The ETF Portfolio Strategist: 24 NOV 2024

Trend Watch: Global Markets & Portfolio Strategy Benchmarks

There are various risks lurking for global markets, but for now the broad trend via prices at a high level assume calm waters ahead. Adopting that view has been a winning strategy and the crowd’s inclined to forecast more of the same, based on last week’s trading activity for globally diversified portfolios.

All of our ETF proxies for global asset allocation rebounded with solid gains last week, repairing much of the damage from the previous week. The latest pop revived bullish Signal scores across the board. Note, too, that year-to-date results are still posting strong advances, led by the 15.0% for the aggressive portfolio (AOA). See this summary for details on the metrics in the tables.

For visual perspective, not that the upside bias of late remains intact via the Global Trend Indicator (GTI), which summarizes the trends for the four funds above.

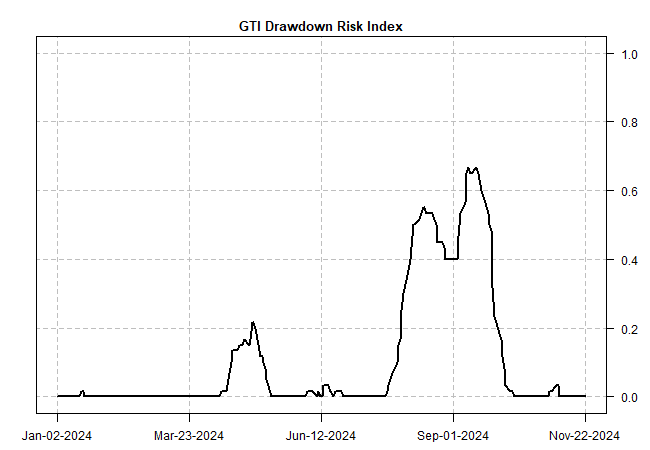

For another spin on the current risk profile, consider the GTI Drawdown Risk Index (GTI-DDRI), which quantifies the current strength of bullish trend activity. When the index is 0, the bulls dominate and the near-term risk for a significant drawdown is estimated to be nil. To the extent that GTI-DDRI rises above 0, drawdown risk increases. At the moment, this benchmark indicates drawdown risk is extremely low. Keep in mind that risk conditions can change quickly, but for now the trend is our friend in the extreme.

Digging into the main components of globla markets reminds that there’s a wide variety of trend profiles. The fuel that’s driving GTI higher: US large-cap (VTI) and small-cap (IJR) stocks, along with commodities (GCC), US REITS (VNQ) and US junk bonds (JNK) are the main sources of animal spirits. Latin America (ILF) and government bonds in developed markets ex-US (BWX) are the weakest.

Meanwhile, the party in US equity sectors is running at full speed these days. The exception: US health care (XLV), which has taken a hit. Investors are running for the exits on the assumption that president-elect Trump’s choices for running the nation’s health agencies will shake up the regulatory landscape, and not necessarily in a good way for the health care sector.

“Generally, government leadership in healthcare is looking increasingly unpredictable,” says Karen Andersen, Morningstar’s director of healthcare equity research.

Could this be an opportunity? “With healthcare companies trading well below Morningstar’s estimates of their fair values, a lot of bad news is baked into the price, increasing the probability of a positive surprise,” advises Morningstar chief research and investment officer Dan Kemp. “The uncertainty around the next four years under the Trump administration has created some buying opportunities.”

By that reasoning, the crowd has priced several other sectors for something approximating perfecion.

The surprise factor, in other words, can cut both ways. ■