavors of global asset allocation posted weekly gains. Encouraging, up to a point. It’s a sign that markets are stabilizing, but that’s a temporary state in the extreme.

Uncertainty is still somewhere above the troposphere due to tariff risk and the related threat of a global trade war, which is becoming more plausible by the day. Markets are still struggling to price in this risk because confidence that the degree and duration of the blowback is open for debate.

President Trump has said that Apr. 2 is the start date for his reciprocal tariffs on countries. If implemented, the trade war will ramp up and almost certainly take a bit out of global growth. But Trump, as he’s wont to do, opened the door for revising his plans (maybe), when on Friday he said there will be “flexibility”:

I don’t change. But the word flexibility is an important word. Sometimes it’s flexibility. So there’ll be flexibility, but basically it’s reciprocal.

Understand?

Meanwhile, markets are still embracing a wait-and-see attitude, albeit one that ended on Friday with a positive spin. It’s all a day-by-day affair, but let’s declare victory for last week’s trading and note that our regular proxies for global asset allocation posted solid gains. Note, too, that across-the-board gains for the year to date also persist. The short-term trend signal is still bearish for three of the four funds, as shown in the table below, but for the moment the downside bias has yet to spill over to the medium- and long-term trends windows. Another win.

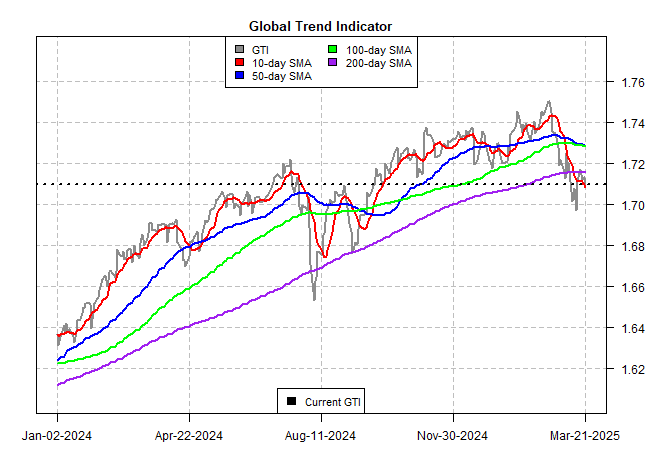

The Global Trend Indicator (GTI) more or less held steady last week. This metric, which aggregates the technical states of the four ETFs listed above, continues to reflect a modest pullback that’s still not forecasting an extended correction—another case of cautiously watching and waiting for the next shoe to drop.

The GTI Drawdown Index shows that the current pullback, overall, is roughly equivalent to last August’s correction, which was a relatively brief affair. Something tells us a quick resolution isn’t imminent this time, but let’s not abandon all hope just yet.

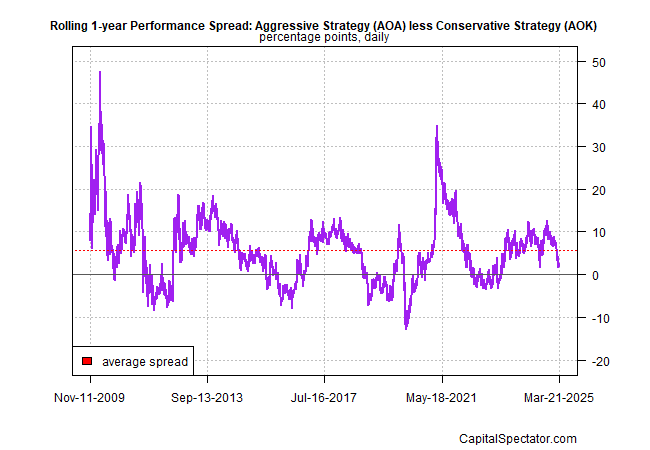

Another measure of how global asset allocation strategies are faring tells a similar story. The rolling 1-year spread for the aggressive allocation strategy (AOA) less its conservative counterpart (AOK) is 1.9 percentage points, not quite as low as last August’s 1.6 trough. History suggests there’s still plenty of room to weaken further. Sans tariff risk, the current level of spread implies an oversold condition, assuming you consider current macro conditions and imagine that tariff risk was absent. The challenge, of course, is that the likely catalyst for deciding the probable path ahead may arrive in the form of ad-hoc comments and impromptu proclamations, and so quantitative profiling’s value at the moment may be of limited, if any, value for the near term.

As a side note, the US economic profile still looks resilient, as discussed in the new issue of The US Business Cycle Risk Report. Several business-cycle indicators still reflect a low probability that economic contraction has started or is imminent, as summarized in the Composite Recession Probability Index (CRPI).

One exception is the weakening first-quarter GDP nowcasts for the US, based on the median estimate via several sources. The current nowcast is a weak 1.0%, a significant drop from Q4’s 2.3%. Is this the canary in the coalmine? Possibly, although the current nowcast has yet to spill over into other business-cycle indicators, such as the still-upbeat readings of the Dallas Fed’s Weekly Economic Index and and the Philly Fed’s ADS Index. Still waiting, still wondering, still watching.

Turning to a more granular review of global markets shows that there was a broad upswing in prices last week, led by Latin American equities (ILF), which led the winners for a second straight week.

Despite the rally in US equities (VTI), which posted a weekly gain for the first time since early February, the short- and medium-term trends still skew negative.

This may be an opportune moment to be a contrarian, but the question is: What type of contrarian? I can make a case for staying defensive, or becoming more so. Alternatively, a speculative bet that the worst has passed is a reasonable calculated-risk trade. But in either case the driving force that will dictate results may reside in an off-hand comment or two from one man in the days or weeks ahead.

For many of us, the middle road that treads somewhere between those two forecasts seems no less reasonable at the moment.

Still waiting, still wondering, still watching. ■