The ETF Portfolio Strategist: 24 MAY 2025

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

Please note that your editor will be traveling for the week ahead and so the next update of The ETF Portfolio Strategist will be June 8.

Markets are again waiting for the next pivot from President Trump. A risk-on trend was in progress last week — until it wasn’t, after the disrupter in chief wrote on Friday wrote on social media that he was considering a new round of 50% tariffs on Europe because of stalled trade talks and other issues. For good measure, he mused that a 25% tariffs on iPhones and other smartphones made overseas might be coming.

To be fair, maybe the recovery pivot is still unfolding and Friday was noise. But yesterday’s mood leaves room for doubt. Sensing a new phase of turmoil, markets sold off and analysts sharpened their pencils and focused anew on trying to decipher the social media tea leaves.

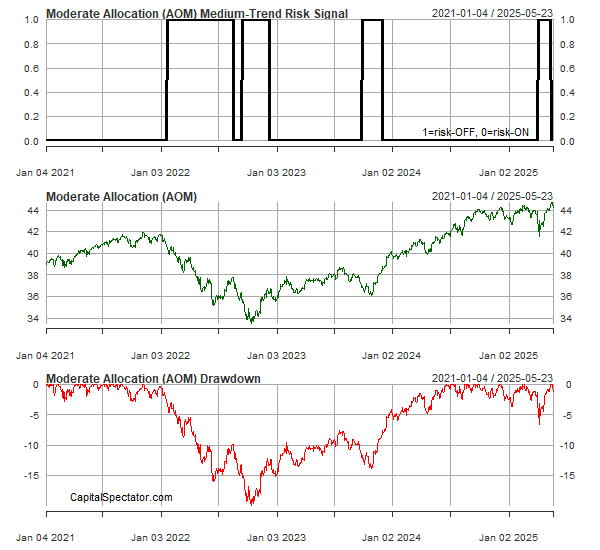

All of our proxy ETFs for global asset allocation took a hit this week, although the setback didn’t derail the across-the-board trend signaling. Whether that lasts is anyone’s guess. Much depends on you know who, which is to say that making informed decisions about portfolio strategy is about as opaque and difficult as it gets at the moment.

Adding to the risk factors top of mind: emerging hints that US economic activity is slipping. The Dallas Fed’s Weekly Economic Index fell to an estimated 1.9% year-over-year growth rate for GDP through May 17. That’s a bit soft, but hardly a tragedy. The concern is the the downward trend of late, which has trimmed the index’s level since November is a sign that tariff-related deterioration is starting to resonate and the path ahead may be even lower readings.

On the fiscal front, the US budget deficit is starting to weigh on sentiment after the House of Representatives passed a spending bill that’s projected to increase the mountain of US debt by $3 trillion-plus over the next decade to more than $36 trillion, according to the Congressional Budget Office. That translates to roughly 125% as a share of the economy. The Senate will sort through the details and, presumably, give the legislation a green light (with changes, presumably), and send it to Trump, who will sign it into law.

The White House counters that the bill cuts $1.6 trillion in spending and provides the country with a pro-growth plan. Minds will differ on those points, but perhaps the only view that matters is the bond market’s, and for the moment the upward trend in Treasury yields suggests that the fixed-income crowd becoming anxious about inflation.

Consider the 30-year yield, the most sensitive maturity for pricing in inflation risk. The long rate briefly rose to ~5.15% on Thursday before pulling back to end the week at 5.04%, close to the highest level since late-2023.

Watching the 30-year yield (and inflation expectations generally) in the days and weeks ahead is on our short list until further notice. If this key rate moves higher in a meaningful degree, other asset classes will likely take note by demanding higher risk premia via lower prices.

Unsurprisingly, gold (GLD) and bitcoin (IBIT) are benefiting from elevated concerns re: the budget deficit and inflation.

Meanwhile, assets ex-US remain strong. For example, stocks in Africa (AFK) rallied for a seventh straight week while government bonds issued by governments in emerging markets (EMLC) rallied to the highest level since Sep. 2021.

The “sell US assets” narrative, it sum, still has room to run. It could all reverse if there was an attitude adjustment in Washington and policymaking returned to those quaint ideas of providing markets with clarity, continuity and constancy. Alas, those attributes will likely remain afterthoughts at best for near term, if not longer. We are, it seems, destined to remain in a world of day-by-day analysis that’s overly reliant on the next update from a certain social media account. ■